Question

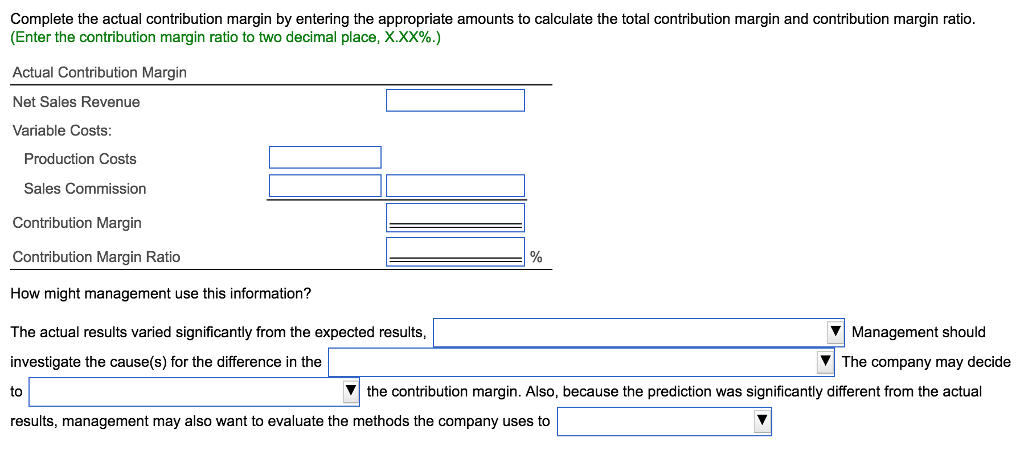

Drop Down Menu Choices: 1.) both in total contribution margin ratio and contribution margin ratio, only in contribtion margin ratio, only in total contribution margin

Drop Down Menu Choices:

1.) both in total contribution margin ratio and contribution margin ratio, only in contribtion margin ratio, only in total contribution margin ratio

2.) actual contribution margin ratio and the actual contribution margin, expected contribution margin ratio and the expected contribution margin, expected variable production costs and the actual variable production costs

3.) continue the product if it is able to decrease, discontinue the product if it is unable to decrease, discontinue the product if it is unable to increase

4.) account for product profitability, predict product profitability

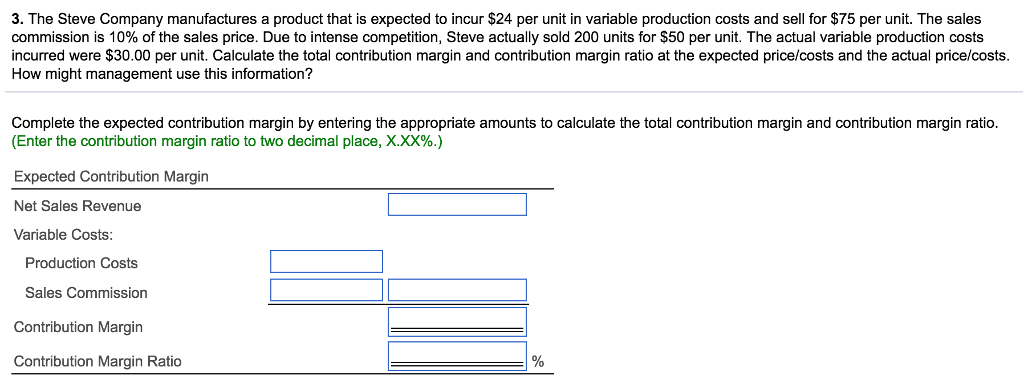

3. The Steve Company manufactures a product that is expected to incur $24 per unit in variable production costs and sell for $75 per unit. The sales commission is 10% of the sales price. Due to intense competition, Steve actually sold 200 units for $50 per unit. The actual variable production costs incurred were $30.00 per unit. Calculate the total contribution margin and contribution margin ratio at the expected price/costs and the actual price/costs How might management use this information? Complete the expected contribution margin by entering the appropriate amounts to calculate the total contribution margin and contribution margin ratio. (Enter the contribution margin ratio to two decimal place, X.XX%.) Expected Contribution Margin Net Sales Revenue Variable Costs: Production Costs Sales Commission Contribution Margin Contribution Margin RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started