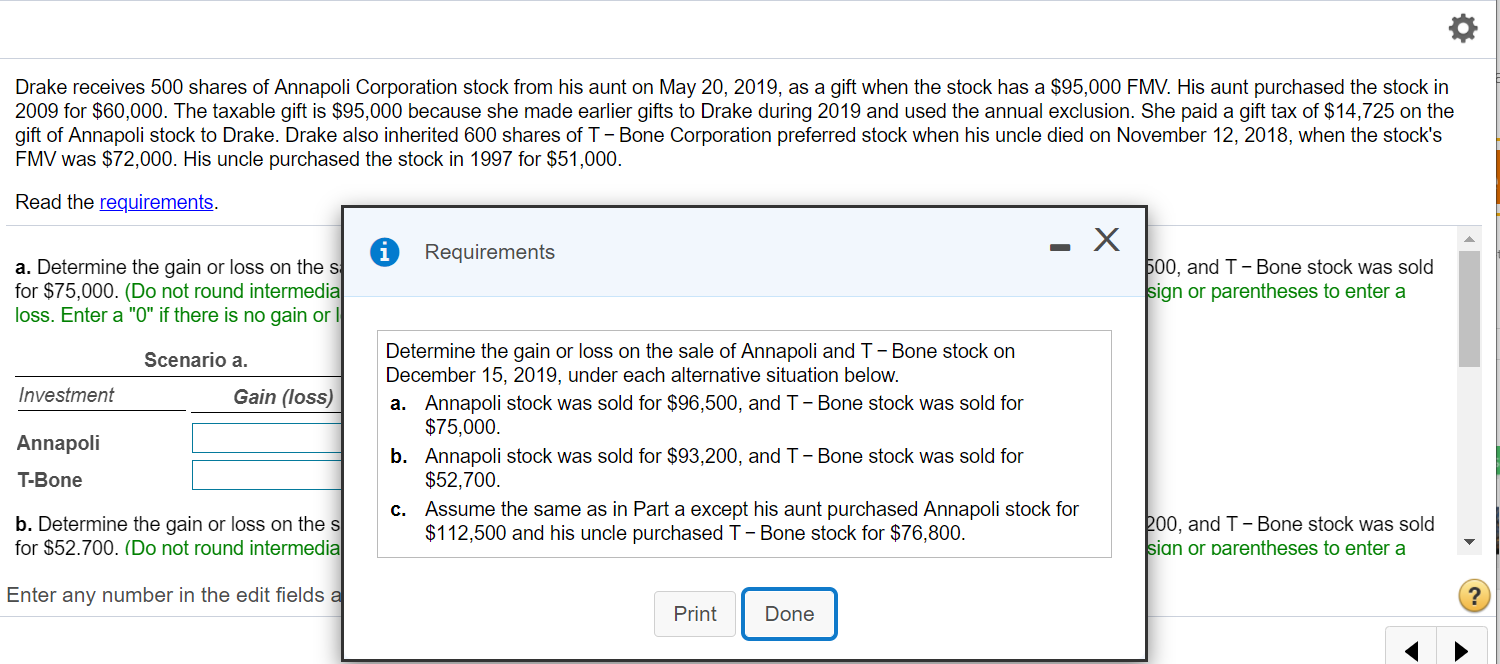

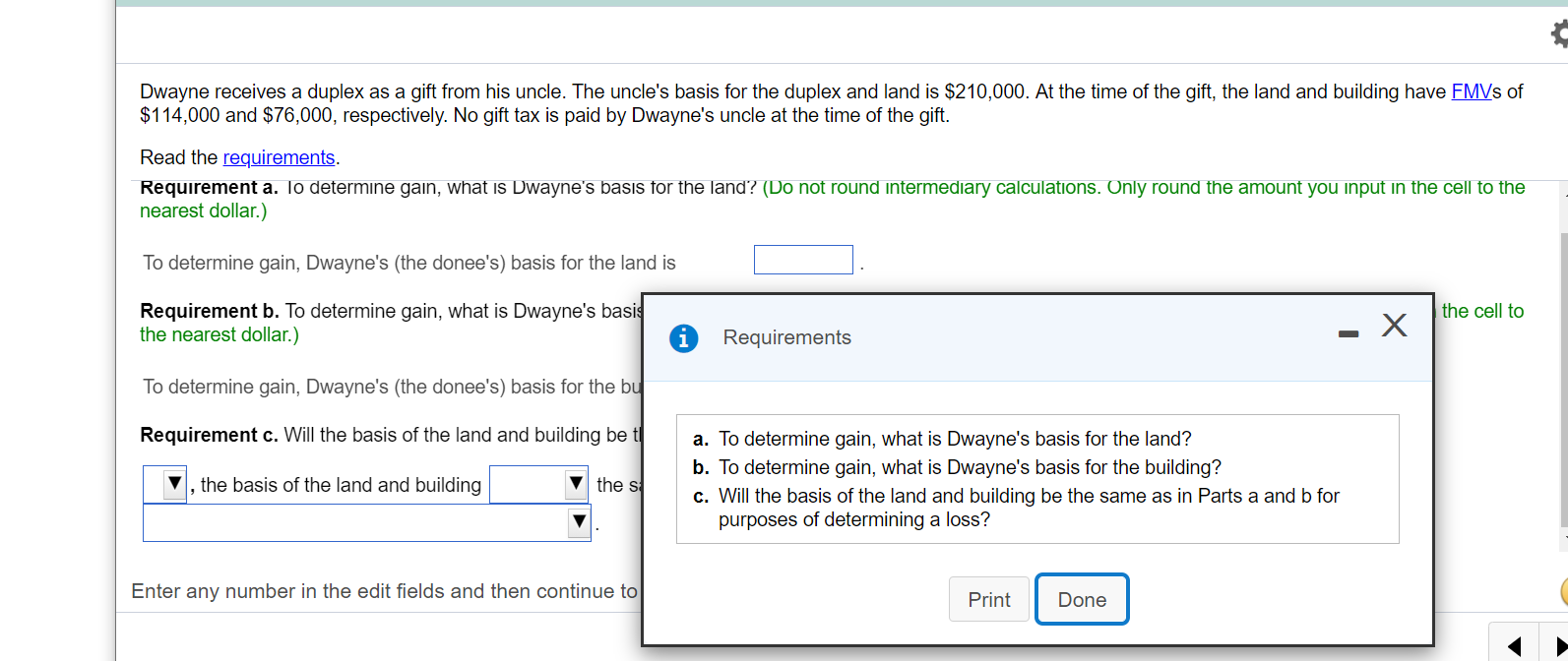

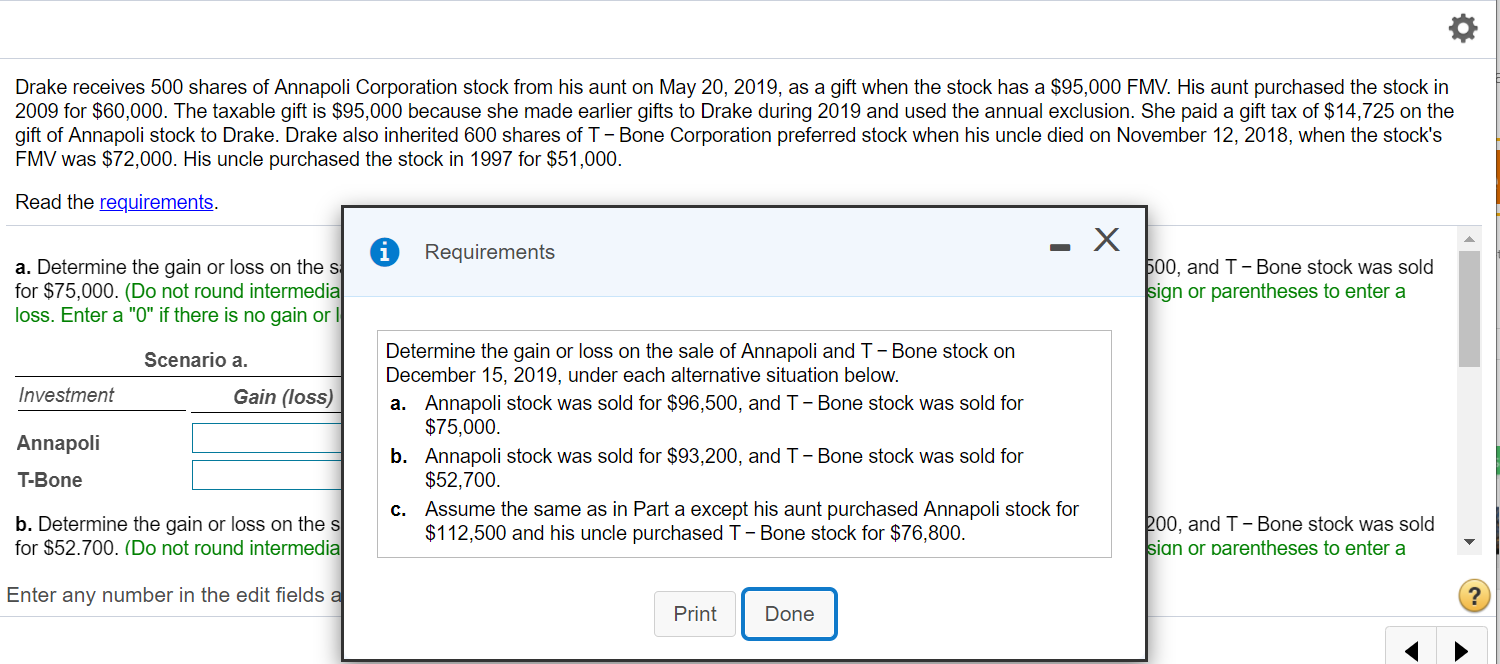

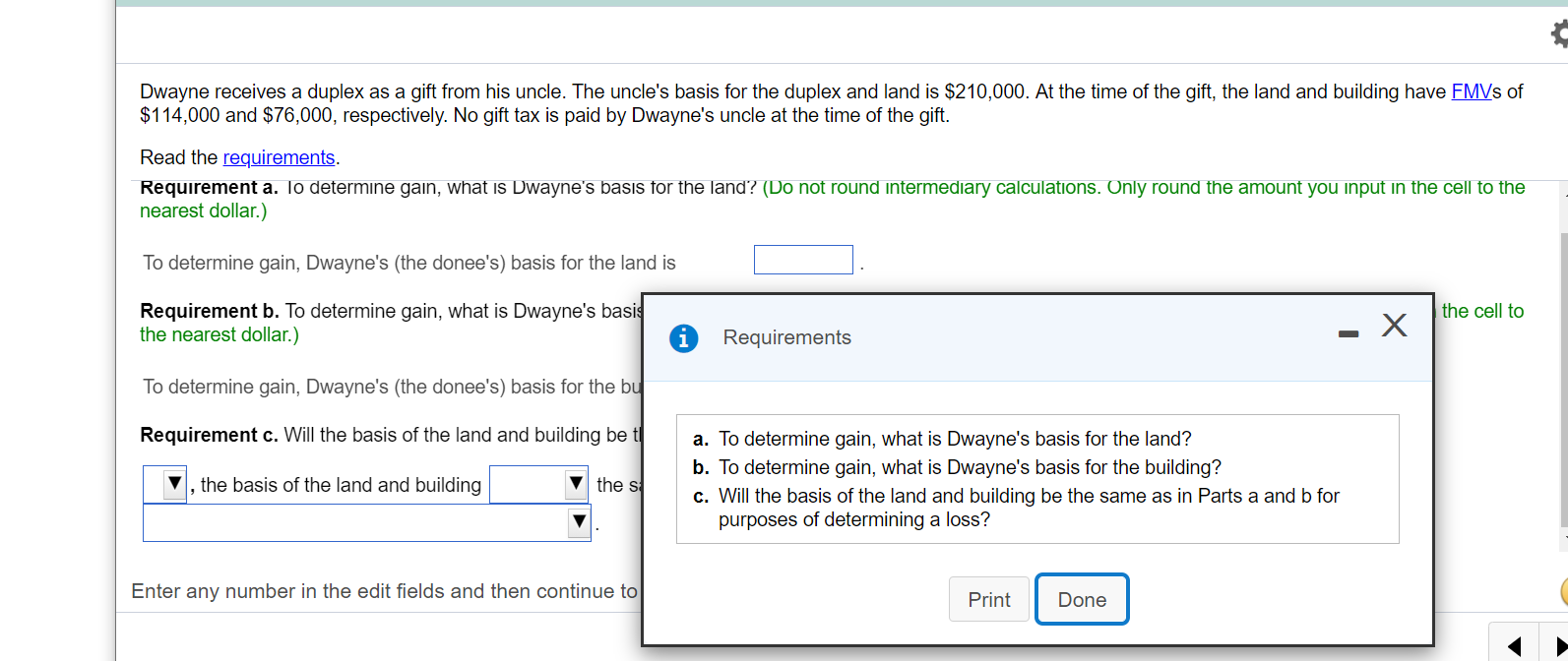

Drake receives 500 shares of Annapoli Corporation stock from his aunt on May 20, 2019, as a gift when the stock has a $95,000 FMV. His aunt purchased the stock in 2009 for $60,000. The taxable gift is $95,000 because she made earlier gifts to Drake during 2019 and used the annual exclusion. She paid a gift tax of $14,725 on the gift of Annapoli stock to Drake. Drake also inherited 600 shares of T-Bone Corporation preferred stock when his uncle died on November 12, 2018, when the stock's FMV was $72,000. His uncle purchased the stock in 1997 for $51,000. Read the requirements. Requirements a. Determine the gain or loss on the s for $75,000. (Do not round intermedia loss. Enter a "0" if there is no gain or ! 500, and T-Bone stock was sold sign or parentheses to enter a Scenario a. Investment Gain (loss) Annapoli Determine the gain or loss on the sale of Annapoli and T-Bone stock on December 15, 2019, under each alternative situation below. a. Annapoli stock was sold for $96,500, and T-Bone stock was sold for $75,000. b. Annapoli stock was sold for $93,200, and T-Bone stock was sold for $52,700. C. Assume