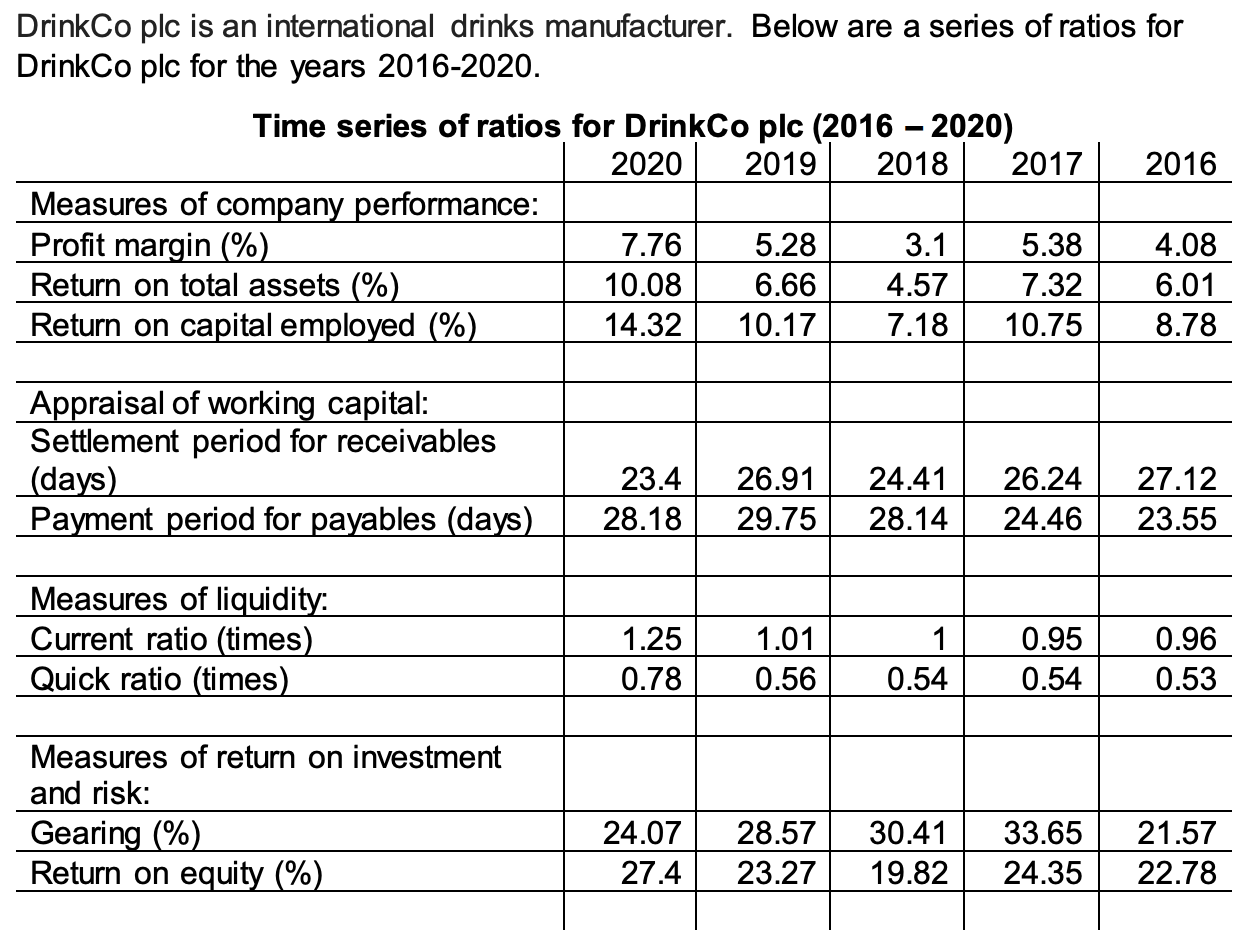

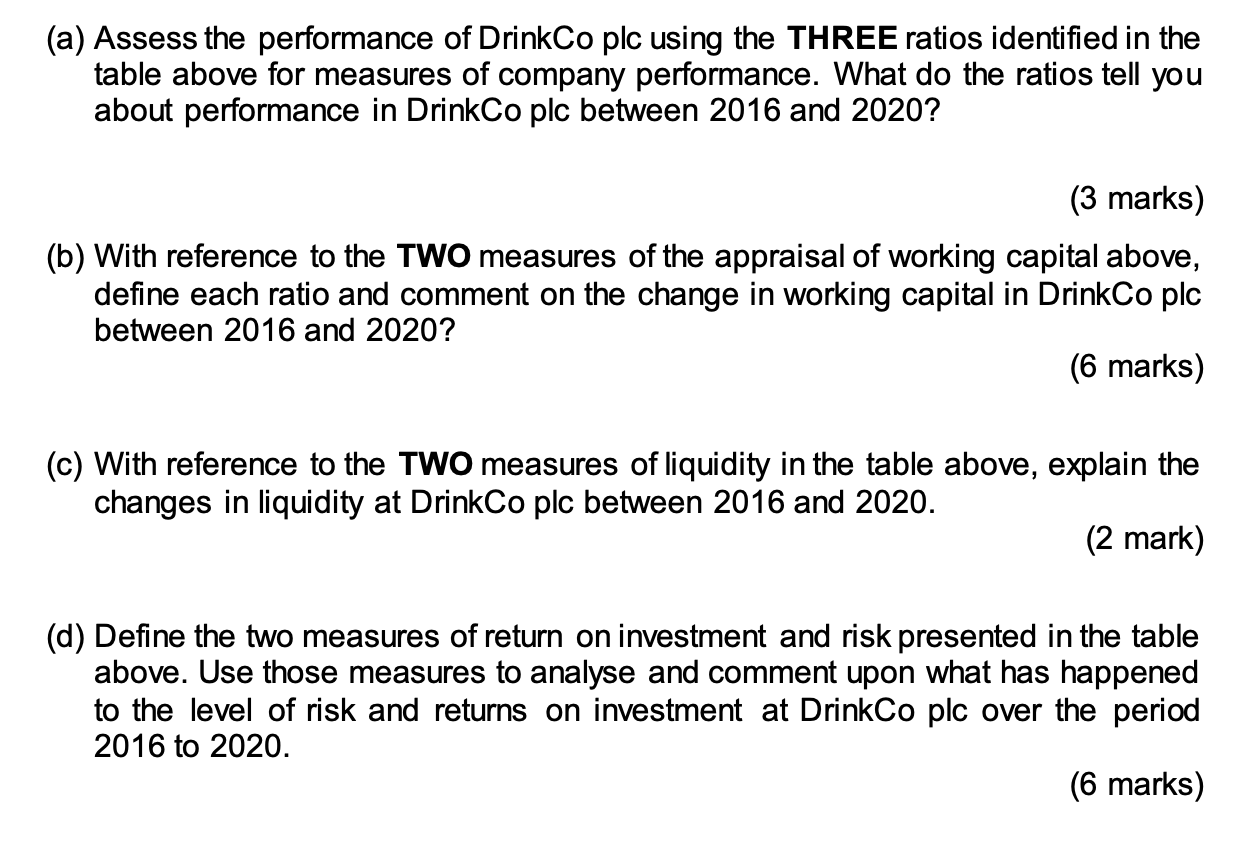

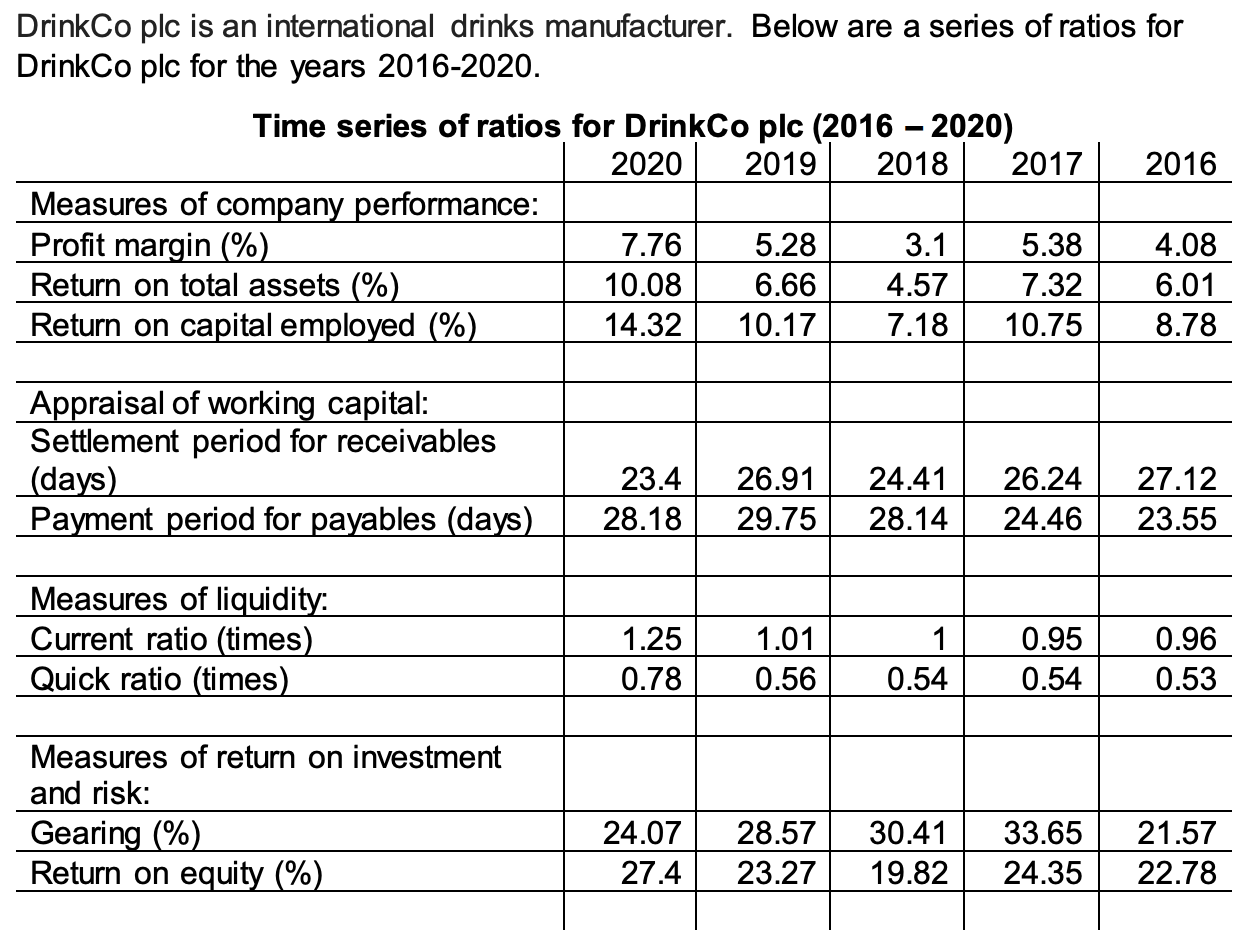

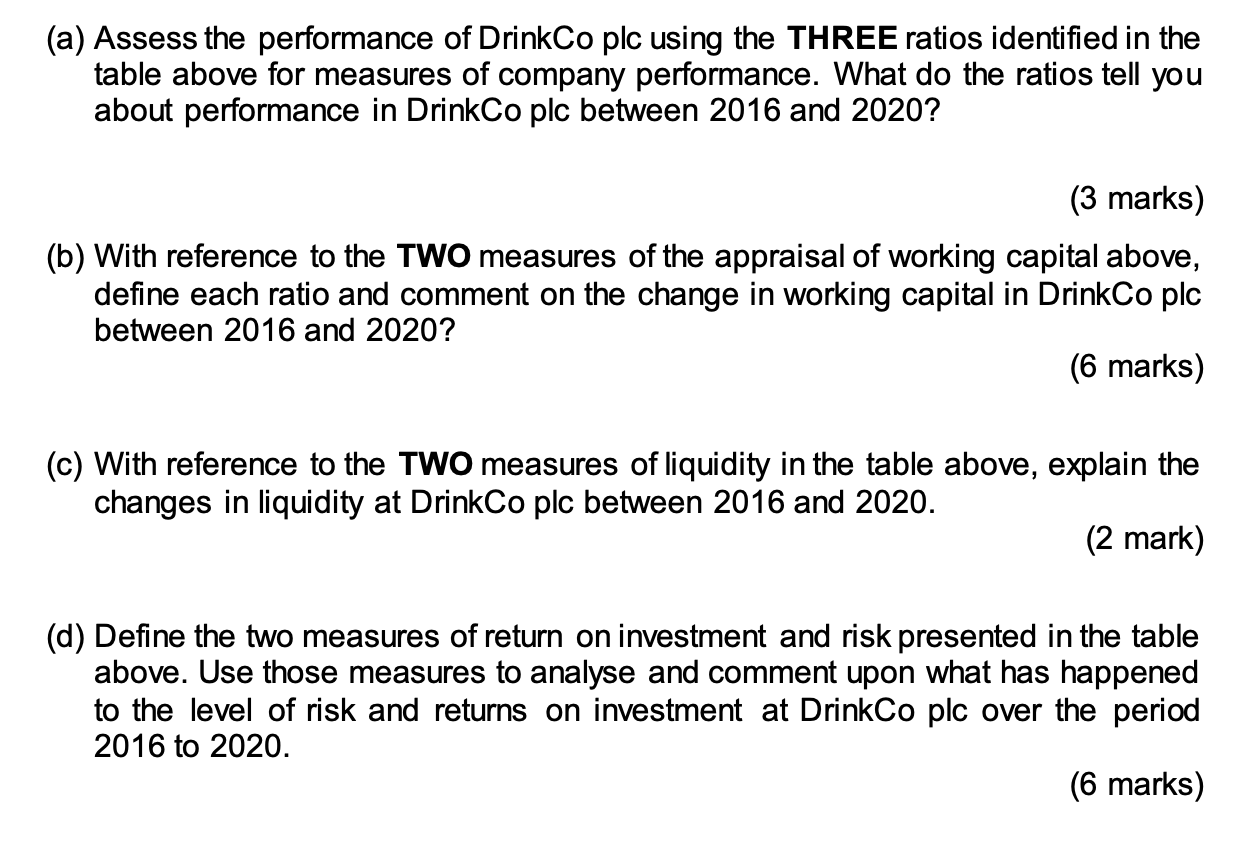

DrinkCo plc is an international drinks manufacturer. Below are a series of ratios for DrinkCo plc for the years 2016-2020. Time series of ratios for DrinkCo plc (2016 2020) 2020 2019 2018 2017 2016 Measures of company performance: Profit margin (%) 7.76 5.28 3.1 5.38 4.08 Return on total assets (%) 10.08 6.66 4.57 7.32 6.01 Return on capital employed (%) 14.32 10.17 7.18 10.75 8.78 Appraisal of working capital: Settlement period for receivables (days) Payment period for payables (days). 23.4 28.18 26.91 29.75 24.41 28.14 26.24 24.46 27.12 23.55 Measures of liquidity: Current ratio (times) Quick ratio (times) 1.25 0.78 1.01 0.56 0.95 0.54 0.96 0.53 0.54 Measures of return on