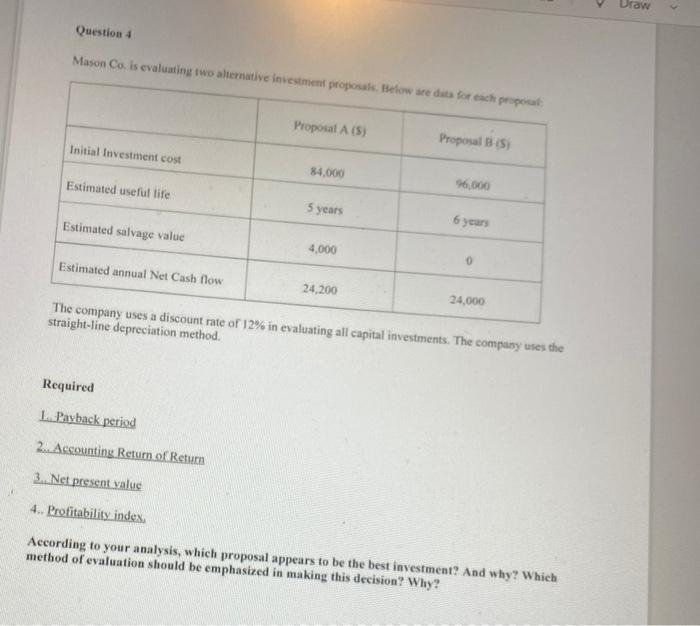

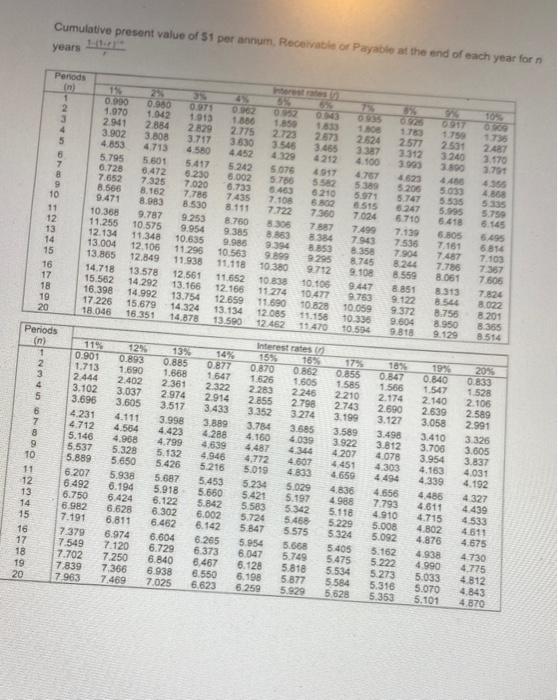

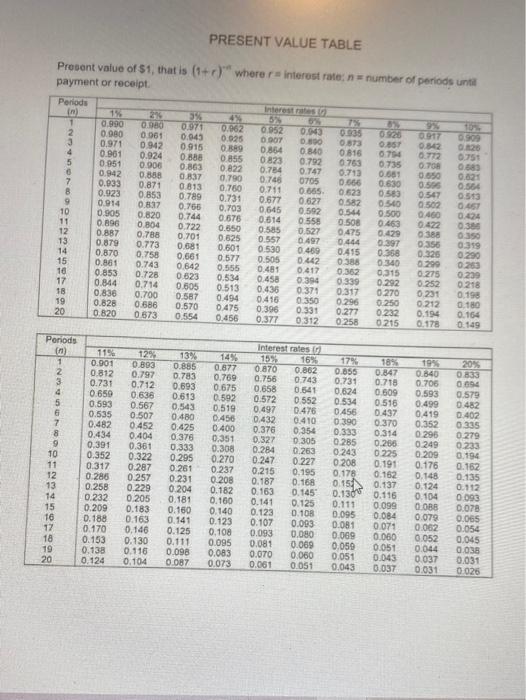

Draw Question 4 Mason Co. is evaluating two alternative investment proposal. Below are data for each proposal Proposal A (5) Proposal (5) Initial Investment cost 84.000 Estimated useful life 96,000 5 years 6 years Estimated salvage value 4.000 0 Estimated annual Net Cash flow 24,200 24,000 The company uses a discount rate of 12% in evaluating all capital investments. The company uses the straight-line depreciation method. Required L. Payback period 2. Accounting Return of Return 3. Net present value 4.. Profitability index According to your analysis, which proposal appears to be the best investment? And why? Which method of evaluation should be emphasized in making this decision? Why? Cumulative present value of 51 per annum. Receivable of Payable at the end of each year forn L years Penods n 4 31 UN ON3 10 4 5 10 2.524 1 TE 2577 3.312 3903 1.750 2531 3240 3.800 4.500 5 7 8 1 0.000 1.970 2941 3.902 4.853 5.795 0.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17 226 18.046 10 0.080 1.042 2884 3.808 4.713 5601 0.472 7.325 8.162 8.983 9.787 10.575 11.348 12.105 12.849 13.578 14.292 14.992 15.679 16.351 11 12 13 14 15 2 829 3.717 4580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11 296 11.938 12 561 13.166 13.754 14.324 14.878 1880 2.775 3830 4452 5 242 5.002 6.733 7.435 8111 8.750 9.385 9.988 10.563 11.118 11.652 12.166 12.659 13.134 13.500 1.85 2723 3546 4329 5075 5756 5.463 7108 7.722 5.306 8.853 9394 9999 10380 10.838 11 274 11 690 12.085 12 452 173 2487 3.170 3.791 4.355 4.88 5335 5.759 5.145 2673 3.455 4212 4957 5582 6210 5.802 7360 7587 8384 8 353 9 295 9712 10.10 10.477 10.828 4757 5389 5.971 6515 7.024 7.499 7 943 8.350 8765 9.100 9.447 9.753 10.059 10.336 10.554 5206 5.747 5247 6.710 7.139 7.536 7.904 8.244 8.559 8851 9.122 9.372 9.604 9818 16 17 18 19 20 5.033 5.535 5.95 5.410 6.805 7.161 7.487 7.796 8.061 8.313 8.544 8.756 8.950 9.129 5.814 7.103 7367 7 806 7824 8.022 8201 8.355 8.514 11470 Periods (n) 1 2 3 4 18% 0.847 1.566 2.174 2.690 3.127 GROWN- 6 7 8 9 Interest rates 15% 16% 0.870 0.862 1626 1.605 2.283 2.246 2.855 2798 3352 3274 3.784 3.585 4.160 4.039 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.202 6.492 6.750 6.982 7.191 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.584 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 13% 0.885 1.668 2 361 2.974 3.517 3.998 4.423 4.799 5.132 5 426 5.687 5.918 6.122 6.302 6.462 6,604 6.729 6.840 6.938 7025 14% 0.877 1547 2322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.650 5.842 6.002 6.142 6.265 6.373 8.467 6.550 6.623 11 12 13 14 15 20% 0.833 1.528 2.100 2.589 2.991 3.326 3.605 3.837 4.031 4.192 3.498 3.812 4.078 4303 4 494 17% 0.855 1.585 2210 2.743 3.199 3.589 3922 4.207 4.451 