Answered step by step

Verified Expert Solution

Question

1 Approved Answer

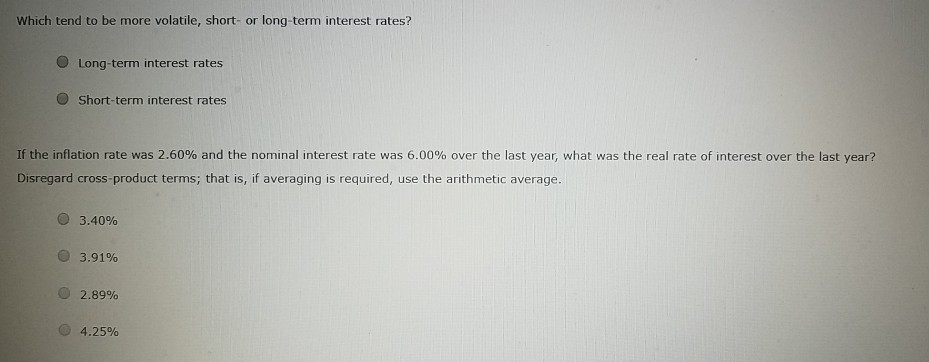

drop down option the same for all questions Which tend to be more volatile, short- or long-term interest rates? Long-term interest rates Short-term interest rates

