Answered step by step

Verified Expert Solution

Question

1 Approved Answer

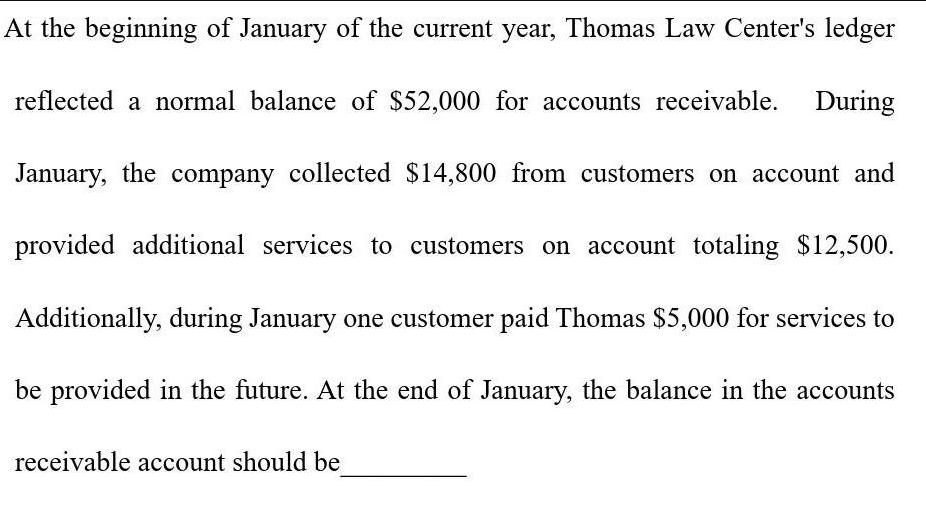

