DRAW ONLY CASH FLOW DIAGRAM OF PROBLEMS FROM ( 13.1 to 13.10 ) Problems.

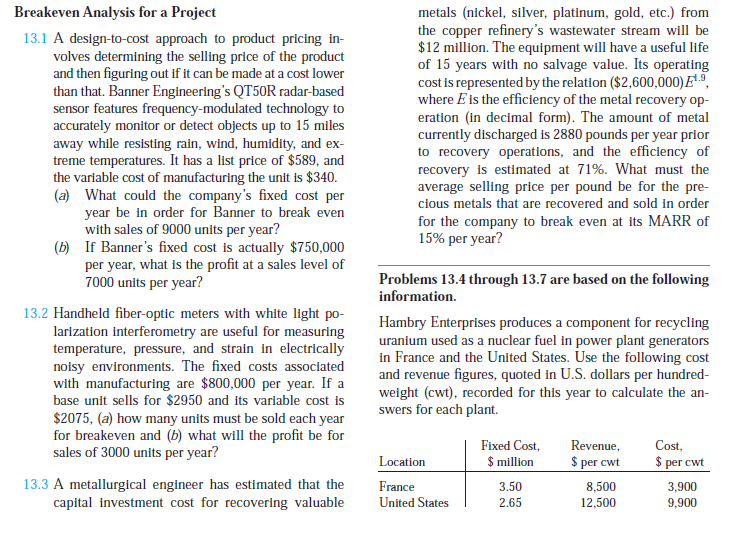

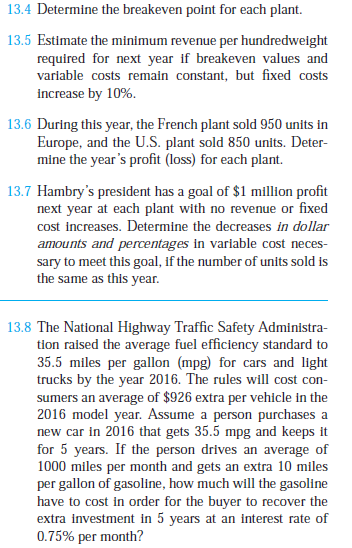

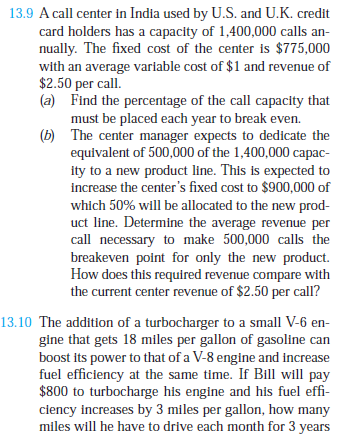

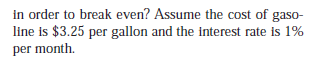

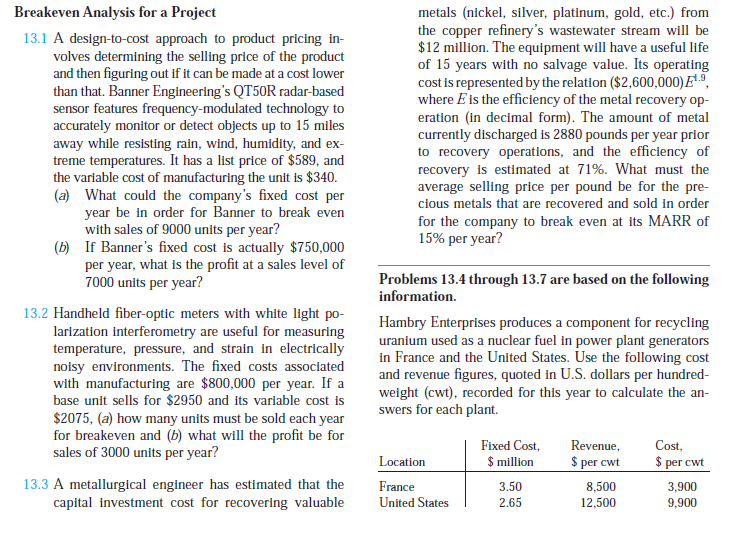

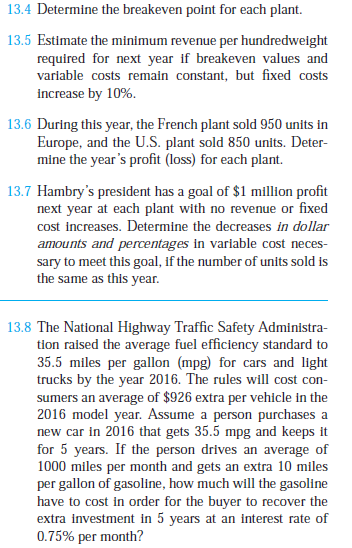

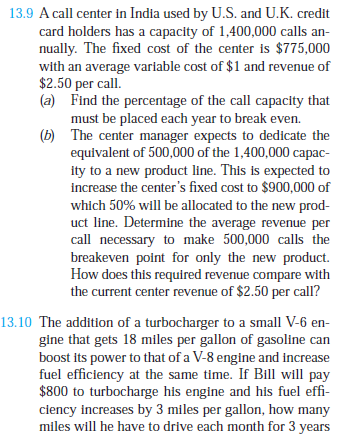

metals (nickel, silver, platinum, gold, etc.) from the copper refinery's wastewater stream will be $12 million. The equipment will have a useful life of 15 years with no salvage value. Its operating cost is represented by the relation ($2,600,000). where E is the efficiency of the metal recovery op- eration (in decimal form). The amount of metal currently discharged is 2880 pounds per year prior to recovery operations, and the efficiency of recovery is estimated at 71%. What must the average selling price per pound be for the pre- cious metals that are recovered and sold in order for the company to break even at its MARR of 15% per year? Breakeven Analysis for a Project 13.1 A design-to-cost approach to product pricing in- volves determining the selling price of the product and then figuring out if it can be made at a cost lower than that. Banner Engineering's QT50R radar-based sensor features frequency-modulated technology to accurately monitor or detect objects up to 15 miles away while resisting rain, wind, humidity, and ex- treme temperatures. It has a list price of $589, and the variable cost of manufacturing the unit is $340. (a) What could the company's fixed cost per year be in order for Banner to break even with sales of 9000 units per year? (6) If Banner's fixed cost is actually $750,000 per year, what is the profit at a sales level of 7000 units per year? 13.2 Handheld fiber-optic meters with white light po- larization interferometry are useful for measuring temperature, pressure, and strain in electrically noisy environments. The fixed costs associated with manufacturing are $800,000 per year. If a base unit sells for $2950 and its variable cost is $2075, (a) how many units must be sold each year for breakeven and (b) what will the profit be for sales of 3000 units per year? 13.3 A metallurgical engineer has estimated that the capital investment cost for recovering valuable Problems 13.4 through 13.7 are based on the following information. Hambry Enterprises produces a component for recycling uranium used as a nuclear fuel in power plant generators in France and the United States. Use the following cost and revenue figures, quoted in U.S. dollars per hundred- weight (cwt), recorded for this year to calculate the an- swers for each plant. Fixed Cost, $ million Location France United States Revenue, $ per cwt 8,500 12,500 Cost, $ per cwt 3,900 9,900 3.50 2.65 13.4 Determine the breakeven point for each plant. 