Answered step by step

Verified Expert Solution

Question

1 Approved Answer

drop down: short-term capital gain, short-term capital loss, long-term capital gain, or long-term capital loss Capital Gains and Losses, Section 1245 Recapture Rule, Unrecatured Section

drop down: short-term capital gain, short-term capital loss, long-term capital gain, or long-term capital loss

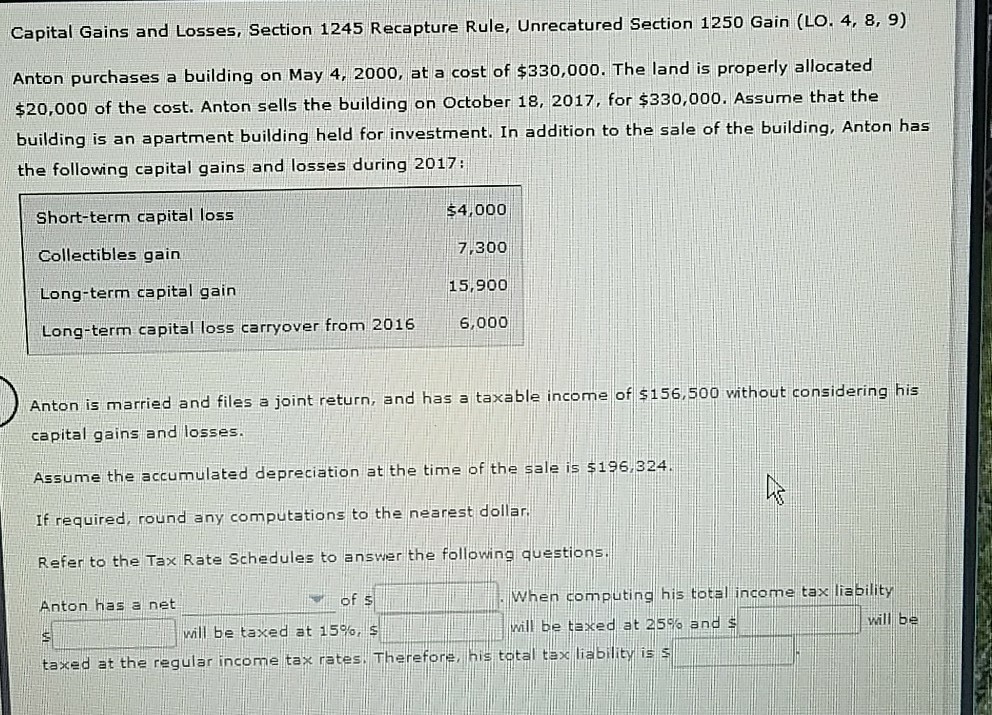

Capital Gains and Losses, Section 1245 Recapture Rule, Unrecatured Section 1250 Gain (LO. 4, 8, 9 Anton purchases a building on May 4, 2000, at a cost of $330,000. The land is properly allocated $20,000 of the cost. Anton sells the building on October 18, 2017, for $330,o00. Assume that the building the following capital gains and losses during 2017: is an apartment building held for investment. In addition to the sale of the building. Anton has Short-term capital loss Collectibles gain Long-term capital gain Long-term capital loss carryover from 20166,000 $4,000 7,300 15,900 00 without considering his Anton is married and files a joint return, and has a taxable income of $156,5 capital gains and losses ume the accumulated depreciation at the time of the sale is $196.324 If required, round any computatio Refer to the Tax Rate Schedules to answer the following questions. Anton has a net of s Fomputing his total income tax liability will be ll be taxed at 25% and I be taxed at 15%, s taxed at the regular income tan rates Therefore, his total tax liabStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started