Answered step by step

Verified Expert Solution

Question

1 Approved Answer

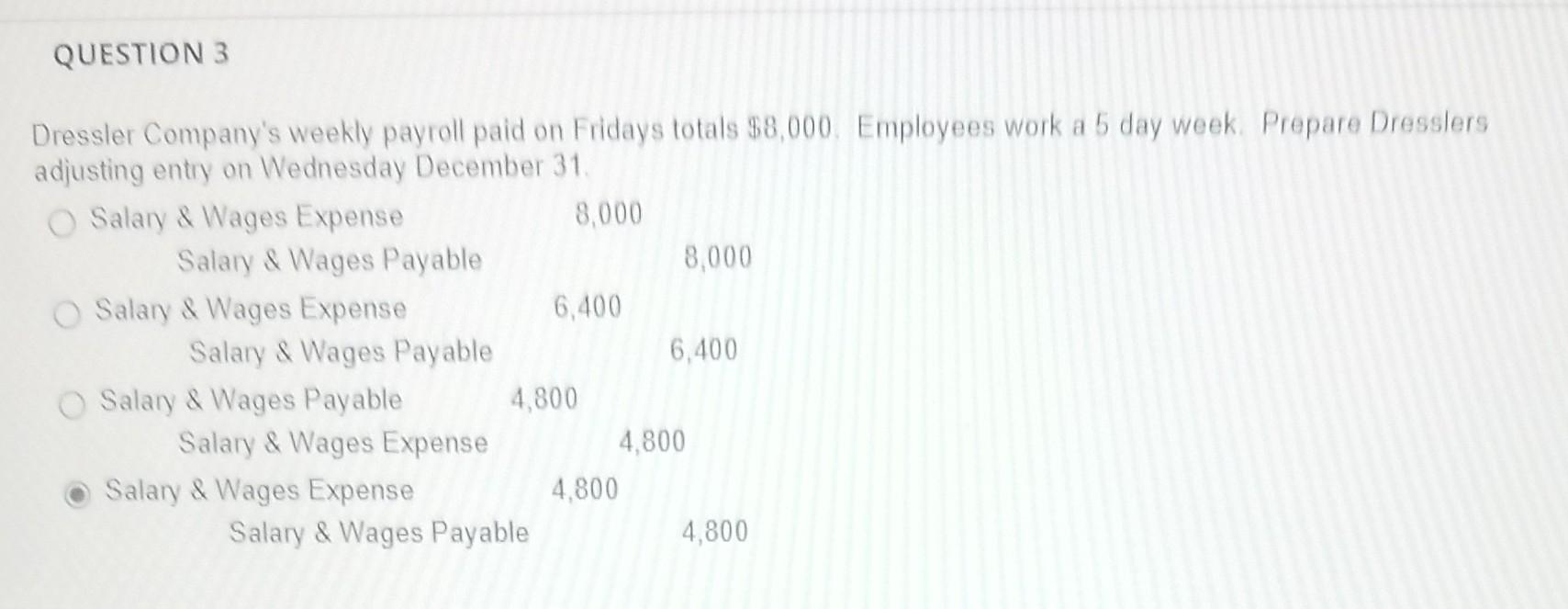

Dressler Company's weekly payroll paid on Fridays totals $8,000. Employees work a 5 day week. Prepare Dresslers adjusting entry on Wednesday December 31 Dressler Company's

