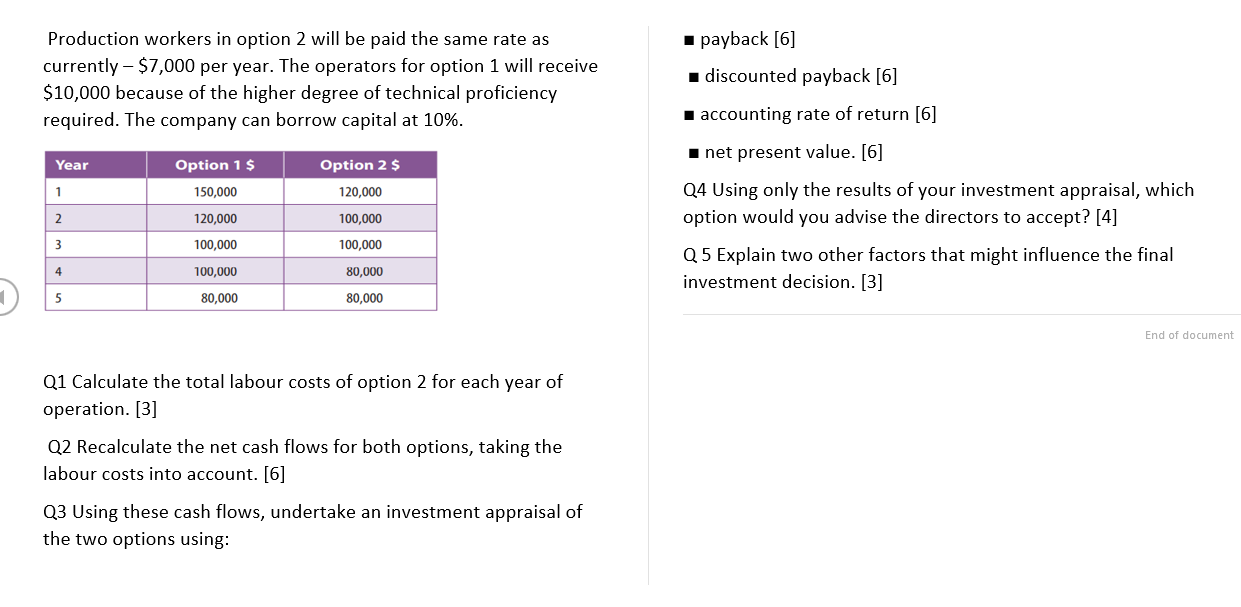

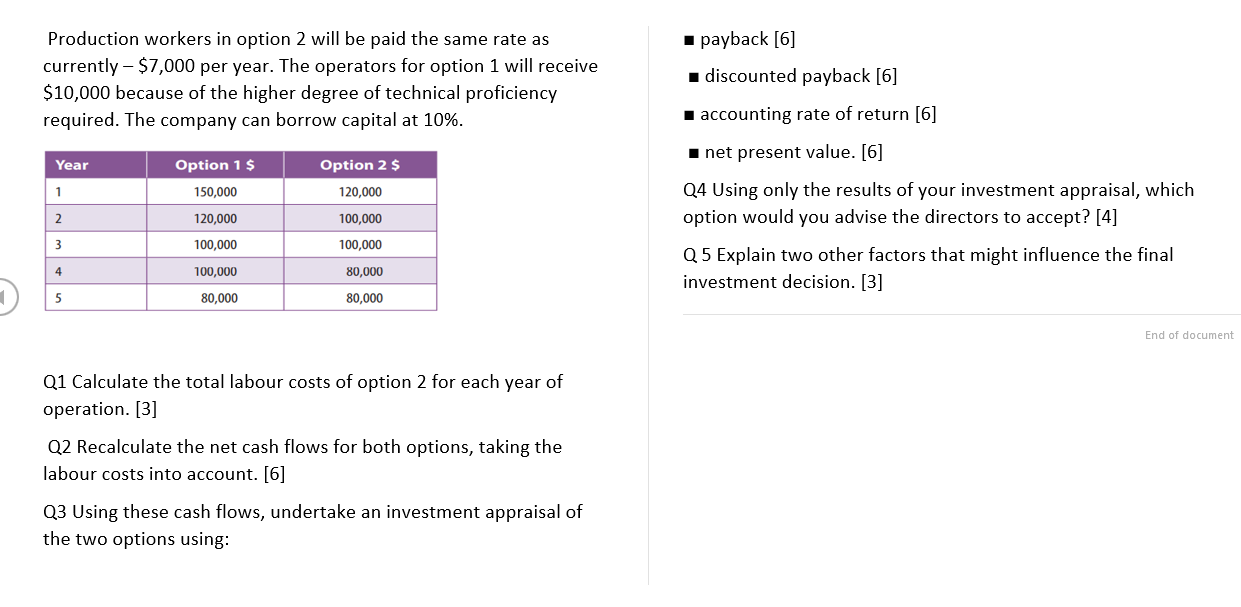

drinks' businesses. The directors of King and Green are considering investing in new equipment to update the production line. There are two main options: Option 1 is to purchase fully automated equipment that would require just one operator per shift. This would allow a very fast switch from one type of soft drink to another. Water-pollution levels are expected to be very low. Two shifts a day will be used. Option 2 is to invest in less-expensive machines that have an established reliability record but higher pollution levels. Each machine needs its own operator for each shift. Four machines would be needed, each producing one type of soft drink. The frm operates two shifts a day at present. Therefore, four production workers are needed for each shift. The expected life of each option is five years. Excluding labour costs, the net cash flows (cash returns less running costs) anticipated from each option are as shown in the table below. The total initial investment required would be: Option 1 $355,000. Option 2 $140,000. King and Green Ltd King and Green Ltd is an old, established soft drinks business. It manufactures and sells a wide range of soft drinks. Since the huge growth of supermarket own label brands, the business has depended for most of its sales on cafs and restaurants - mainly in the south of the country. The company is prof table, but only just- and the return on capital employed is below that of much larger Production workers in option 2 will be paid the same rate as currently - $7,000 per year. The operators for option 1 will receive $10,000 because of the higher degree of technical proficiency required. The company can borrow capital at 10%. payback [6] discounted payback [6] I accounting rate of return [6] net present value. [6] Year Option 1 $ Option 2 $ 120,000 1 150,000 2 120,000 100,000 Q4 Using only the results of your investment appraisal, which option would you advise the directors to accept? [4] Q5 Explain two other factors that might influence the final investment decision. [3] 3 100,000 100,000 4 100,000 80,000 5 80,000 80,000 End of document Q1 Calculate the total labour costs of option 2 for each year of operation. [3] Q2 Recalculate the net cash flows for both options, taking the labour costs into account. [6] Q3 Using these cash flows, undertake an investment appraisal of the two options using