Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Drapkins Stationers ( DS ) sells pens in its retail store location based in Chapel Hill, NC . DS has thefollowing November 3 0 ,

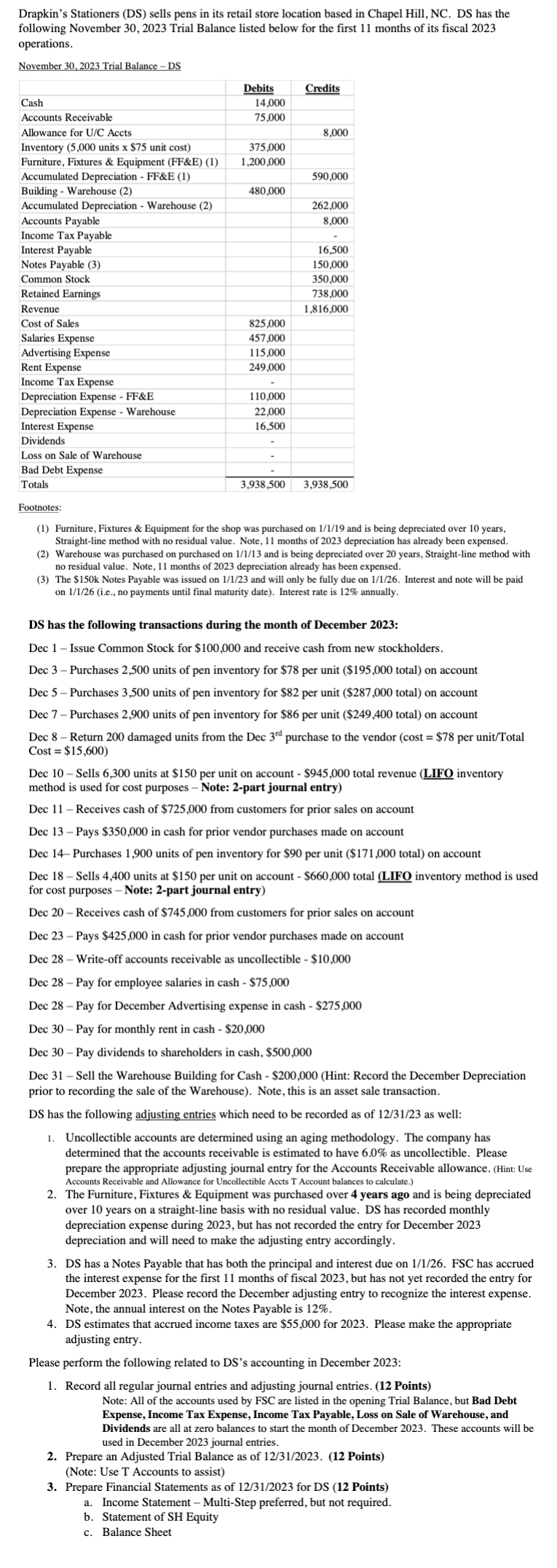

Drapkins Stationers DS sells pens in its retail store location based in Chapel Hill, NC DS has thefollowing November Trial Balance listed below for the first months of its fiscal operations.November Trial Balance

Footnotes: Furniture, Fixtures & Equipment for the shop was purchased on and is being depreciated over years,Straightline method with no residual value. Note, months of depreciation has already been expensed. Warehouse was purchased on purchased on and is being depreciated over years, Straightline method withno residual value. Note, months of depreciation already has been expensed. The $k Notes Payable was issued on and will only be fully due on Interest and note will be paidon ie no payments until final maturity date Interest rate is annually.

Trial Balance: Cash Accounts Receivable Allowance for UC Accts Inventory units x $ unit costFurniture, Fixtures & Equipment FF&EAccumulated Depreciation FF&E Building Warehouse Accumulated Depreciation Warehouse Accounts Payable Income Tax Payable Interest Payable Notes Payable Common Stock Retained Earnings Revenue Cost of Sales Salaries Expense Advertising Expense Rent Expense Income Tax Expense Depreciation Expense FF&E Depreciation Expense Warehouse Interest Expense Dividends Loss on Sale of Warehouse Bad Debt Expense Totals DS has the following transactions during the month of December :Dec Issue Common Stock for $ and receive cash from new stockholders.Dec Purchases units of pen inventory for $ per unit $ total on accountDec Purchases units of pen inventory for $ per unit $ total on accountDec Purchases units of pen inventory for $ per unit $ total on accountDec Return damaged units from the Dec rd purchase to the vendor cost $ per unitTotalCost $Dec Sells units at $ per unit on account $ total revenue LIFO inventorymethod is used for cost purposes Note: part journal entryDec Receives cash of $ from customers for prior sales on accountDec Pays $ in cash for prior vendor purchases made on accountDec Purchases units of pen inventory for $ per unit $ total on accountDec Sells units at $ per unit on account $ total LIFO inventory method is usedfor cost purposes Note: part journal entryDec Receives cash of $ from customers for prior sales on accountDec Pays $ in cash for prior vendor purchases made on accountDec Writeoff accounts receivable as uncollectible $Dec Pay for employee salaries in cash $Dec Pay for December Advertising expense in cash $Dec Pay for monthly rent in cash $Dec Pay dividends to shareholders in cash, $Dec Sell the Warehouse Building for Cash $Hint: Record the December Depreciationprior to recording the sale of the Warehouse Note, this is an asset sale transaction.DS has the following adjusting entries which need to be recorded as of as well: Uncollectible accounts are determined using an aging methodology. The company hasdetermined that the accounts receivable is estimated to have as uncollectible. Pleaseprepare the appropriate adjusting journal entry for the Accounts Receivable allowance. Hint: UseAccounts Receivable and Allowance for Uncollectible Accts T Account balances to calculate. The Furniture, Fixtures & Equipment was purchased over years ago and is being depreciatedover years on a straightline basis with no residual value. DS has recorded monthlydepreciation expense during but has not recorded the entry for December depreciation and will need to make the adjusting entry accordingly DS has a Notes Payable that has both the principal and interest due on FSC has accruedthe interest expense for the first months of fiscal but has not yet recorded the entry forDecember Please record the December adjusting entry to recognize the interest expense.Note, the annual interest on the Notes Payable is DS estimates that accrued income taxes are $ for Please make the appropriateadjusting entry.Please perform the following related to DSs accounting in December : Record all regular journal entries and adjusting journal entries. PointsNote: All of the accounts used by FSC are listed in the opening Trial Balance, but Bad DebtExpense, Income Tax Expense, Income Tax Payable, Loss on Sale of Warehouse, andDividends are all at zero balances to start the month of December These accounts will beused in December journal entries Prepare an Adjusted Trial Balance as of PointsNote: Use T Accounts to assist Prepare Financial Statements as of for DS Pointsa Income Statement MultiStep preferred, but not required.b Statement of SH Equityc. Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started