Answered step by step

Verified Expert Solution

Question

1 Approved Answer

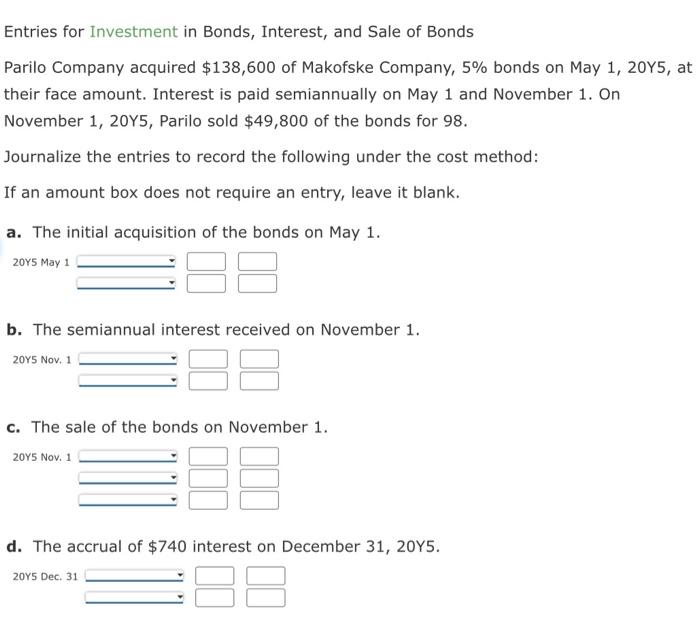

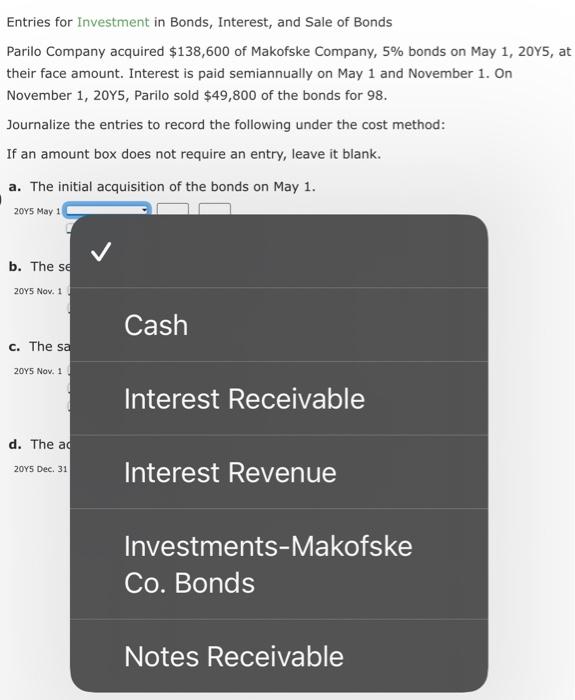

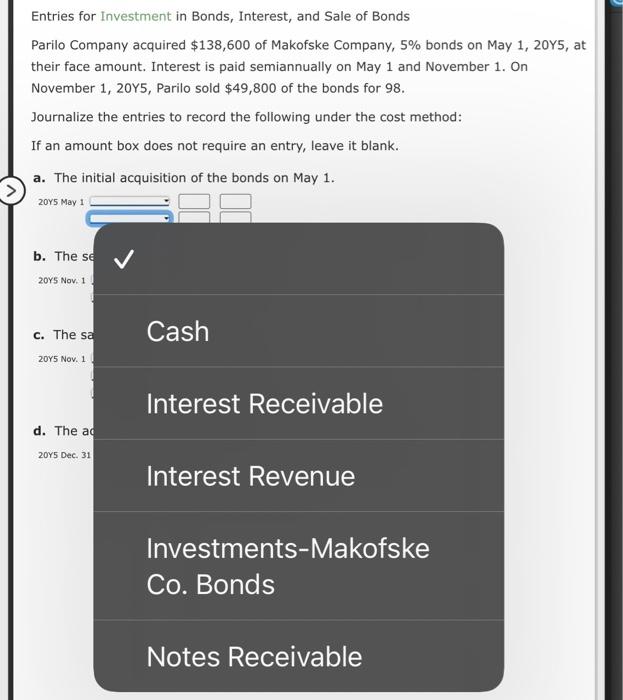

