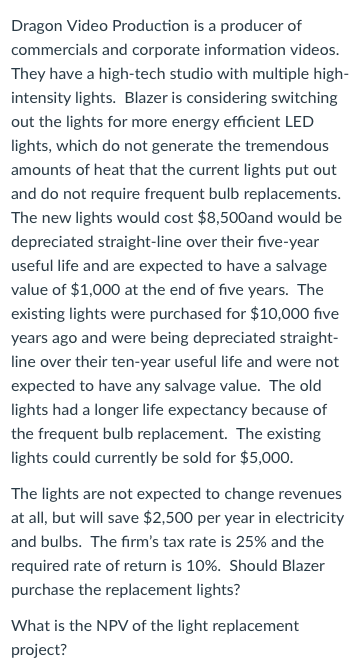

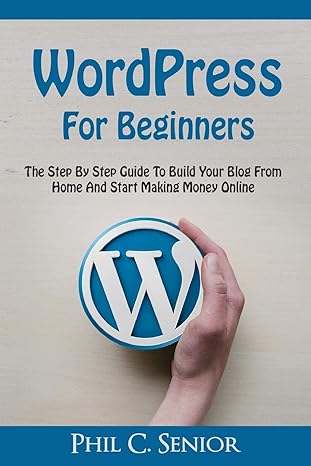

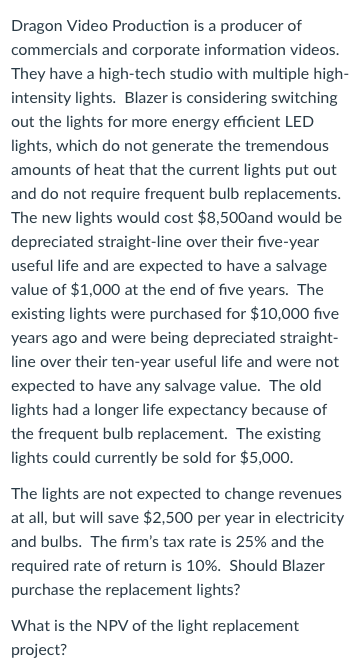

Dragon Video Production is a producer of commercials and corporate information videos They have a high-tech studio with multiple high- intensity lights. Blazer is considering switching out the lights for more energy efficient lights, which do not generate the tremendous amounts of heat that the current lights put out and do not require frequent bulb replacements The new lights would cost $8,500and would be depreciated straight-line over their five-year useful life and are expected to have a salvage value of $1,000 at the end of five years. The existing lights were purchased for $10,000 five years ago and were being depreciated straight- line over their ten-year useful life and were not expected to have any salvage value. The old lights had a longer life expectancy because of the frequent bulb replacement. The existing lights could currently be sold for $5,000. LED The lights are not expected to change revenues at all, but will save $2,500 per year in electricity and bulbs. The firm's tax rate is 25% and the required rate of return is 10%. Should Blazer purchase the replacement lights? What is the NPV of the light replacement project? What is the NPV of the light replacement project? -$263.20 $4,736.80 O $1,243.40 O-$1,243.40 Dragon Video Production is a producer of commercials and corporate information videos They have a high-tech studio with multiple high- intensity lights. Blazer is considering switching out the lights for more energy efficient lights, which do not generate the tremendous amounts of heat that the current lights put out and do not require frequent bulb replacements The new lights would cost $8,500and would be depreciated straight-line over their five-year useful life and are expected to have a salvage value of $1,000 at the end of five years. The existing lights were purchased for $10,000 five years ago and were being depreciated straight- line over their ten-year useful life and were not expected to have any salvage value. The old lights had a longer life expectancy because of the frequent bulb replacement. The existing lights could currently be sold for $5,000. LED The lights are not expected to change revenues at all, but will save $2,500 per year in electricity and bulbs. The firm's tax rate is 25% and the required rate of return is 10%. Should Blazer purchase the replacement lights? What is the NPV of the light replacement project? What is the NPV of the light replacement project? -$263.20 $4,736.80 O $1,243.40 O-$1,243.40