Answered step by step

Verified Expert Solution

Question

1 Approved Answer

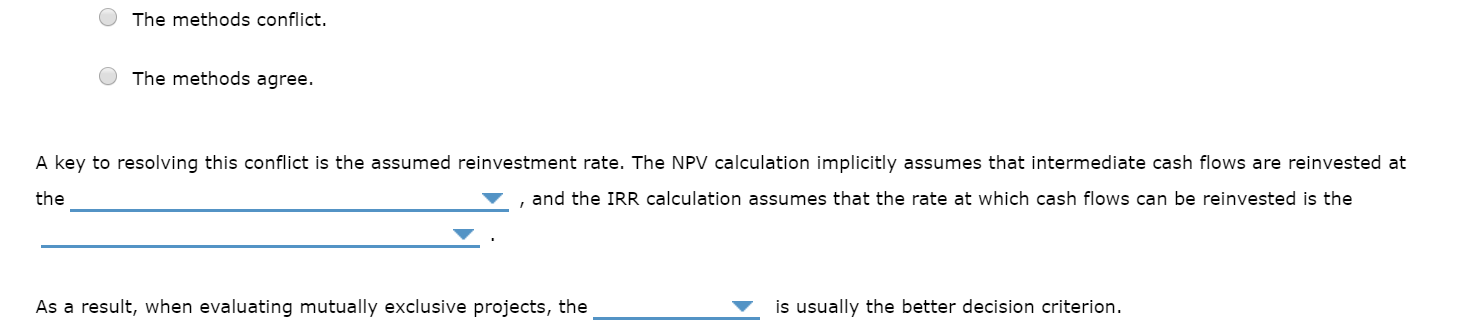

Drop down 1- always / sometimes / never Drop down 2 & 3- required rate of return / modified internal rate of return (MIRR) /

Drop down 1- always / sometimes / never

Drop down 1- always / sometimes / never

Drop down 2 & 3- required rate of return / modified internal rate of return (MIRR) / internal rate of return (IRR)