4.659 4.836 4.988 5.118 5229 5.324 5.405 5.475 5.534 5.584 5.628 4,772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 5.198 6.259 199 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4339 4.486 4.611 4.715 4.802 4.876 4 938 4.990 5.033 5.070 5.101 4607 4833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.810 5.877 5.929 16 17 18 19 20 4 327 4439 4533 4511 4675 4.656 7.793 4.910 5.000 5.092 5.162 5.222 5 273 5.316 5.353 7.379 7.549 7.702 7.839 7 963 4730 4.775 4812 4.843 4.870 PRESENT VALUE TABLE Present value of S1, that is (1+r)" wherer interest rate, ne number of periods unti payment or receipt interest 9% Periods m) 1 2 3 4 5 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 7 8 9 10 11 12 13 14 15 10 17 18 19 20 0.542 6.772 0.70 0.650 0.596 0.547 0502 0460 5% 0971 0.043 0.915 0888 0.863 0837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.505 0.587 0.570 0554 0.980 0.061 0.942 0.924 0.900 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.586 0673 0.062 0.025 0.889 0.855 0.822 0.790 0.750 0.731 0.703 0.676 0.550 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0456 0.952 O BOY 0.864 0823 0.784 0.768 0.711 0.677 0 645 0.614 0.585 0.557 0.530 0.505 0.481 0.45a 0.435 0.416 0.396 0.377 0.00 0.800 0.840 0.792 0.747 0705 0.665 0.627 0.592 0.556 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0335 0.573 0.816 0753 0.713 0.666 0.623 0582 0.544 0508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0258 OS 0.85 0.794 0.735 0.661 0.630 0583 0.540 0.500 0.483 0.429 0.397 0.368 0340 0.315 0.292 0.270 0.250 0.232 0215 0388 0.356 0.325 0290 0275 0.252 0231 0.212 0.194 0.178 0.900 26 0.751 0.583 0.821 0.504 0.513 0.651 0.424 0.30 0.350 0319 0.290 023 0239 0218 0.198 0.180 0.164 0.149 Porods 1 2 3 4 5 6 7 8 9 TO 11 12. 13 14 15 16 12 18 19 20 119 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 129 0.893 0.797 0.712 0.638 0.567 0.507 0452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0,146 0.130 0.116 0.104 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0_208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 Interest rates 15% 16% 0.870 0.862 0.756 0.743 0.658 0.541 0.572 0.552 0.497 0.476 0.432 0.410 0.376 0.354 0.327 0.305 0.284 0.263 0.247 0.227 0.215 0.195 0.187 0.168 0.163 0.145 0.141 0.125 0.123 0.108 0.107 0.003 0.093 0.080 0.081 0.069 0.070 0060 0.061 0.051 17% 0.656 0.731 0.624 0.534 0.456 0 390 0.333 0.285 0.243 0208 0.178 0.151 10% 0.847 0.718 0509 0.516 0.437 0.370 0.314 0.286 0225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.000 0051 0.043 0.037 19% 0.840 0.706 0.593 0.499 0.419 0.352 0296 0.249 0209 0.176 0.148 0.124 0.104 00BB 0.079 0.002 0.052 0.044 0.037 0.031 20% 0833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.152 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.1307 0.111 0.095 0.081 0.069 0.059 0.051 0,043