the same as in Part a except his aunt purchased Annapoli stock for $112,500 and his uncle purchased T-Bone stock for $76,800. T-Bone b. Determine the gain or loss on the for $52.700. (Do not round intermedia koo, and T-Bone stock was sold sian or parentheses to enter a Enter any number in the edit fields a Print Done Dwayne receives a duplex as a gift from his uncle. The uncle's basis for the duplex and land is $210,000. At the time of the gift, the land and building have FMVs of $114,000 and $76,000, respectively. No gift tax is paid by Dwayne's uncle at the time of the gift. Read the requirements. Requirement a. lo determine gain, what is Dwayne's basis for the land? (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) To determine gain, Dwayne's (the donee's) basis for the land is the cell to Requirement b. To determine gain, what is Dwayne's basis the nearest dollar.) - X Requirements To determine gain, Dwayne's (the donee's) basis for the bu Requirement c. Will the basis of the land and building bet the basis of the land and building the s a. To determine gain, what is Dwayne's basis for the land? b. To determine gain, what is Dwayne's basis for the building? c. Will the basis of the land and building be the same as in Parts a and b for purposes of determining a loss? Enter any number in the edit fields and then continue to Print Done Drake receives 500 shares of Annapoli Corporation stock from his aunt on May 20, 2019, as a gift when the stock has a $95,000 FMV. His aunt purchased the stock in 2009 for $60,000. The taxable gift is $95,000 because she made earlier gifts to Drake during 2019 and used the annual exclusion. She paid a gift tax of $14,725 on the gift of Annapoli stock to Drake. Drake also inherited 600 shares of T-Bone Corporation preferred stock when his uncle died on November 12, 2018, when the stock's FMV was $72,000. His uncle purchased the stock in 1997 for $51,000. Read the requirements. Requirements a. Determine the gain or loss on the s for $75,000. (Do not round intermedia loss. Enter a "0" if there is no gain or ! 500, and T-Bone stock was sold sign or parentheses to enter a Scenario a. Investment Gain (loss) Annapoli Determine the gain or loss on the sale of Annapoli and T-Bone stock on December 15, 2019, under each alternative situation below. a. Annapoli stock was sold for $96,500, and T-Bone stock was sold for $75,000. b. Annapoli stock was sold for $93,200, and T-Bone stock was sold for $52,700. C. Assume the same as in Part a except his aunt purchased Annapoli stock for $112,500 and his uncle purchased T-Bone stock for $76,800. T-Bone b. Determine the gain or loss on the for $52.700. (Do not round intermedia koo, and T-Bone stock was sold sian or parentheses to enter a Enter any number in the edit fields a Print Done Dwayne receives a duplex as a gift from his uncle. The uncle's basis for the duplex and land is $210,000. At the time of the gift, the land and building have FMVs of $114,000 and $76,000, respectively. No gift tax is paid by Dwayne's uncle at the time of the gift. Read the requirements. Requirement a. lo determine gain, what is Dwayne's basis for the land? (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) To determine gain, Dwayne's (the donee's) basis for the land is the cell to Requirement b. To determine gain, what is Dwayne's basis the nearest dollar.) - X Requirements To determine gain, Dwayne's (the donee's) basis for the bu Requirement c. Will the basis of the land and building bet the basis of the land and building the s a. To determine gain, what is Dwayne's basis for the land? b. To determine gain, what is Dwayne's basis for the building? c. Will the basis of the land and building be the same as in Parts a and b for purposes of determining a loss? Enter any number in the edit fields and then continue to Print Done