13.5 Estimate the minimum revenue per hundredweight required for next year if breakeven values and variable costs remain constant, but fixed costs increase by 10% 13.6 During this year, the French plant sold 950 units in Europe, and the U.S. plant sold 850 units. Deter- mine the year's profit (loss) for each plant. 13.7 Hambry's president has a goal of $1 million profit next year at each plant with no revenue or fixed cost increases. Determine the decreases in dollar amounts and percentages in variable cost neces- sary to meet this goal, if the number of units sold is the same as this year. 13.8 The National Highway Traffic Safety Administra- tion raised the average fuel efficiency standard to 35.5 miles per gallon (mpg) for cars and light trucks by the year 2016. The rules will cost con- sumers an average of $926 extra per vehicle in the 2016 model year. Assume a person purchases a new car in 2016 that gets 35.5 mpg and keeps it for 5 years. If the person drives an average of 1000 miles per month and gets an extra 10 miles per gallon of gasoline, how much will the gasoline have to cost in order for the buyer to recover the extra investment in 5 years at an interest rate of 0.75% per month? 13.9 A call center in India used by U.S. and U.K. credit card holders has a capacity of 1,400,000 calls an- nually. The fixed cost of the center is $775,000 with an average variable cost of $1 and revenue of $2.50 per call. (a) Find the percentage of the call capacity that must be placed each year to break even. (b) The center manager expects to dedicate the equivalent of 500,000 of the 1,400,000 capac- ity to a new product line. This is expected to increase the center's fixed cost to $900,000 of which 50% will be allocated to the new prod- uct line. Determine the average revenue per call necessary to make 500,000 calls the breakeven point for only the new product. How does this required revenue compare with the current center revenue of $2.50 per call? 13.10 The addition of a turbocharger to a small V-6 en- gine that gets 18 miles per gallon of gasoline can boost its power to that of a V-8 engine and increase fuel efficiency at the same time. If Bill will pay $800 to turbocharge his engine and his fuel effi- ciency increases by 3 miles per gallon, how many miles will he have to drive each month for 3 years in order to break even? Assume the cost of gaso- line is $3.25 per gallon and the interest rate is 1% per month