investment and risk: Gearing (%) Return on equity (%) 24.07 27.4 28.57 23.27 30.41 19.82 33.65 24.35 21.57 22.78 (a) Assess the performance of DrinkCo plc using the THREE ratios identified in the table above for measures of company performance. What do the ratios tell you about performance in DrinkCo plc between 2016 and 2020? (3 marks) (b) With reference to the TWO measures of the appraisal of working capital above, define each ratio and comment on the change in working capital in Drink Co plc between 2016 and 2020? (6 marks) (c) With reference to the TWO measures of liquidity in the table above, explain the changes in liquidity at DrinkCo plc between 2016 and 2020. (2 mark) (d) Define the two measures of return on investment and risk presented in the table above. Use those measures to analyse and comment upon what has happened to the level of risk and returns on investment at DrinkCo plc over the period 2016 to 2020. (6 marks) DrinkCo plc is an international drinks manufacturer. Below are a series of ratios for DrinkCo plc for the years 2016-2020. Time series of ratios for DrinkCo plc (2016 2020) 2020 2019 2018 2017 2016 Measures of company performance: Profit margin (%) 7.76 5.28 3.1 5.38 4.08 Return on total assets (%) 10.08 6.66 4.57 7.32 6.01 Return on capital employed (%) 14.32 10.17 7.18 10.75 8.78 Appraisal of working capital: Settlement period for receivables (days) Payment period for payables (days). 23.4 28.18 26.91 29.75 24.41 28.14 26.24 24.46 27.12 23.55 Measures of liquidity: Current ratio (times) Quick ratio (times) 1.25 0.78 1.01 0.56 0.95 0.54 0.96 0.53 0.54 Measures of return on investment and risk: Gearing (%) Return on equity (%) 24.07 27.4 28.57 23.27 30.41 19.82 33.65 24.35 21.57 22.78 (a) Assess the performance of DrinkCo plc using the THREE ratios identified in the table above for measures of company performance. What do the ratios tell you about performance in DrinkCo plc between 2016 and 2020? (3 marks) (b) With reference to the TWO measures of the appraisal of working capital above, define each ratio and comment on the change in working capital in Drink Co plc between 2016 and 2020? (6 marks) (c) With reference to the TWO measures of liquidity in the table above, explain the changes in liquidity at DrinkCo plc between 2016 and 2020. (2 mark) (d) Define the two measures of return on investment and risk presented in the table above. Use those measures to analyse and comment upon what has happened to the level of risk and returns on investment at DrinkCo plc over the period 2016 to 2020. (6 marks)