drop down option the same for all questions

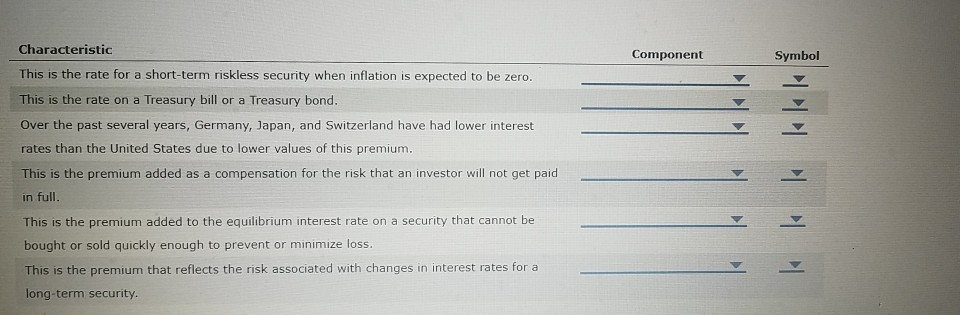

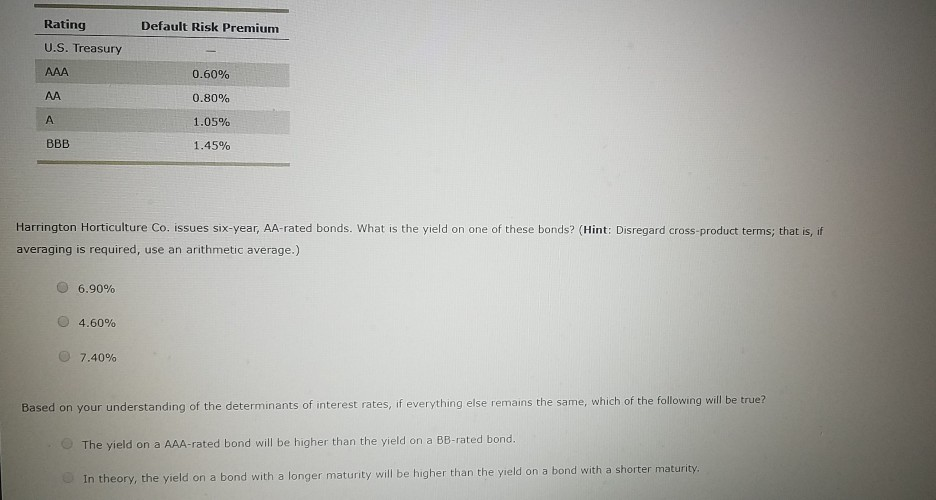

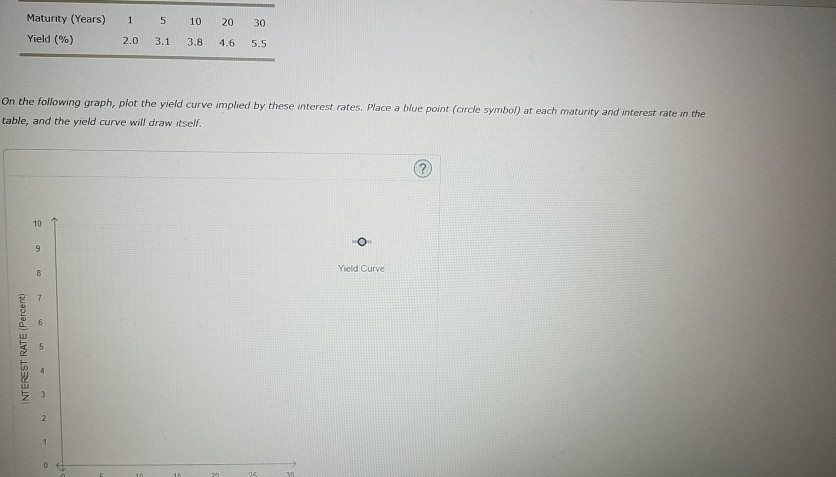

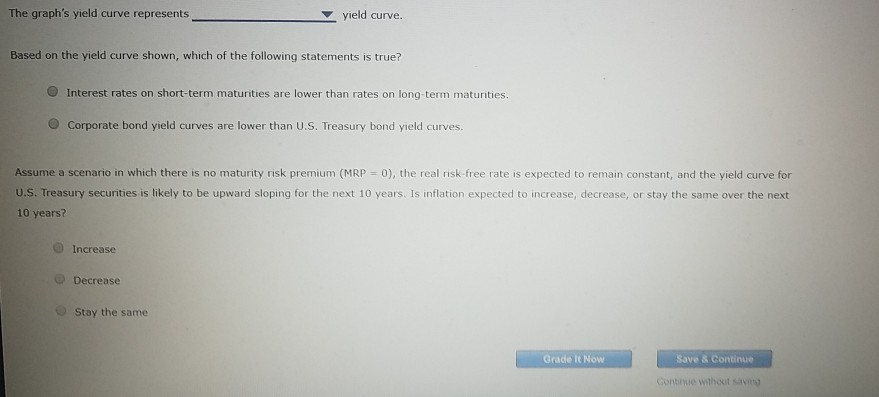

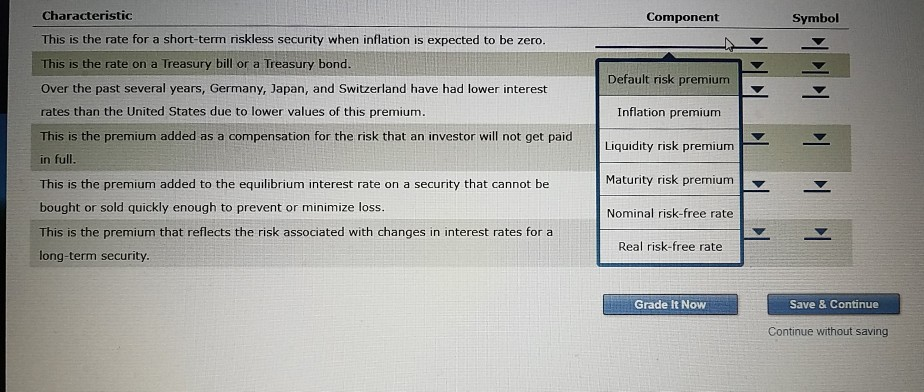

Which tend to be more volatile, short- or long-term interest rates? Long-term interest rates Short-term interest rates If the inflation rate was 2.60% and the nominal interest rate was 6.00% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. O 3.40% 3.91% 2.89% 4.25% Component Symbol Characteristic This is the rate for a short-term riskless security when inflation is expected to be zero. This is the rate on a Treasury bill or a Treasury bond. Over the past several years, Germany, Japan, and Switzerland have had lower interest rates than the United States due to lower values of this premium. This is the premium added as a compensation for the risk that an investor will not get paid in full. This is the premium added to the equilibrium interest rate on a security that cannot be bought or sold quickly enough to prevent or minimize loss. This is the premium that reflects the risk associated with changes in interest rates for a long-term security. klo k kkk Default Risk Premium Rating U.S. Treasury AAA 0.60% AA 0.80% 1.05% BBB 1.45% Harrington Horticulture Co. issues six-year, AA-rated bonds. What is the yield on one of these bonds? (Hint: Disregard cross-product terms; that is, if averaging is required, use an arithmetic average.) O 6.90% 4.60% 7.40% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? The yield on a AAA-rated bond will be higher than the yield on a BB-rated bond. In theory, the yield on a bond with a longer maturity will be higher than the yield on a bond with a shorter maturity. Maturity (Years) Yield (%) 1 2.0 5 3.1 10 3.8 20 4.6 30 5.5 On the following graph, plot the yield curve implied by these interest rates. Place a blue point (circle symbol) at each maturity and interest rate in the table, and the yield curve will draw itself. Yield Curve INTEREST RATE (Percent) The graph's yield curve represents yield curve. Based on the yield curve shown, which of the following statements is true? Interest rates on short-term maturities are lower than rates on long-term maturities. Corporate bond yield curves are lower than U.S. Treasury bond yield curves. Assume a scenario in which there is no maturity risk premium (MRP = 0), the real risk-free rate is expected to remain constant, and the yield curve for U.S. Treasury securities is likely to be upward sloping for the next 10 years. Is inflation expected to increase, decrease, or stay the same over the next 10 years? Increase Decrease Stay the same Grade It Now Save & Continue Continue without Component Symbol Characteristic This is the rate for a short-term riskless security when inflation is expected to be zero. This is the rate on a Treasury bill or a Treasury bond. Over the past several years, Germany, Japan, and Switzerland have had lower interest rates than the United States due to lower values of this premium. This is the premium added as a compensation for the risk that an investor will not get paid Default risk premium kkkk Inflation premium Liquidity risk premium in full. Maturity risk premium This is the premium added to the equilibrium interest rate on a security that cannot be bought or sold quickly enough to prevent or minimize loss. This is the premium that reflects the risk associated with changes in interest rates for a Nominal risk-free rate Real risk-free rate long-term security. Grade It Now Save & Continue Continue without savingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started