Answered step by step

Verified Expert Solution

Question

1 Approved Answer

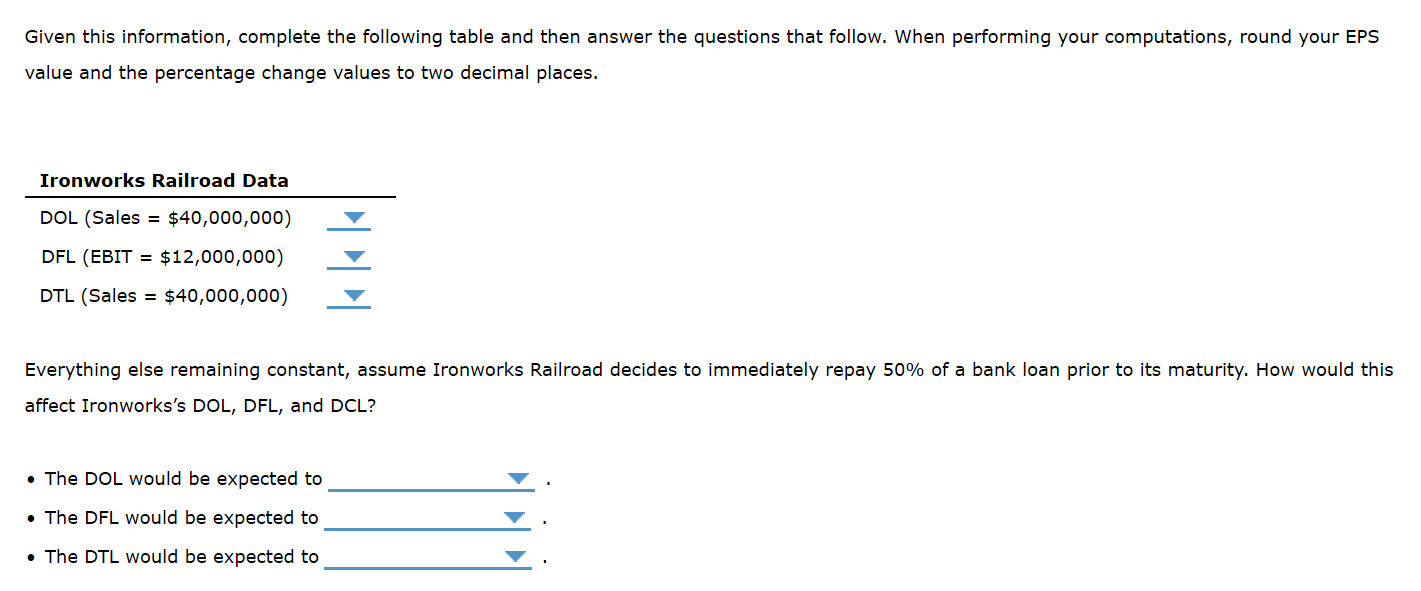

Drop down 1 options: 1.14, 1.67, 1.06 Drop down 2 options: 1.06, 1.14, 1.07 Drop down 3 options: 1.79, 1.14, 1.06 Drop down 4-6 options:

Drop down 1 options: 1.14, 1.67, 1.06

Drop down 1 options: 1.14, 1.67, 1.06

Drop down 2 options: 1.06, 1.14, 1.07

Drop down 3 options: 1.79, 1.14, 1.06

Drop down 4-6 options: decrease, increase, remain constant

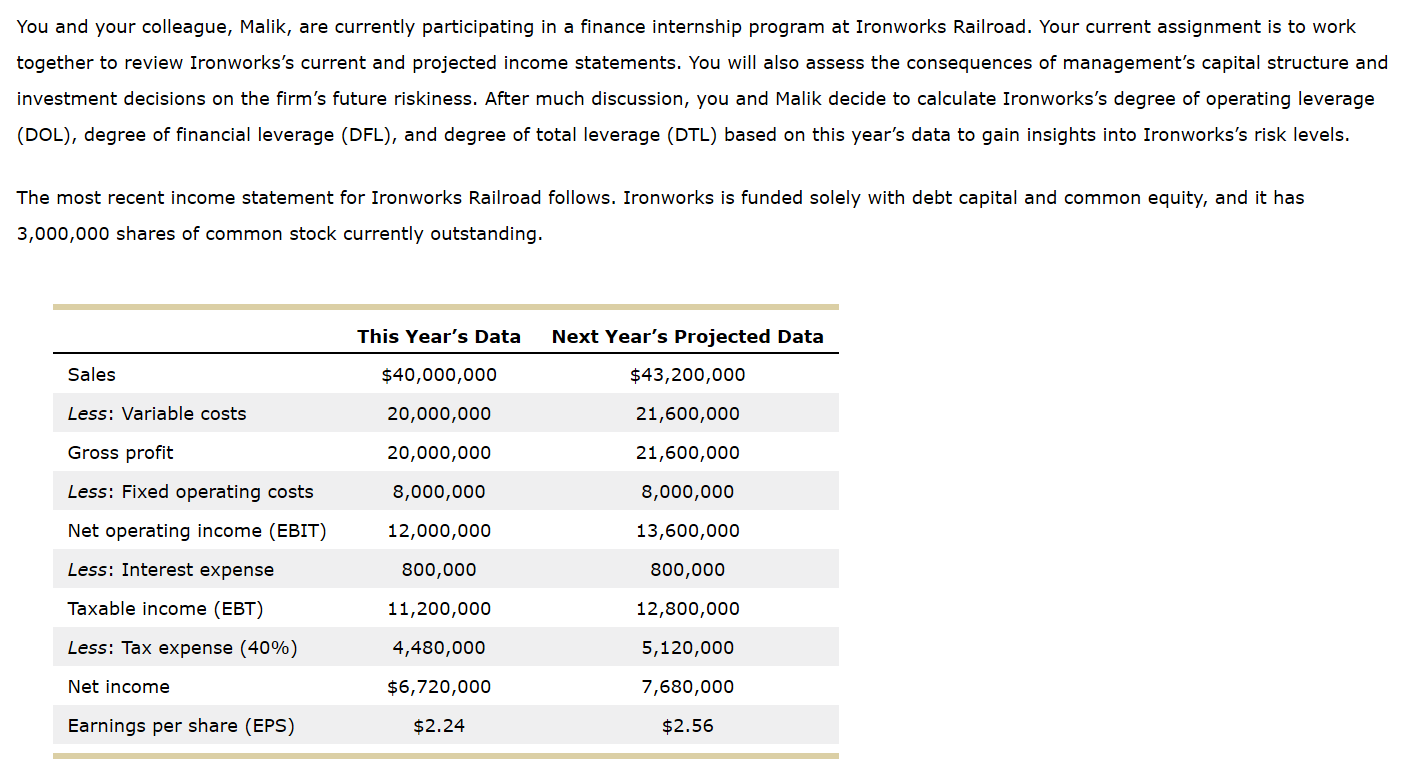

You and your colleague, Malik, are currently participating in a finance internship program at Ironworks Railroad. Your current assignment is to work together to review Ironworks's current and projected income statements. You will also assess the consequences of management's capital structure and investment decisions on the firm's future riskiness. After much discussion, you and Malik decide to calculate Ironworks's degree of operating leverage (DOL), degree of financial leverage (DFL), and degree of total leverage (DTL) based on this year's data to gain insights into Ironworks's risk levels. The most recent income statement for Ironworks Railroad follows. Ironworks is funded solely with debt capital and common equity, and it has 3,000,000 shares of common stock currently outstanding. Sales Less: Variable costs This Year's Data $40,000,000 20,000,000 20,000,000 8,000,000 12,000,000 Next Year's Projected Data $43,200,000 21,600,000 21,600,000 8,000,000 13,600,000 Gross profit Less: Fixed operating costs Net operating income (EBIT) 800,000 800,000 Less: Interest expense Taxable income (EBT) Less: Tax expense (40%) 11,200,000 4,480,000 12,800,000 5,120,000 7,680,000 Net income $6,720,000 Earnings per share (EPS) $2.24 $2.56 Given this information, complete the following table and then answer the questions that follow. When performing your computations, round your EPS value and the percentage change values to two decimal places. Ironworks Railroad Data DOL (Sales = $40,000,000) DFL (EBIT = $12,000,000) DTL (Sales = $40,000,000) Everything else remaining constant, assume Ironworks Railroad decides to immediately repay 50% of a bank loan prior to its maturity. How would this affect Ironworks's DOL, DFL, and DCL? The DOL would be expected to The DFL would be expected to The DTL would be expected toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started