Answered step by step

Verified Expert Solution

Question

1 Approved Answer

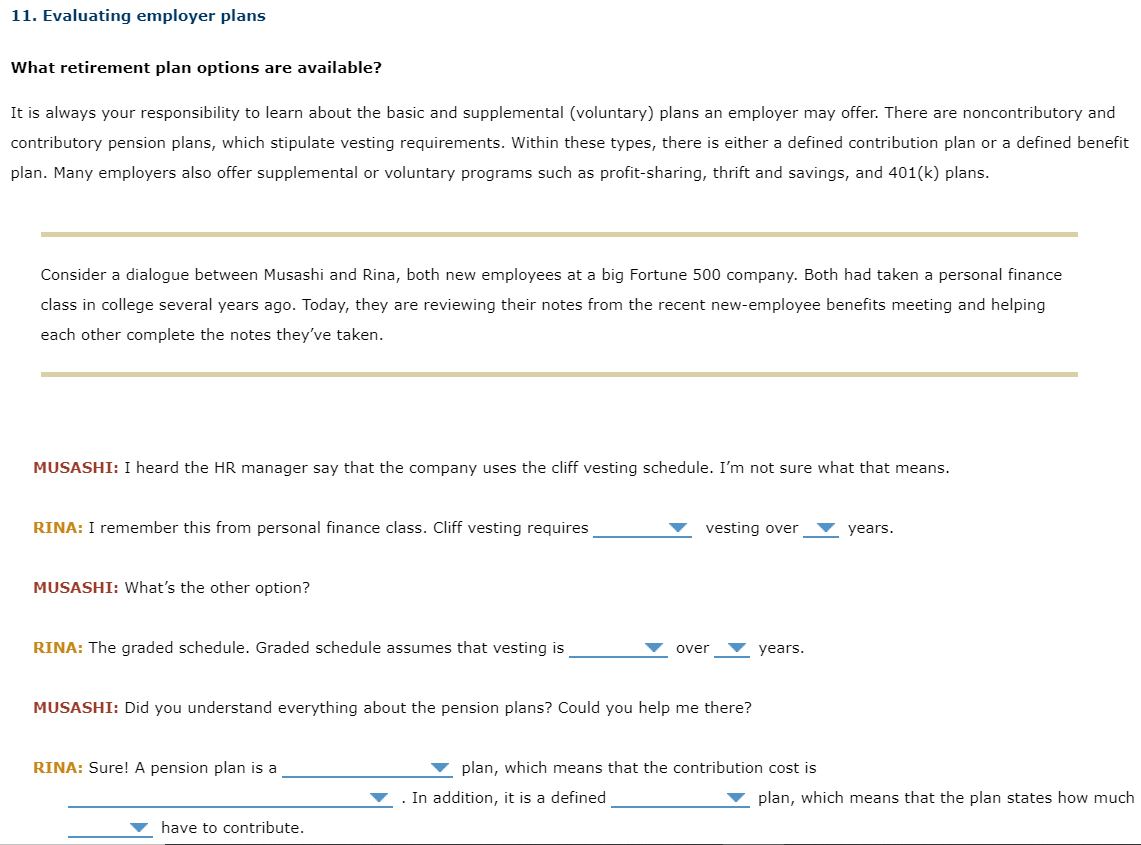

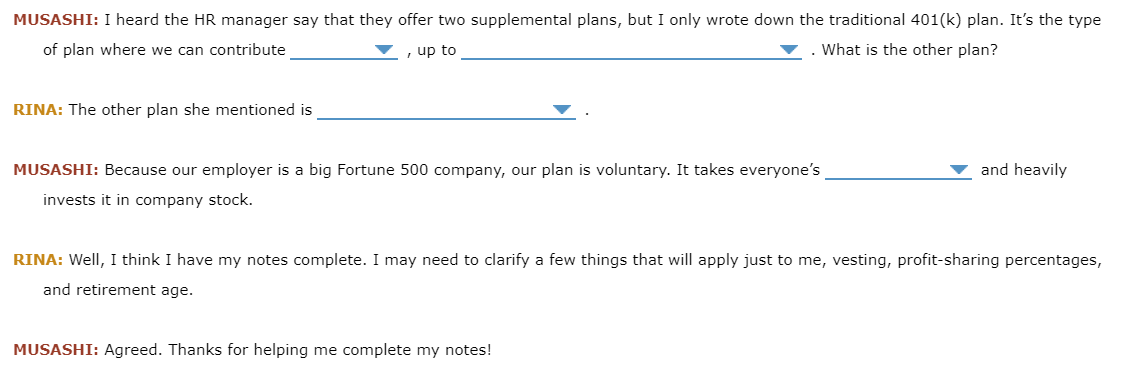

DROP DOWN OPTIONS FROM TOP TO BOTTOM: 1.) gradual / full 2 six / three 3.) noncontributory / contributory 4.) paid by company / shared

DROP DOWN OPTIONS FROM TOP TO BOTTOM:

DROP DOWN OPTIONS FROM TOP TO BOTTOM:

1.) gradual / full

2 six / three

3.) noncontributory / contributory

4.) paid by company / shared by employer and employee

5.) benifit / contribution

6.) pretax / aftertax

7.) an IRS-set maximum / the maximum set by plan provisions / what we can afford

8.) ERISA / the profit-sharing plan / the pension protection act

9.) benifits / contributions

11. Evaluating employer plans What retirement plan options are available? It is always your responsibility to learn about the basic and supplemental (voluntary) plans an employer may offer. There are noncontributory and contributory pension plans, which stipulate vesting requirements. Within these types, there is either a defined contribution plan or a defined benefit plan. Many employers also offer supplemental or voluntary programs such as profit-sharing, thrift and savings, and 401(k) plans. Consider a dialogue between Musashi and Rina, both new employees at a big Fortune 500 company. Both had taken a personal finance class in college several years ago. Today, they are reviewing their notes from the recent new-employee benefits meeting and helping each other complete the notes they've taken. MUSASHI: I heard the HR manager say that the company uses the cliff vesting schedule. I'm not sure what that means. RINA: I remember this from personal finance class. Cliff vesting requires vesting over years. MUSASHI: What's the other option? RINA: The graded schedule. Graded schedule assumes that vesting is over years. MUSASHI: Did you understand everything about the pension plans? Could you help me there? RINA: Sure! A pension plan is a plan, which means that the contribution cost is . In addition, it is a defined have to contribute. plan, which means that the plan states how much MUSASHI: I heard the HR manager say that they offer two supplemental plans, but I only wrote down the traditional 401(k) plan. It's the type . What is the other plan? of plan where we can contribute , up to RINA: The other plan she mentioned is and heavily MUSASHI: Because our employer is a big Fortune 500 company, our plan is voluntary. It takes everyone's invests it in company stock. RINA: Well, I think I have my notes complete. I may need to clarify a few things that will apply just to me, vesting, profit-sharing percentages, and retirement age. MUSASHI: Agreed. Thanks for helping me complete my notesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started