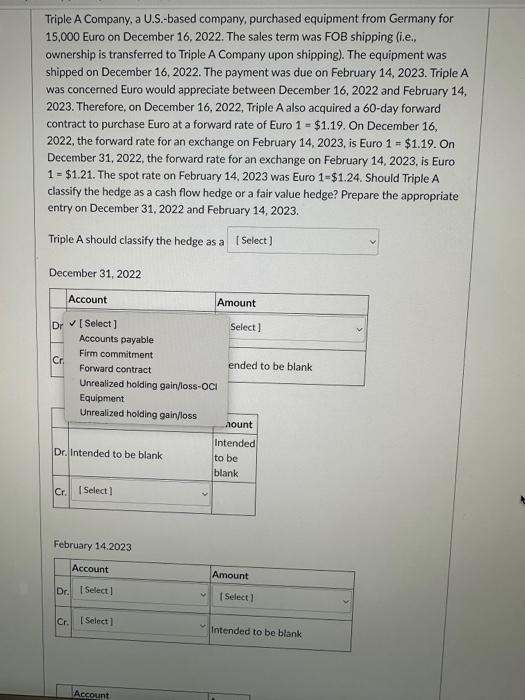

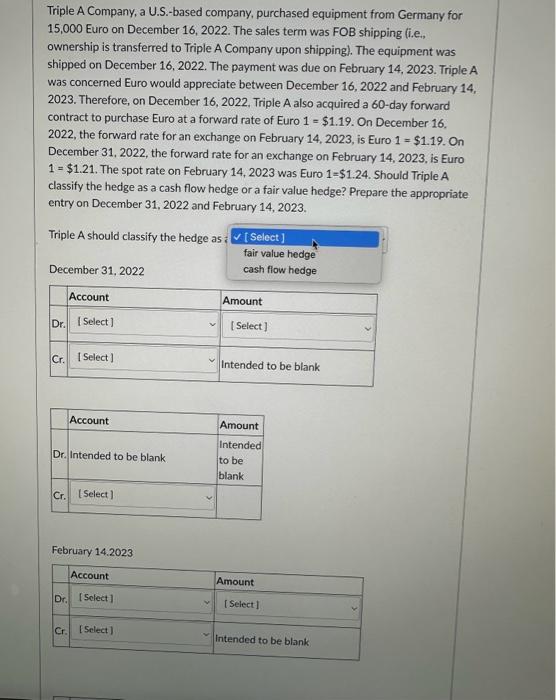

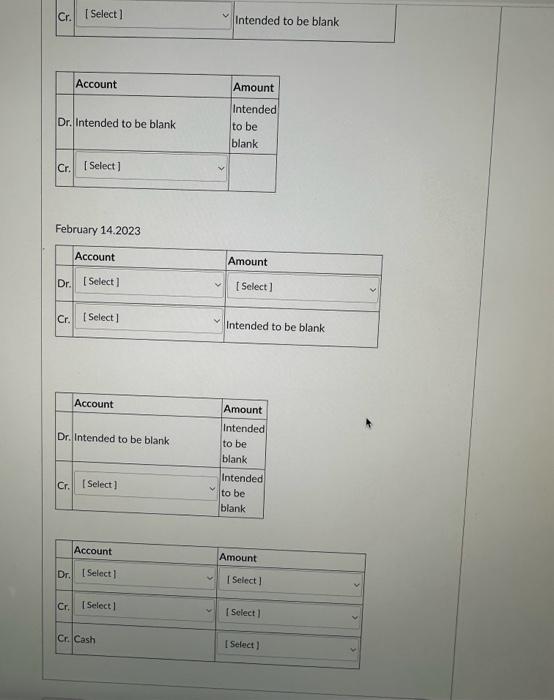

drop menus show the options for all fields

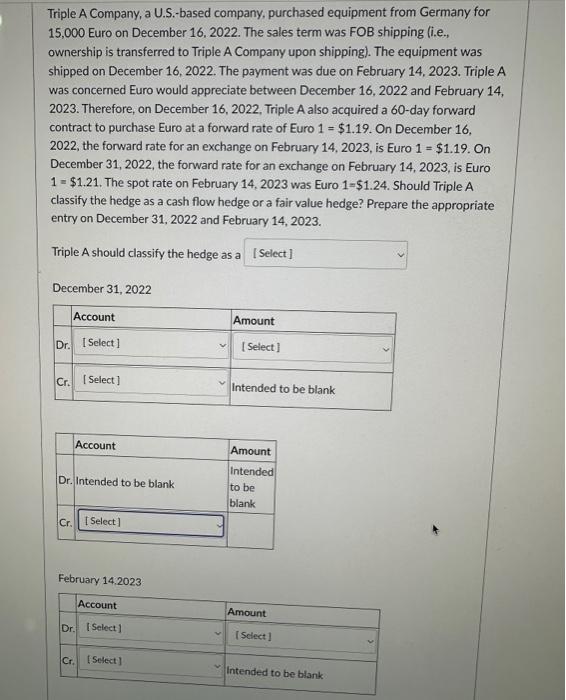

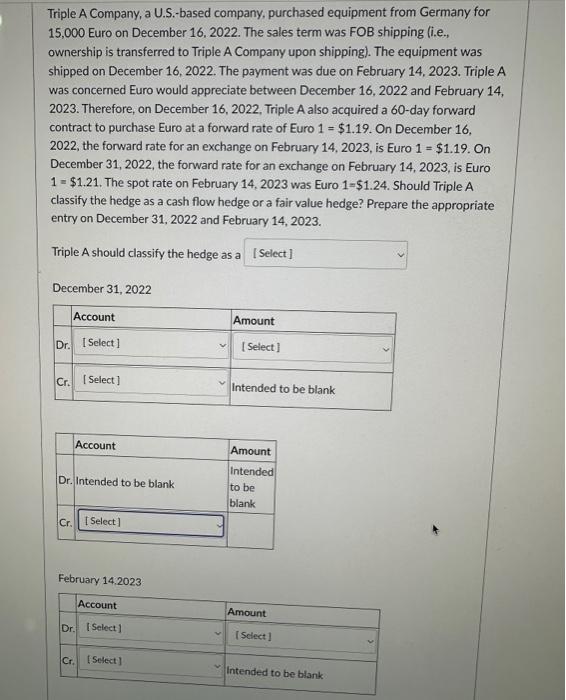

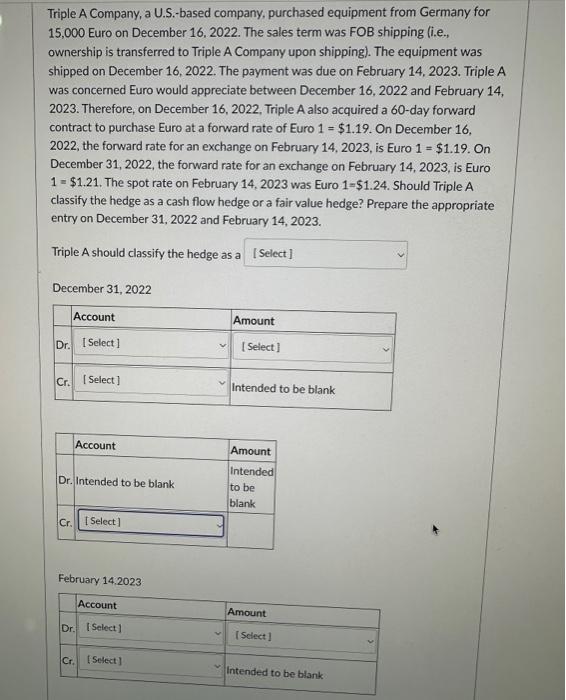

Triple A Company, a U.S.-based company, purchased equipment from Germany for 15,000 Euro on December 16,2022 . The sales term was FOB shipping (i.e., ownership is transferred to Triple A Company upon shipping). The equipment was shipped on December 16, 2022. The payment was due on February 14, 2023. Triple A was concerned Euro would appreciate between December 16, 2022 and February 14 , 2023. Therefore, on December 16, 2022, Triple A also acquired a 60-day forward contract to purchase Euro at a forward rate of Euro 1=$1.19. On December 16 , 2022, the forward rate for an exchange on February 14,2023 , is Euro 1=$1.19. On December 31, 2022, the forward rate for an exchange on February 14, 2023, is Euro 1=$1.21. The spot rate on February 14, 2023 was Euro 1=$1.24. Should Triple A classify the hedge as a cash flow hedge or a fair value hedge? Prepare the appropriate entry on December 31, 2022 and February 14, 2023. Triple A should classify the hedge as a December 31,2022 February 14:2023 Triple A Company, a U.S.-based company, purchased equipment from Germany for 15,000 Euro on December 16, 2022. The sales term was FOB shipping (i.e., ownership is transferred to Triple A Company upon shipping). The equipment was shipped on December 16, 2022. The payment was due on February 14, 2023. Triple A was concerned Euro would appreciate between December 16, 2022 and February 14, 2023. Therefore, on December 16,2022 , Triple A also acquired a 60-day forward contract to purchase Euro at a forward rate of Euro 1=$1.19. On December 16 , 2022, the forward rate for an exchange on February 14,2023 , is Euro 1=$1.19. On December 31, 2022, the forward rate for an exchange on February 14, 2023, is Euro 1=$1.21. The spot rate on February 14, 2023 was Euro 1=$1.24. Should Triple A classify the hedge as a cash flow hedge or a fair value hedge? Prepare the appropriate entry on December 31, 2022 and February 14, 2023. Triple A should classify the hedge as a December 31,2022 February 14.2023 Triple A Company, a U.S.