Answered step by step

Verified Expert Solution

Question

1 Approved Answer

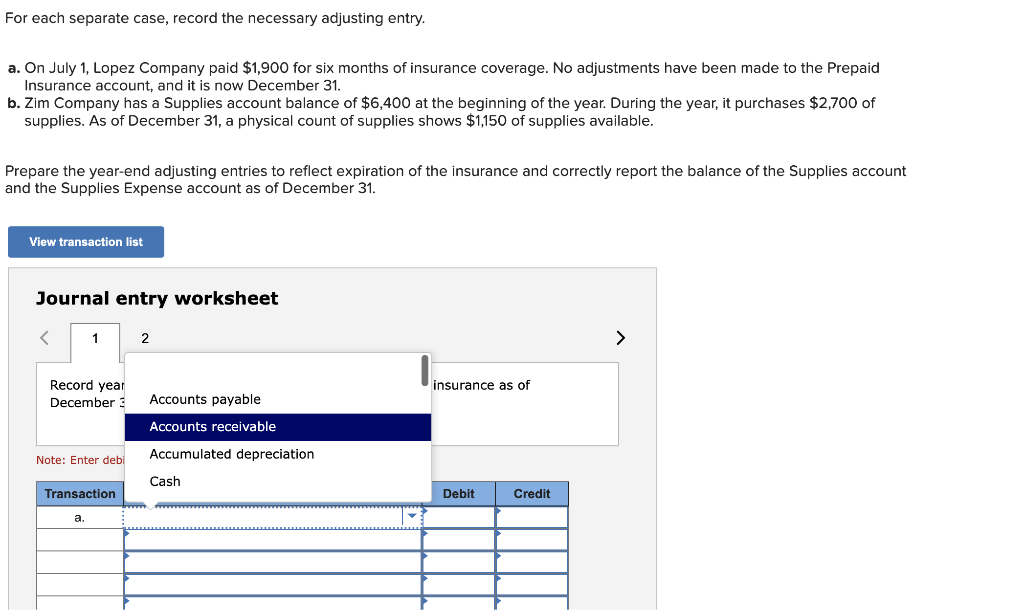

Drop down menu options are accounts payable, accounts receivable, accumulated depreciation, cash, depreciation expense - equipment, equipment, insurance expense, interest expense, interest payable, interest receivable,

Drop down menu options are accounts payable, accounts receivable, accumulated depreciation, cash, depreciation expense - equipment, equipment, insurance expense, interest expense, interest payable, interest receivable, interest revenue, land, misc. expenses, notes receivable, prepaid insurance, prepaid rent, rent expense, rent receivable, rent revenue, salaries expense salaries payable, service revenue, supplies, supplies expense, and unearned fees.

For each separate case, record the necessary adjusting entry. a. On July 1, Lopez Company paid $1,900 for six months of insurance coverage. No adjustments have been made to the Prepaid Insurance account, and it is now December 31. b. Zim Company has a Supplies account balance of $6,400 at the beginning of the year. During the year, it purchases $2,700 of supplies. As of December 31 , a physical count of supplies shows $1,150 of supplies available. Prepare the year-end adjusting entries to reflect expiration of the insurance and correctly report the balance of the Supplies account and the Supplies Expense account as of December 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started