Answered step by step

Verified Expert Solution

Question

1 Approved Answer

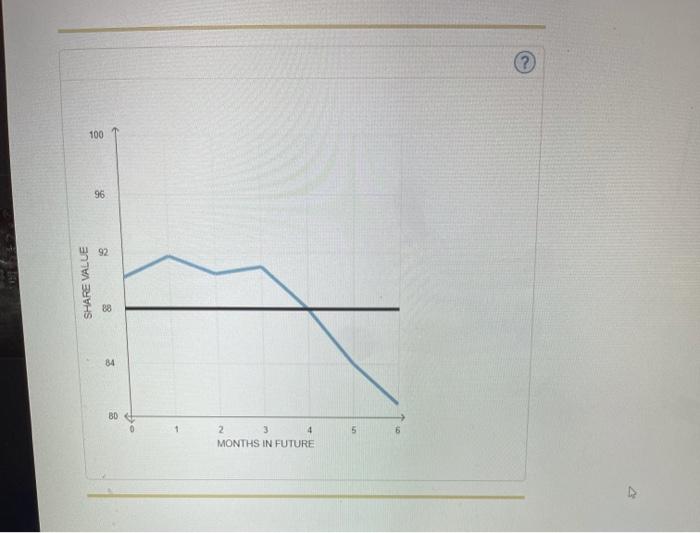

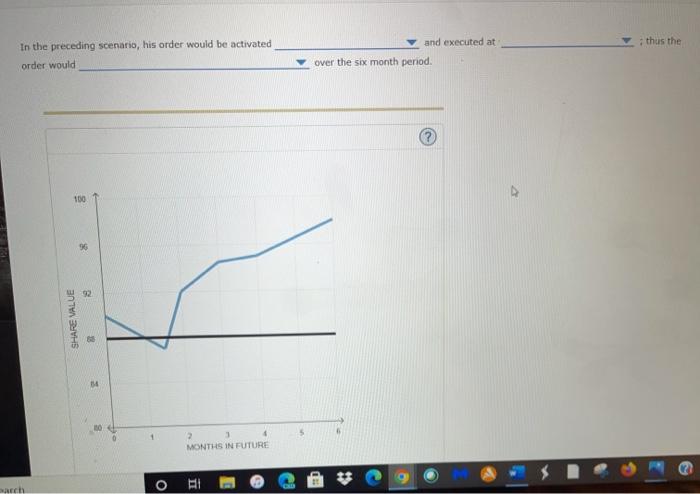

Drop down1-market,stop limit2-after 4 months,after 3 months,after1month,when the marketopenef,at no point in this period,after 5 month,after 2month.a3- thr best aviablr price,no point in thid period.exactly

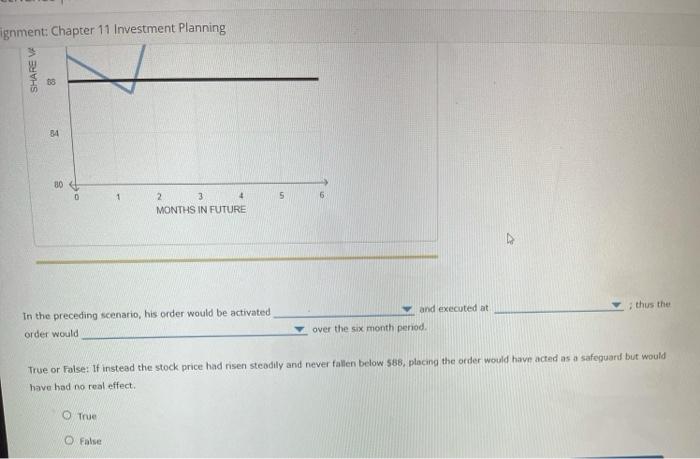

Drop down1-market,stop limit2-after 4 months,after 3 months,after1month,when the marketopenef,at no point in this period,after 5 month,after 2month.a3- thr best aviablr price,no point in thid period.exactly 88$ 4-prevent him from earning large gains,act as a sageguard but have no real effect,limit his losses

