Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Drillmaster Sdn Bhd has developed a powerful new hand drill that would be used for woodwork and carpentry activities. It would cost $1 million

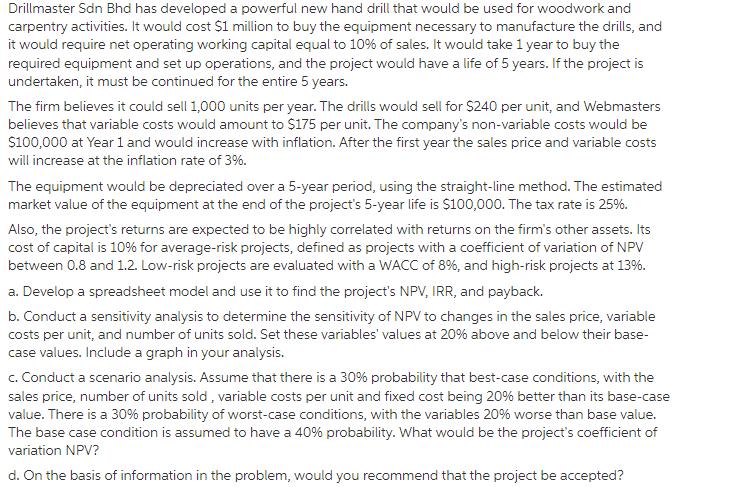

Drillmaster Sdn Bhd has developed a powerful new hand drill that would be used for woodwork and carpentry activities. It would cost $1 million to buy the equipment necessary to manufacture the drills, and it would require net operating working capital equal to 10% of sales. It would take 1 year to buy the required equipment and set up operations, and the project would have a life of 5 years. If the project is undertaken, it must be continued for the entire 5 years. The firm believes it could sell 1,000 units per year. The drills would sell for $240 per unit, and Webmasters believes that variable costs would amount to $175 per unit. The company's non-variable costs would be $100,000 at Year 1 and would increase with inflation. After the first year the sales price and variable costs will increase at the inflation rate of 3%. The equipment would be depreciated over a 5-year period, using the straight-line method. The estimated market value of the equipment at the end of the project's 5-year life is $100,000. The tax rate is 25%. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets. Its cost of capital is 10% for average-risk projects, defined as projects with a coefficient of variation of NPV between 0.8 and 1.2. Low-risk projects are evaluated with a WACC of 8%, and high-risk projects at 13%. a. Develop a spreadsheet model and use it to find the project's NPV, IRR, and payback. b. Conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, variable costs per unit, and number of units sold. Set these variables' values at 20% above and below their base- case values. Include a graph in your analysis. c. Conduct a scenario analysis. Assume that there is a 30% probability that best-case conditions, with the sales price, number of units sold, variable costs per unit and fixed cost being 20% better than its base-case value. There is a 30% probability of worst-case conditions, with the variables 20% worse than base value. The base case condition is assumed to have a 40% probability. What would be the project's coefficient of variation NPV? d. On the basis of information in the problem, would you recommend that the project be accepted?

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANNUAL DEPRECIATION 10000001000005180000 Present ValuePV of Cash FlowCash Flow1iN idiscount rateRequired Return1001 NYear of Cash Flow BASE CASE SCENA...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started