Drop down 4- NPV method / IRR method

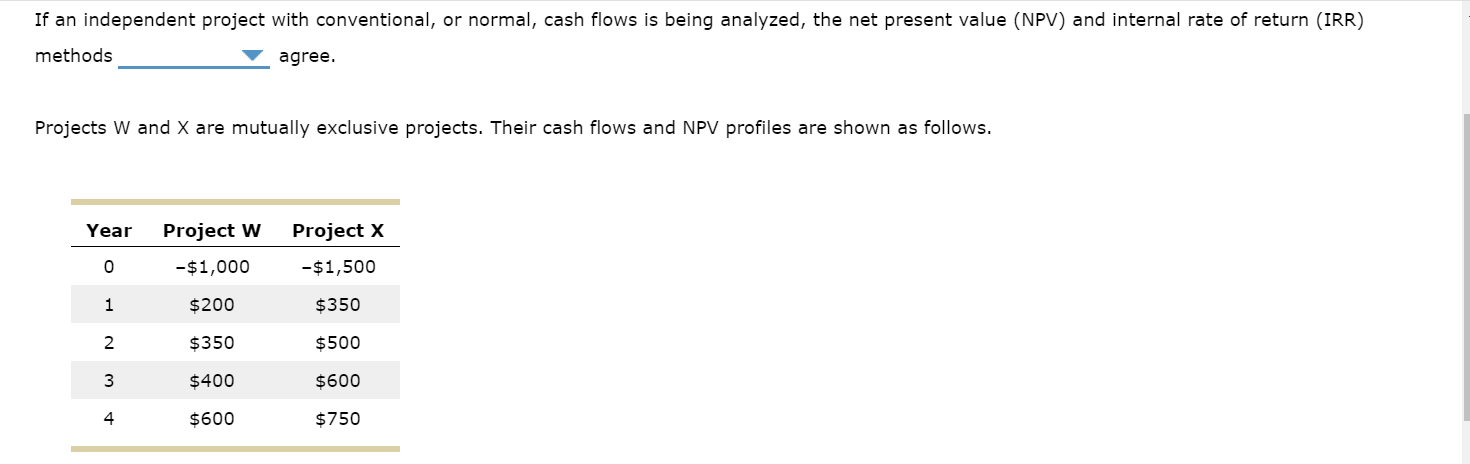

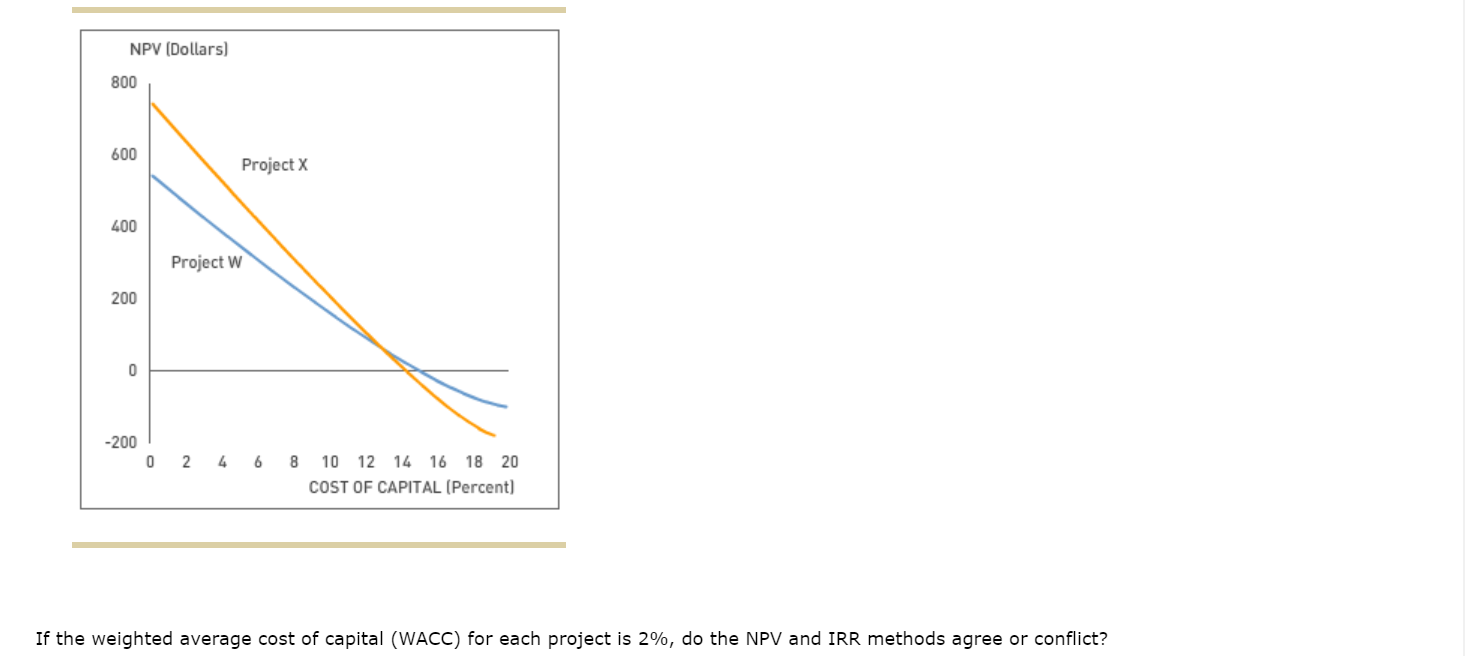

If an independent project with conventional, or normal, cash flows is being analyzed, the net present value (NPV) and internal rate of return (IRR) methods agree. Projects W and X are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows. Year 0 Project W -$1,000 $200 Project X -$1,500 $350 $500 $600 $750 3 $350 $400 $600 NPV (Dollars) 800 600 Project X Project W 0 2 4 6 8 10 12 14 16 18 20 COST OF CAPITAL (Percent) If the weighted average cost of capital (WACC) for each project is 2%, do the NPV and IRR methods agree or conflict? O The methods conflict. O The methods agree. A key to resolving this conflict is the assumed reinvestment rate. The NPV calculation implicitly assumes that intermediate cash flows are reinvested at the , and the IRR calculation assumes that the rate at which cash flows can be reinvested is the As a result, when evaluating mutually exclusive projects, the is usually the better decision criterionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started