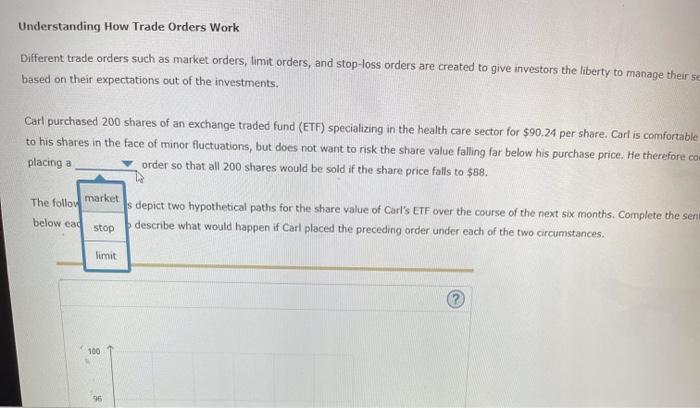

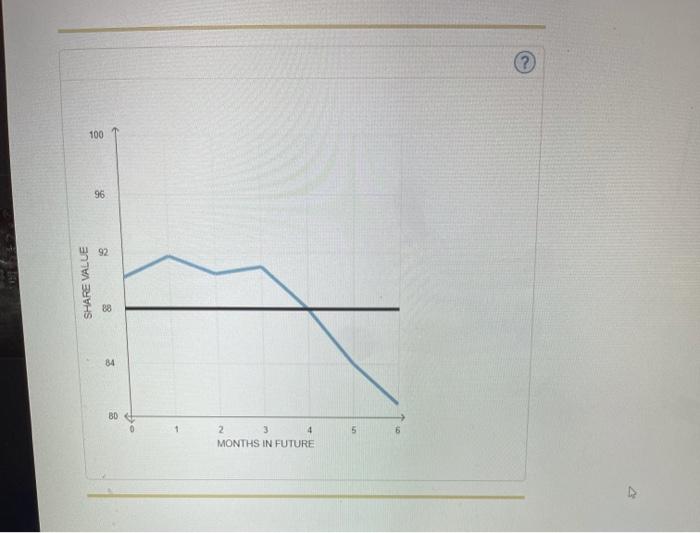

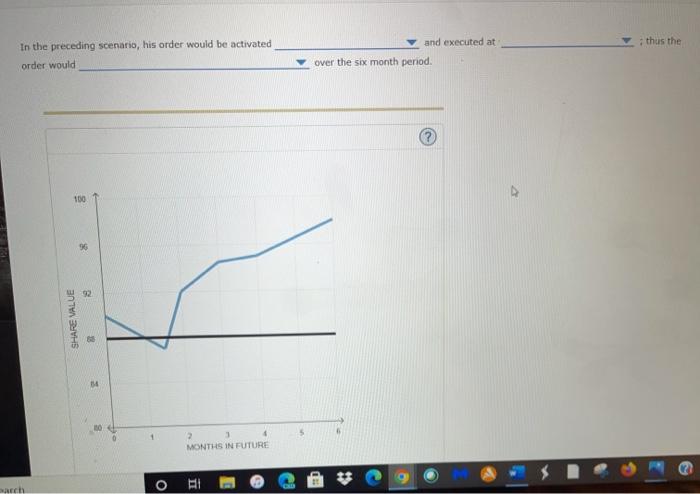

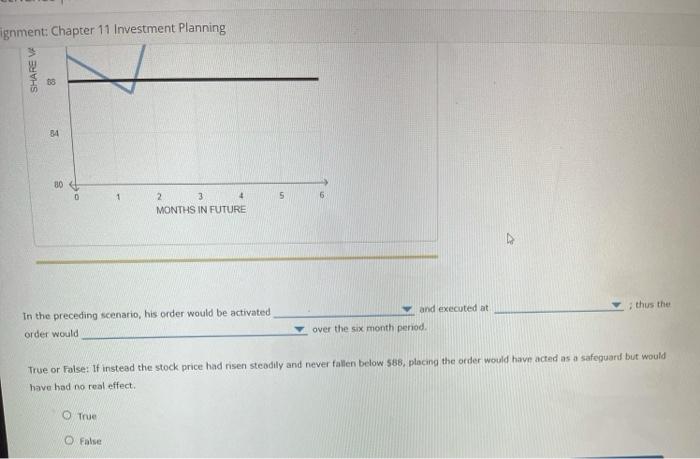

Understanding How Trade Orders Work Different trade orders such as market orders, limit orders, and stop-loss orders are created to give investors the liberty to manage their se based on their expectations out of the investments, Carl purchased 200 shares of an exchange traded fund (ETF) specializing in the health care sector for $90.24 per share. Carl is comfortable to his shares in the face of minor fluctuations, but does not want to risk the share value falling far below his purchase price. He therefore com placing a order so that all 200 shares would be sold if the share price falls to $88. The follow market s depict two hypothetical paths for the share value of Carl's ETF over the course of the next six months. Complete the ser below ead stop describe what would happen if Carl placed the preceding order under each the two circumstances. limit 100 95 100 96 92 SHARE VALUE 88 84 BD 0 5 2 3 MONTHS IN FUTURE V and executed at ; thus the In the preceding scenario, his order would be activated order would over the six month period. 100 95 8 SHARE VALUE 14 8 5 2 3 MONTHS IN FUTURE O HI C ignment: Chapter 11 Investment Planning SHARE V 19 34 80 0 1 5 6 2 4 MONTHS IN FUTURE thus the In the preceding scenario, his order would be activated order would and executed at over the six month period. True or False: If instead the stock price had risen steadily and never fallen below 586, placing the order would have acted as a safeguard but would have had no real effect, O True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started