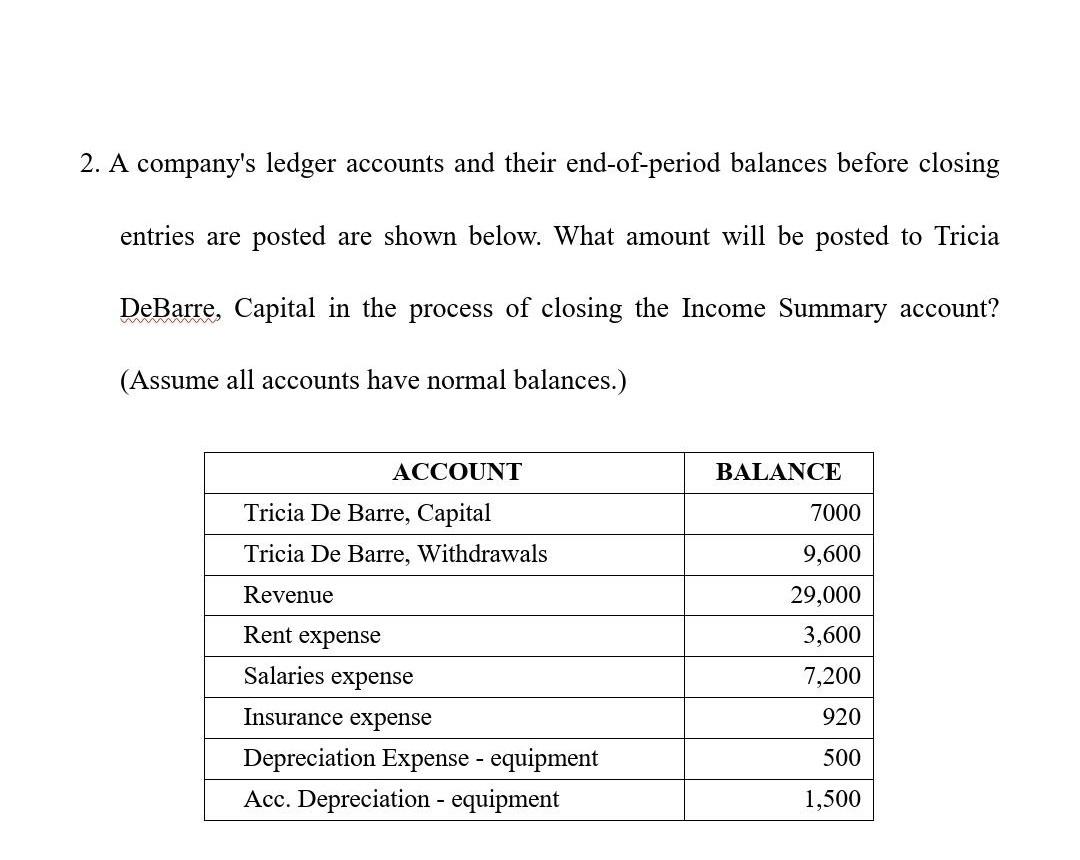

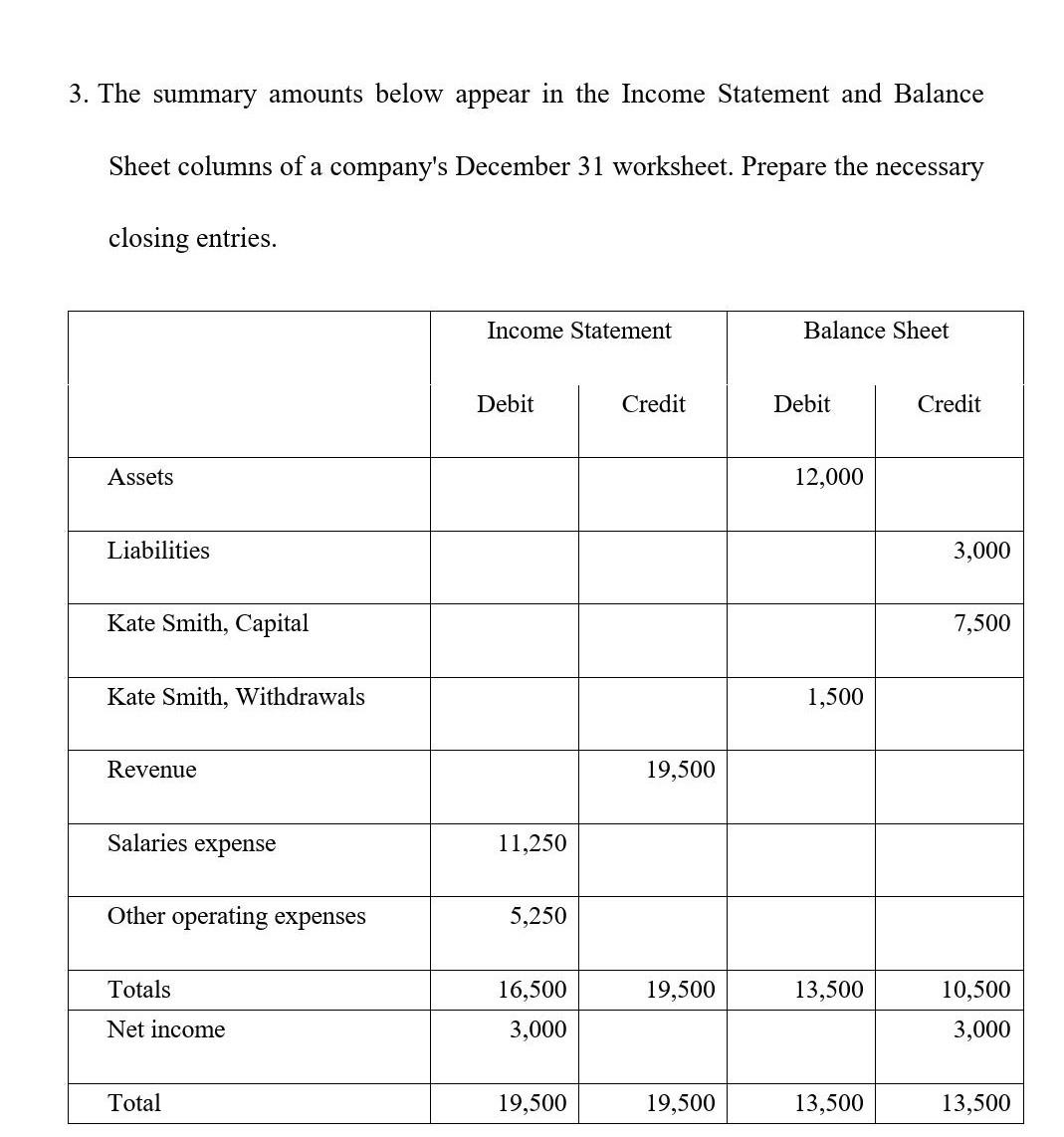

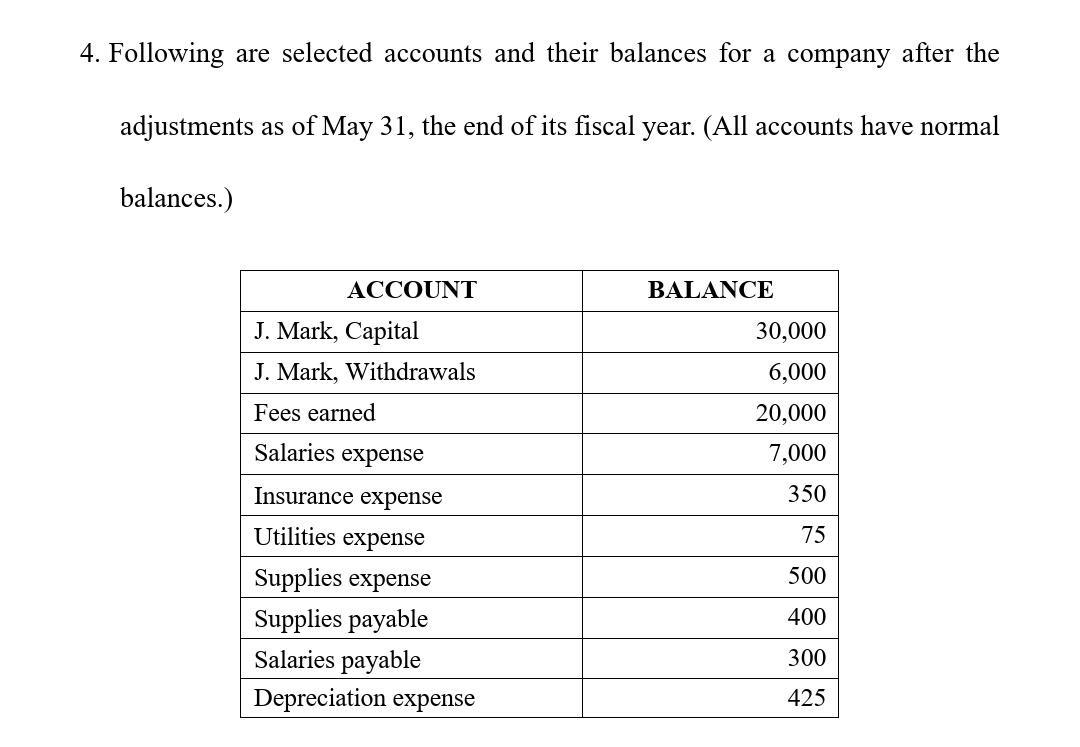

At the beginning of January of the current year, Thomas Law Center's ledger reflected a normal balance of $52,000 for accounts receivable. During January,

