Question

Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $745,000, and the sales mix is 20%

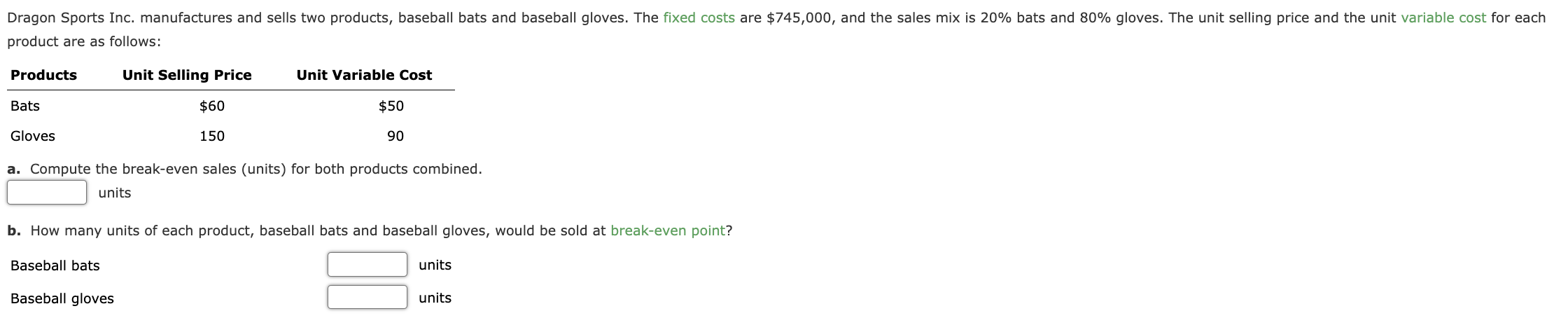

Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $745,000, and the sales mix is 20% bats and 80% gloves. The unit selling price and the unit variable cost for each product are as follows: Products Bats Gloves Unit Selling Price Unit Variable Cost $60 $50 150 90 a. Compute the break-even sales (units) for both products combined. units b. How many units of each product, baseball bats and baseball gloves, would be sold at break-even point? Baseball bats Baseball gloves units units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute the breakeven sales units for both products combined we need to calculate the total contribution margin and divide it by the weighted ave...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting Using Excel for Success

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

1st edition

1111535221, 1111535223, 9781285400914 , 978-1111993979

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App