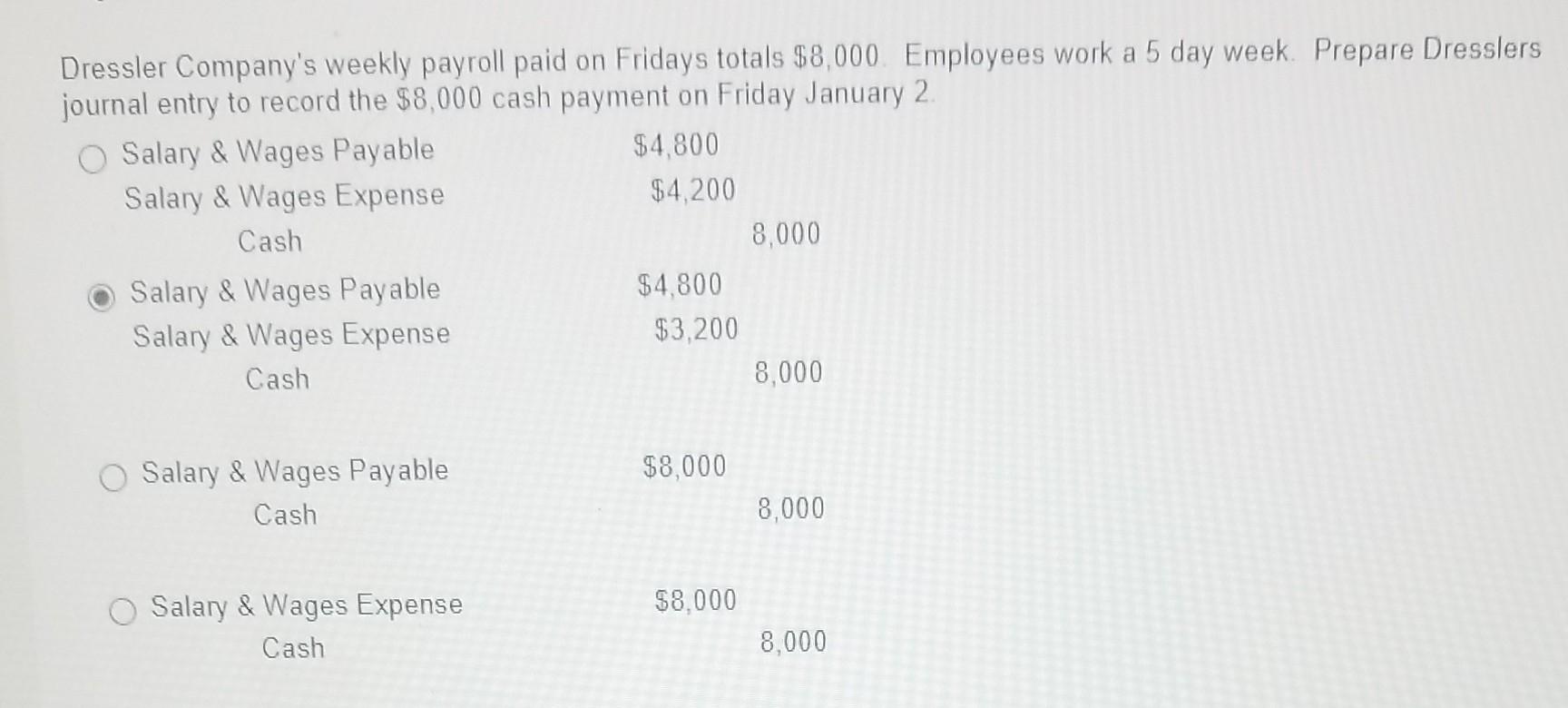

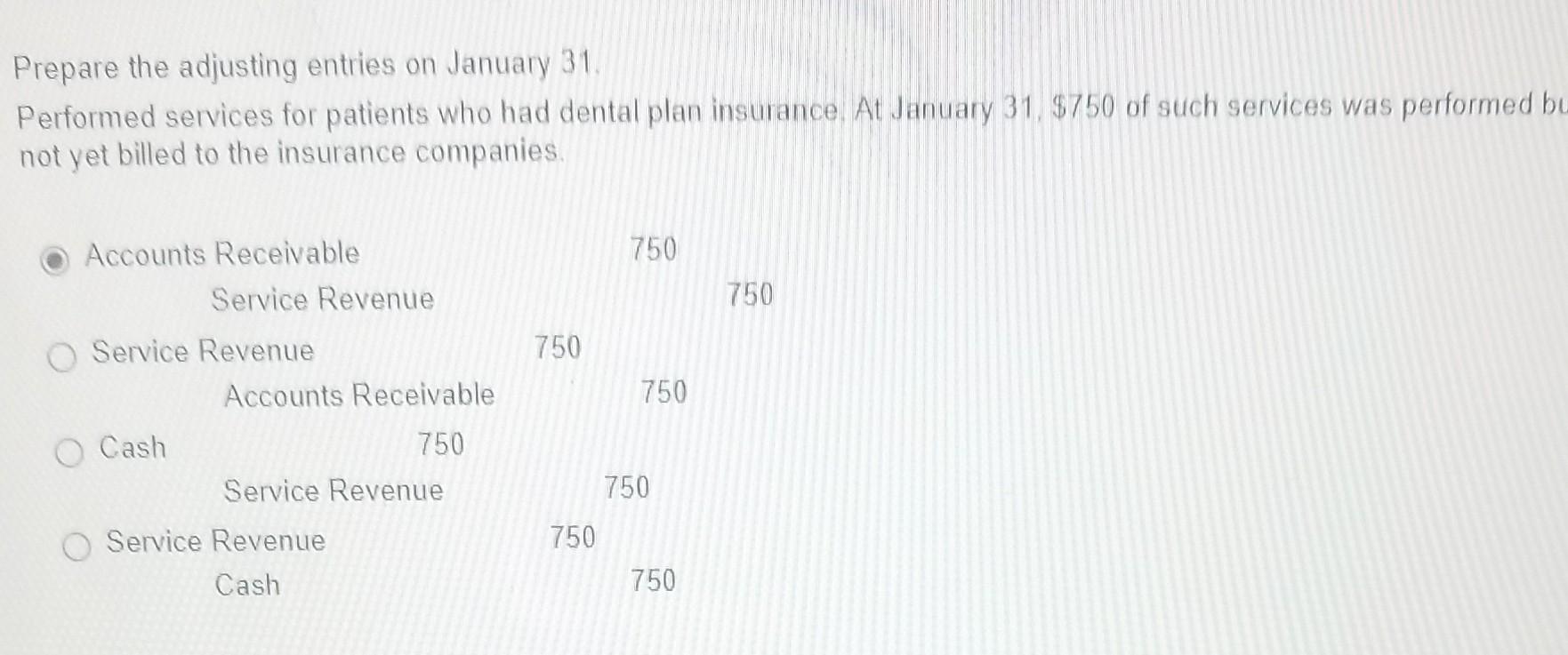

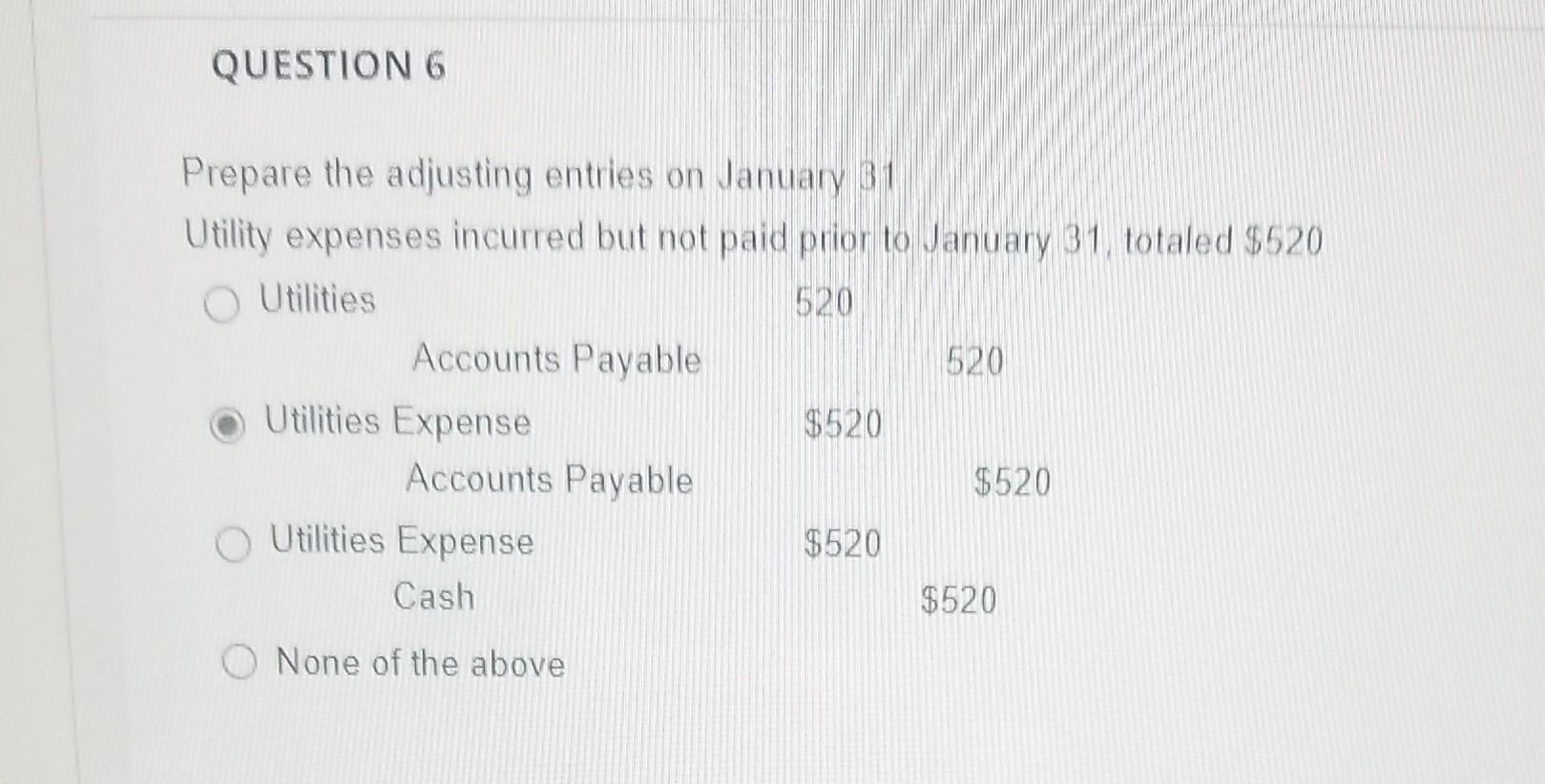

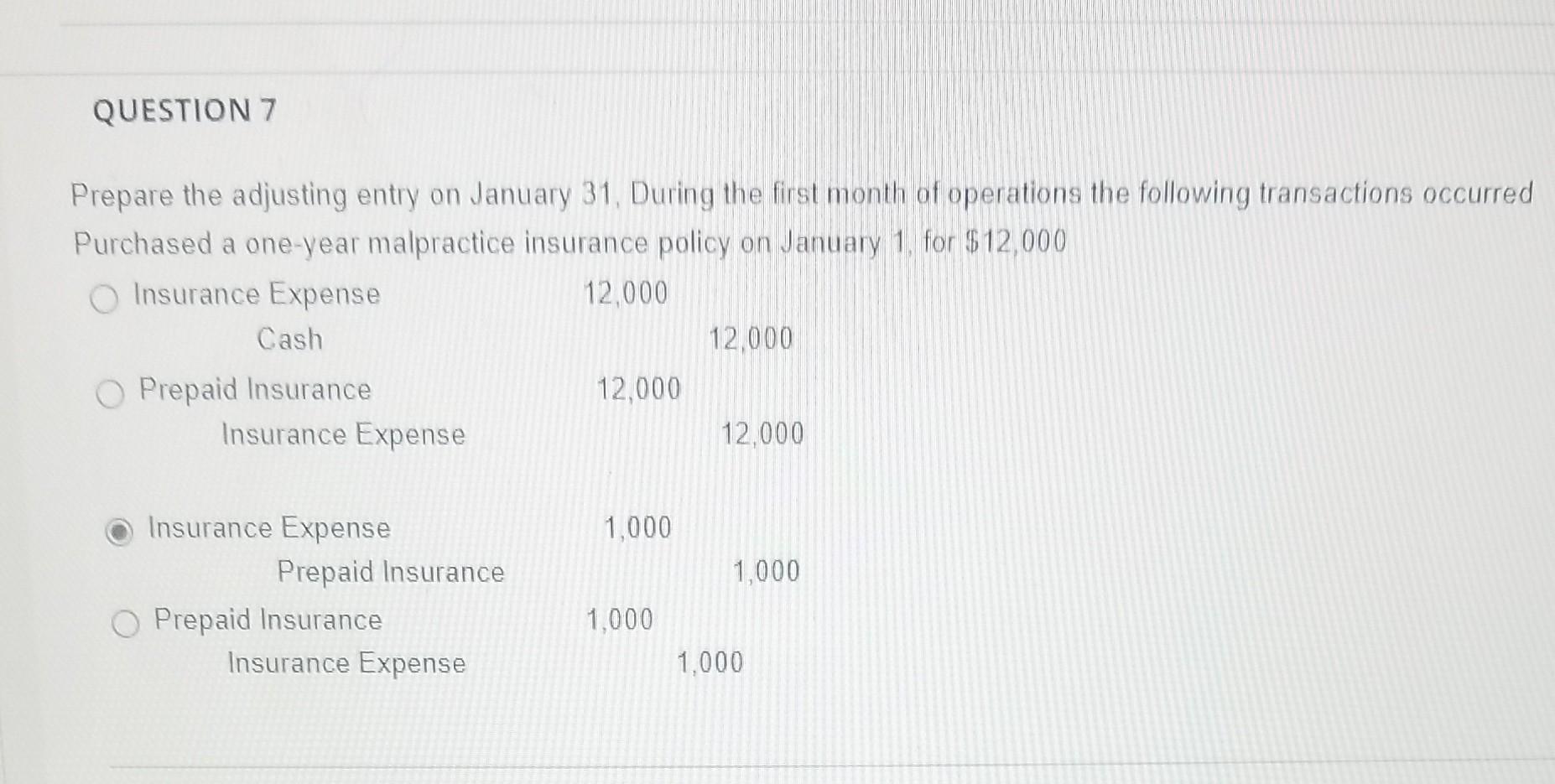

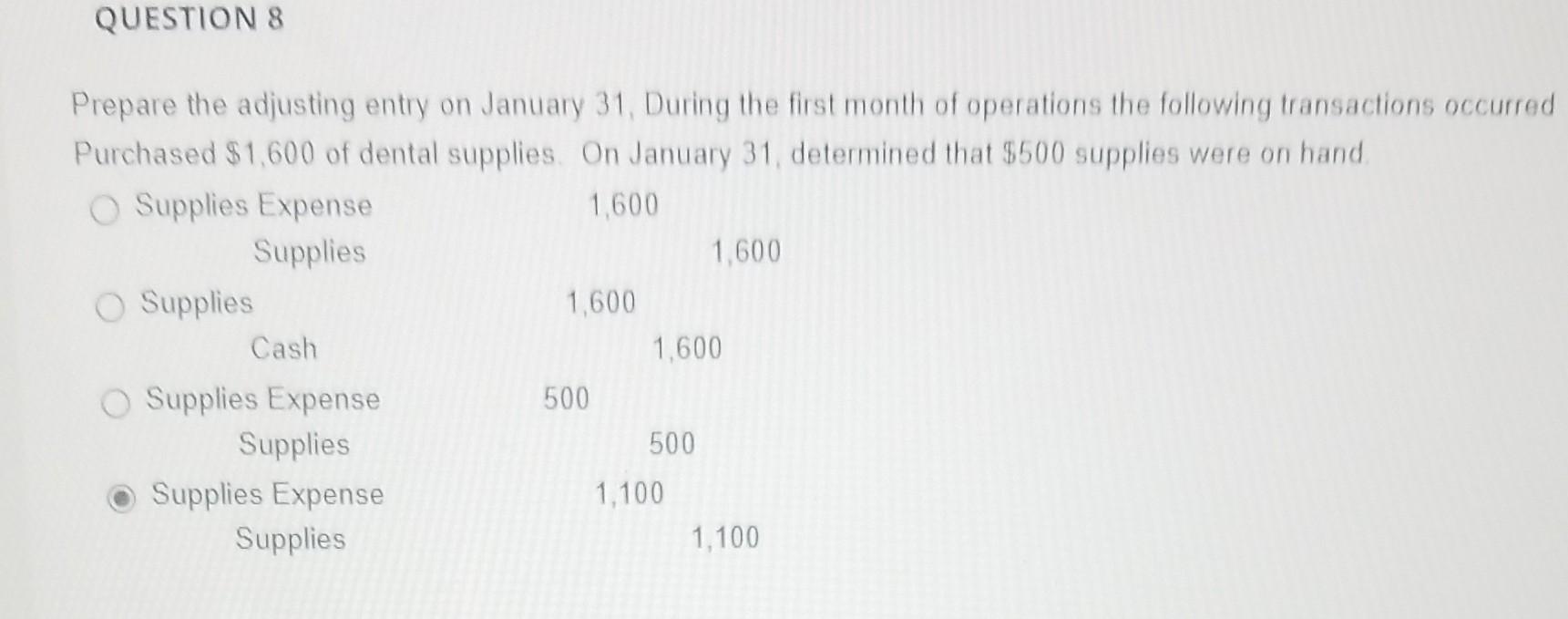

Dressler Company's weekly payroll paid on Fridays totals $8,000. Employees work a 5 day week. Prepare Dresslers adjusting entry on Wednesday December 31 Dressler Company's weekly payroll paid on Fridays totals $8,000. Employees work a 5 day week. Prepare Dresslers iournal entry to record the $8,000 cash payment on Friday January 2 Prepare the adjusting entries on January 31 . Performed services for patients who had dental plan insurance. At January 31,\$750 of such services was performed b not yet billed to the insurance companies. Prepare the adjusting entries on January 31 Utility expenses incurred but not paid prior to January 31 , totaled $520 Prepare the adjusting entry on January 31. During the first month of operations the following transactions occurred Purchased a one-year malpractice insurance policy on January 1 , for $12,000 Prepare the adjusting entry on January 31, During the first month of operations the following transactions occurred Purchased \$1,600 of dental supplies. On January 31, determined that \$500 supplies were on hand

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started