-based company, purchased equipment from Germany for 15,000 Euro on December 16,2022 . The sales term was FOB shipping (i.e., ownership is transferred to Triple A Company upon shipping). The equipment was shipped on December 16, 2022. The payment was due on February 14, 2023. Triple A was concerned Euro would appreciate between December 16, 2022 and February 14, 2023. Therefore, on December 16,2022 , Triple A also acquired a 60 -day forward contract to purchase Euro at a forward rate of Euro 1=$1.19. On December 16 . 2022 , the forward rate for an exchange on February 14,2023 , is Euro 1=$1.19. On December 31, 2022, the forward rate for an exchange on February 14, 2023, is Euro 1=$1.21. The spot rate on February 14,2023 was Euro 1=$1.24. Should Triple A classify the hedge as a cash flow hedge or a fair value hedge? Prepare the appropriate entry on December 31, 2022 and February 14, 2023. Triple A should classify the hedge as December 31, 2022 February 14.2023 February 14.2023 Triple A Company, a U.S.-based company, purchased equipment from Germany for 15,000 Euro on December 16,2022 . The sales term was FOB shipping (i.e., ownership is transferred to Triple A Company upon shipping). The equipment was shipped on December 16, 2022. The payment was due on February 14, 2023. Triple A was concerned Euro would appreciate between December 16, 2022 and February 14 , 2023. Therefore, on December 16, 2022, Triple A also acquired a 60-day forward contract to purchase Euro at a forward rate of Euro 1=$1.19. On December 16 , 2022, the forward rate for an exchange on February 14,2023 , is Euro 1=$1.19. On December 31, 2022, the forward rate for an exchange on February 14, 2023, is Euro 1=$1.21. The spot rate on February 14, 2023 was Euro 1=$1.24. Should Triple A classify the hedge as a cash flow hedge or a fair value hedge? Prepare the appropriate entry on December 31, 2022 and February 14, 2023. Triple A should classify the hedge as a December 31,2022 February 14:2023 Triple A Company, a U.S.