Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Drills Ltd is a company involved in the search for, production of and sale of oil and gas resources. During the year ended 30

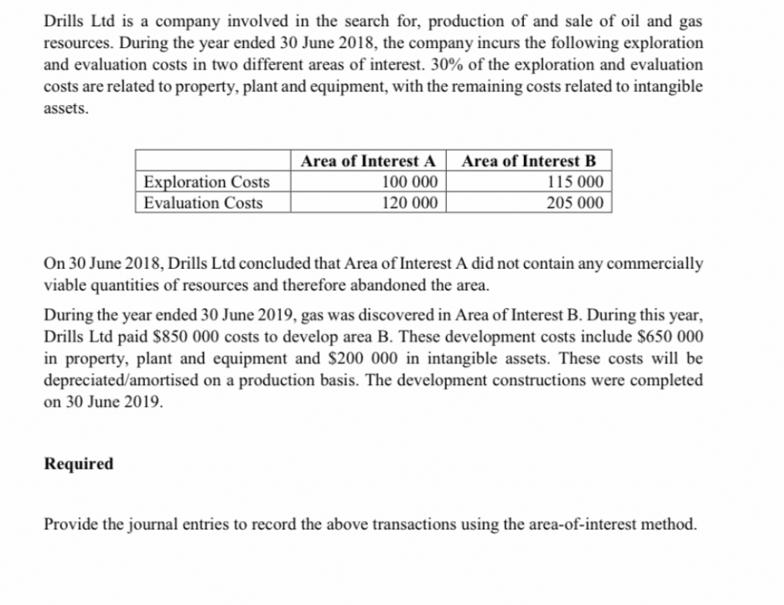

Drills Ltd is a company involved in the search for, production of and sale of oil and gas resources. During the year ended 30 June 2018, the company incurs the following exploration and evaluation costs in two different areas of interest. 30% of the exploration and evaluation costs are related to property, plant and equipment, with the remaining costs related to intangible assets. Exploration Costs Evaluation Costs Area of Interest A Area of Interest B 100 000 115 000 205 000 120 000 On 30 June 2018, Drills Ltd concluded that Area of Interest A did not contain any commercially viable quantities of resources and therefore abandoned the area. Required During the year ended 30 June 2019, gas was discovered in Area of Interest B. During this year, Drills Ltd paid $850 000 costs to develop area B. These development costs include $650 000 in property, plant and equipment and $200 000 in intangible assets. These costs will be depreciated/amortised on a production basis. The development constructions were completed on 30 June 2019. Provide the journal entries to record the above transactions using the area-of-interest method.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Year Ended 30 June 2018 Dr Exploration Evaluation Costs Intangibl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started