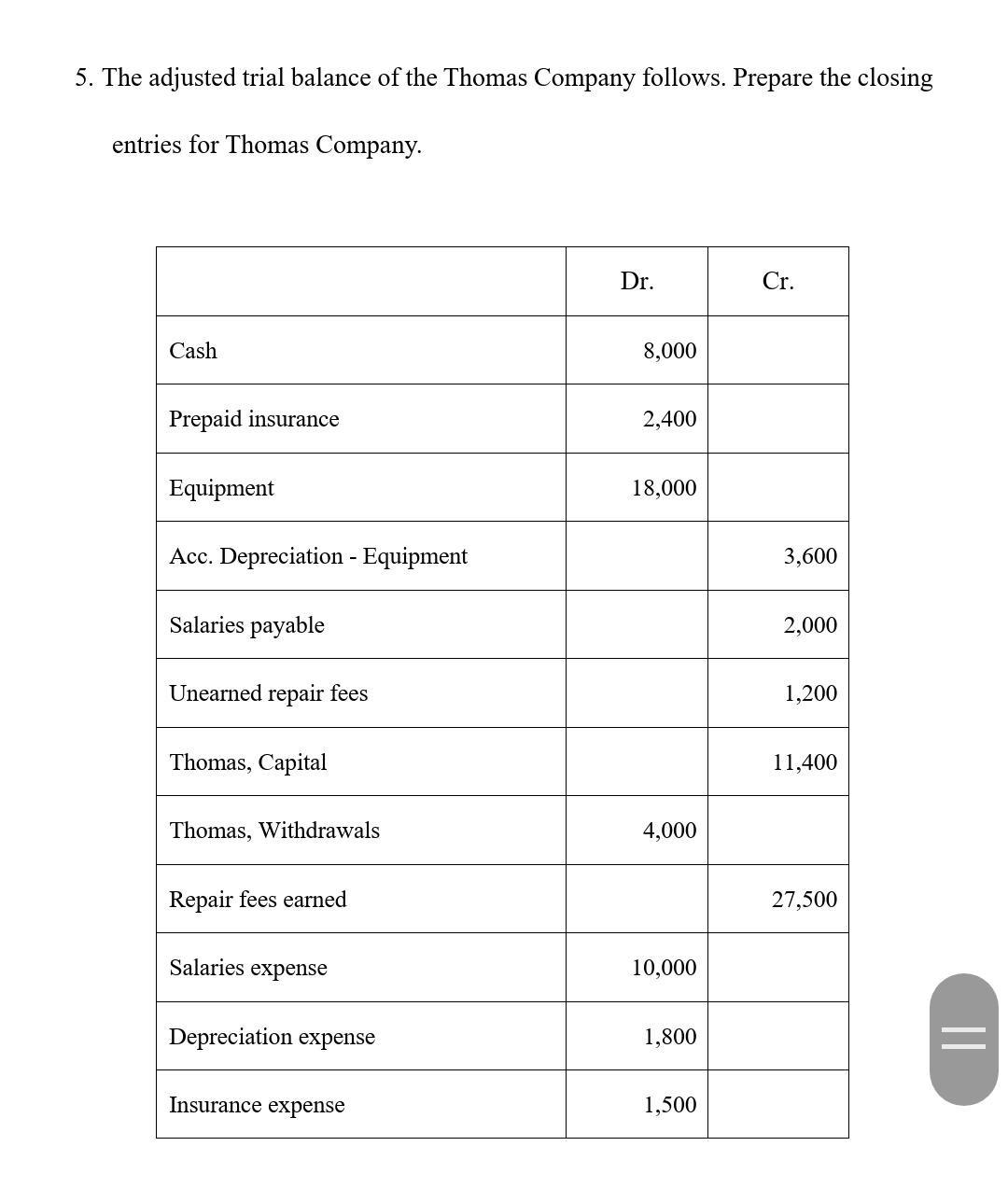

At the beginning of January of the current year, Thomas Law Center's ledger reflected a normal balance of $52,000 for accounts receivable. During January, the company collected $14,800 from customers on account and provided additional services to customers on account totaling $12,500. Additionally, during January one customer paid Thomas $5,000 for services to be provided in the future. At the end of January, the balance in the accounts receivable account should be 2. A company's ledger accounts and their end-of-period balances before closing entries are posted are shown below. What amount will be posted to Tricia DeBarre, Capital in the process of closing the Income Summary account? (Assume all accounts have normal balances.) ACCOUNT Tricia De Barre, Capital Tricia De Barre, Withdrawals Revenue Rent expense Salaries expense Insurance expense Depreciation Expense - equipment Acc. Depreciation - equipment BALANCE 7000 9,600 29,000 3,600 7,200 920 500 1,500 3. The summary amounts below appear in the Income Statement and Balance Sheet columns of a company's December 31 worksheet. Prepare the necessary closing entries. Assets Liabilities Kate Smith, Capital Kate Smith, Withdrawals Revenue Salaries expense Other operating expenses Totals Net income Total Income Statement Debit 11,250 5,250 16,500 3,000 19,500 Credit 19,500 19,500 19,500 Balance Sheet Debit 12,000 1,500 13,500 13,500 Credit 3,000 7,500 10,500 3,000 13,500 4. Following are selected accounts and their balances for a company after the adjustments as of May 31, the end of its fiscal year. (All accounts have normal balances.) ACCOUNT J. Mark, Capital J. Mark, Withdrawals Fees earned Salaries expense Insurance expense Utilities expense Supplies expense Supplies payable Salaries payable Depreciation expense BALANCE 30,000 6,000 20,000 7,000 350 75 500 400 300 425 5. The adjusted trial balance of the Thomas Company follows. Prepare the closing entries for Thomas Company. Cash Prepaid insurance Equipment Acc. Depreciation - Equipment Salaries payable Unearned repair fees Thomas, Capital Thomas, Withdrawals Repair fees earned Salaries expense Depreciation expense Insurance expense Dr. 8,000 2,400 18,000 4,000 10,000 1,800 1,500 Cr. 3,600 2,000 1,200 11,400 27,500 ||

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To address each question At the beginning of January the balance in the accounts receivable account was 52000 During January 14800 was collected from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started