Answered step by step

Verified Expert Solution

Question

1 Approved Answer

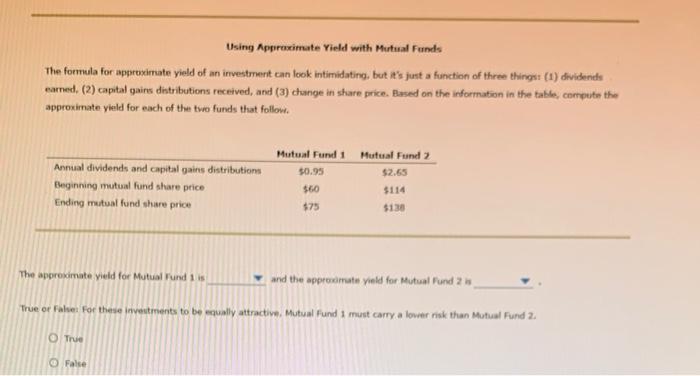

drop downs are: first question- 4.56%; 23.63%; 19.90%; or 21.15% second question- 5.99%; 17.98%; 21.15%, or 23.63% Using Approximate Yield with Mutual Funds The formula

drop downs are:

Using Approximate Yield with Mutual Funds The formula for approximate yield of an investment can look intimidating, but it's just a function of three things (1) dividends earned, (2) capital gains dintributions received, and (3) change in share price. Based on the information in the table, compute the approximate yield for each of the two funds that follow Annual dividends and capital gains distribution Beginning mutual fund share price Ending mutual fund share price Mutual Fund 1 Mutual Fund 2 $0.95 $2.65 $60 $114 $75 $130 The approximate yield for Mutual Fund 1 is and the appreciate yield for Mutual Fund 2 True or Falue: For these investments to be equally attractive, Mutual Fund 1 must carry a lower risk than Mutual Fund 2. True @ False first question- 4.56%; 23.63%; 19.90%; or 21.15%

second question- 5.99%; 17.98%; 21.15%, or 23.63%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started