-based company, purchased equipment from Germany for 15,000 Euro on December 16, 2022. The sales term was FOB shipping (i.e., ownership is transferred to Triple A Company upon shipping). The equipment was shipped on December 16, 2022. The payment was due on February 14, 2023. Triple A was concerned Euro would appreciate between December 16, 2022 and February 14, 2023. Therefore, on December 16,2022 , Triple A also acquired a 60-day forward contract to purchase Euro at a forward rate of Euro 1=$1.19. On December 16 , 2022, the forward rate for an exchange on February 14,2023 , is Euro 1=$1.19. On December 31, 2022, the forward rate for an exchange on February 14, 2023, is Euro 1=$1.21. The spot rate on February 14, 2023 was Euro 1=$1.24. Should Triple A classify the hedge as a cash flow hedge or a fair value hedge? Prepare the appropriate entry on December 31, 2022 and February 14, 2023. Triple A should classify the hedge as a December 31,2022 February 14.2023 Triple A Company, a U.S.-based company, purchased equipment from Germany for 15,000 Euro on December 16,2022 . The sales term was FOB shipping (i.e., ownership is transferred to Triple A Company upon shipping). The equipment was shipped on December 16, 2022. The payment was due on February 14, 2023. Triple A was concerned Euro would appreciate between December 16, 2022 and February 14, 2023. Therefore, on December 16,2022 , Triple A also acquired a 60 -day forward contract to purchase Euro at a forward rate of Euro 1=$1.19. On December 16 . 2022 , the forward rate for an exchange on February 14,2023 , is Euro 1=$1.19. On December 31, 2022, the forward rate for an exchange on February 14, 2023, is Euro 1=$1.21. The spot rate on February 14,2023 was Euro 1=$1.24. Should Triple A classify the hedge as a cash flow hedge or a fair value hedge? Prepare the appropriate entry on December 31, 2022 and February 14, 2023. Triple A should classify the hedge as December 31, 2022 February 14.2023 February 14.2023