Question

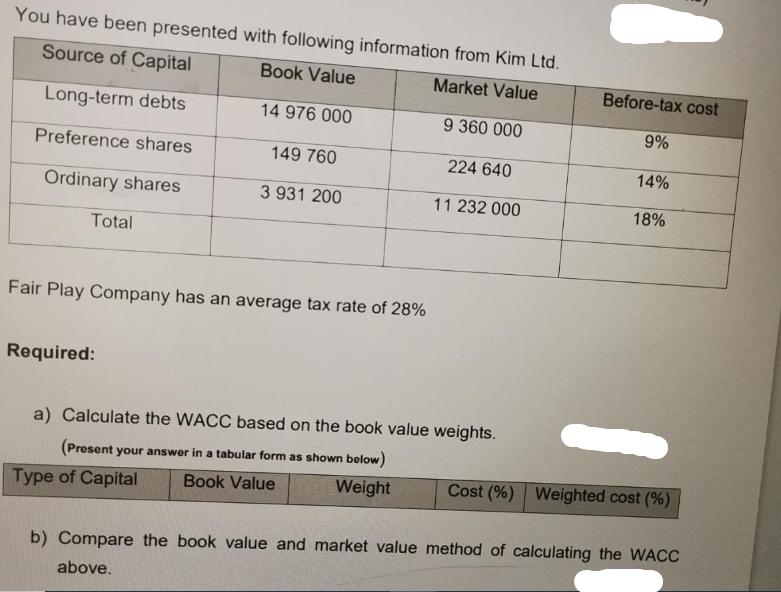

You have been presented with following information from Kim Ltd. Source of Capital Book Value Market Value Long-term debts 9 360 000 Preference shares

You have been presented with following information from Kim Ltd. Source of Capital Book Value Market Value Long-term debts 9 360 000 Preference shares Ordinary shares Total 14 976 000 Required: 149 760 3 931 200 Fair Play Company has an average tax rate of 28% 224 640 11 232 000 a) Calculate the WACC based on the book value weights. (Present your answer in a tabular form as shown below) Weight Type of Capital Book Value Before-tax cost 9% 14% 18% Cost (%) Weighted cost (%) b) Compare the book value and market value method of calculating the WACC above.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The calculation of the weighted cost of each type of capital is as follows Weighted cost of longterm ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

5th Edition

9781118560952, 1118560957, 978-0470239803

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App