Answered step by step

Verified Expert Solution

Question

1 Approved Answer

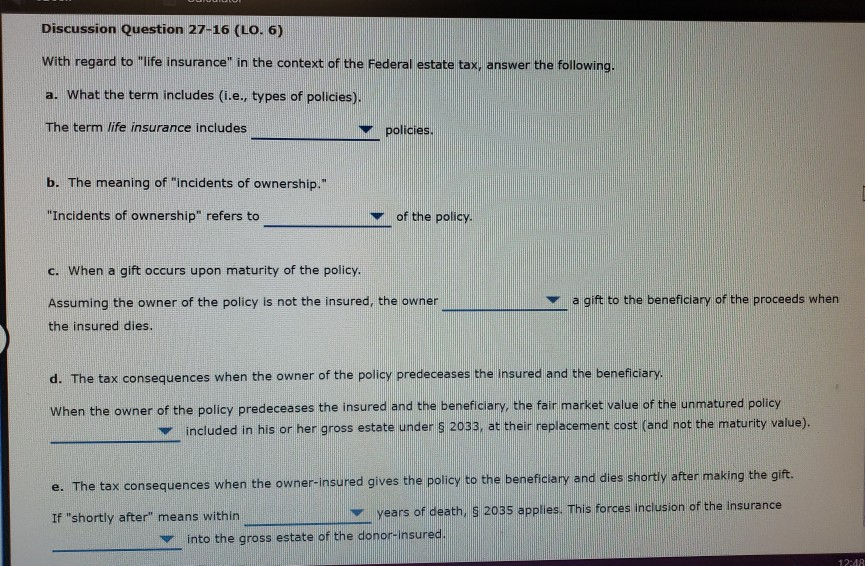

Drop down values are: a. both term and whole life / only term / only whole life b. the legal ownership and economic benefits /

Drop down values are:

a. both term and whole life / only term / only whole life

b. the legal ownership and economic benefits / only the legal ownership / only the right to the economic benefits

c. does not make / makes

d. is / is not

e. three / four cash surrender value / proceeds

Discussion Question 27-16 (LO. 6) With regard to "life insurance" in the context of the Federal estate tax, answer the following. a. What the term includes (i.e., types of policies). The term life insurance includes policies. b. The meaning of "incidents of ownership." "Incidents of ownership" refers to of the policy. c. When a gift occurs upon maturity of the policy. Assuming the owner of the policy is not the insured, the owner the insured dies. a gift to the beneficiary of the proceeds when d. The tax consequences when the owner of the policy predeceases the insured and the beneficiary. When the owner of the policy predeceases the insured and the beneficiary, the fair market value of the unmatured policy included in his or her gross estate under $ 2033, at their replacement cost (and not the maturity value). e. The tax consequences when the owner-insured gives the policy to the beneficiary and dies shortly after making the gift. If "shortly after" means within years of death, S 2035 applies. This forces inclusion of the insurance into the gross estate of the donor-insured. 12:48Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started