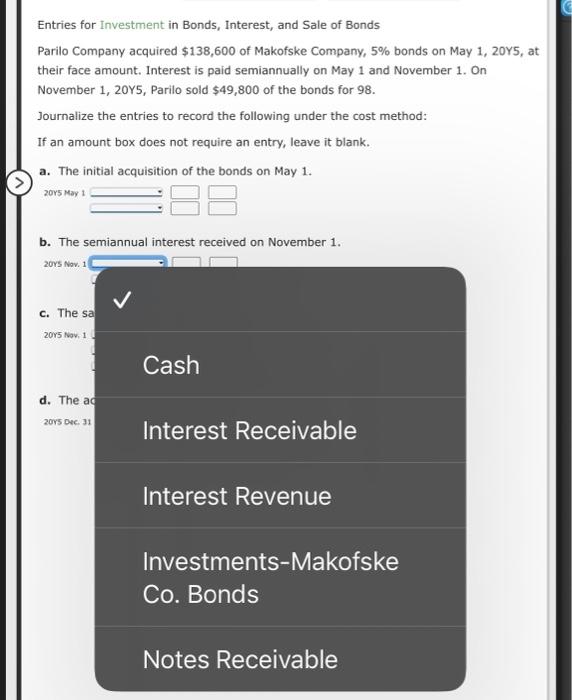

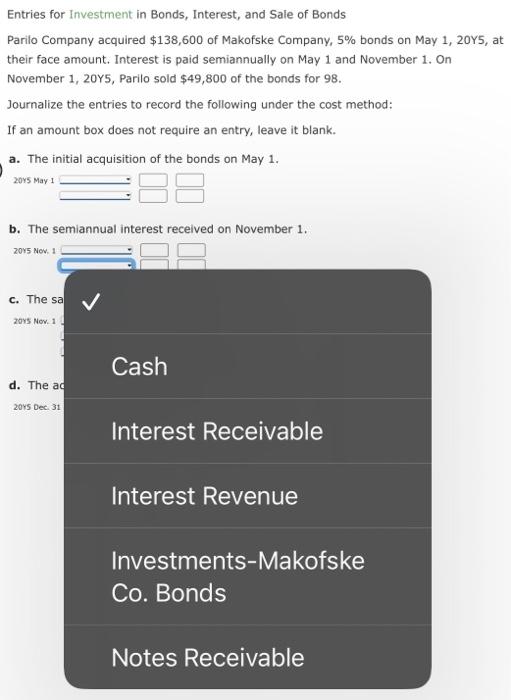

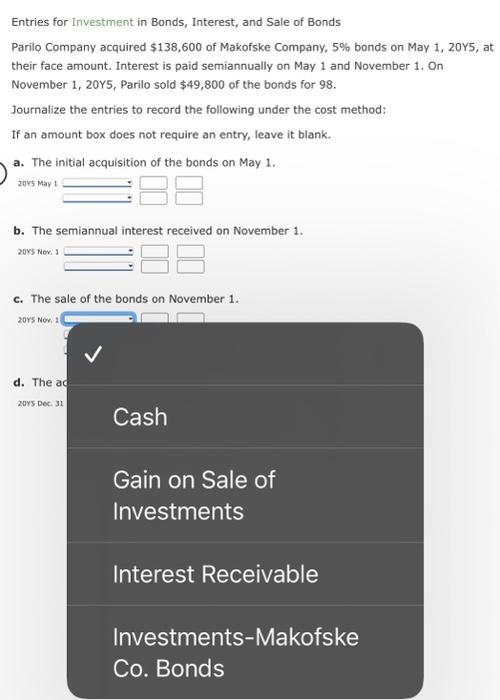

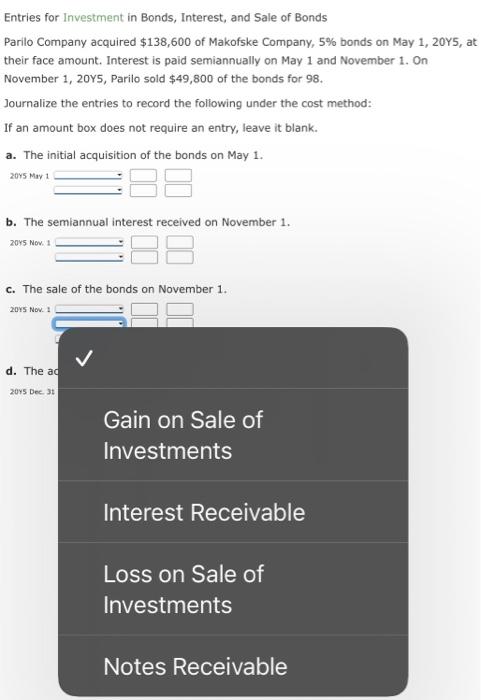

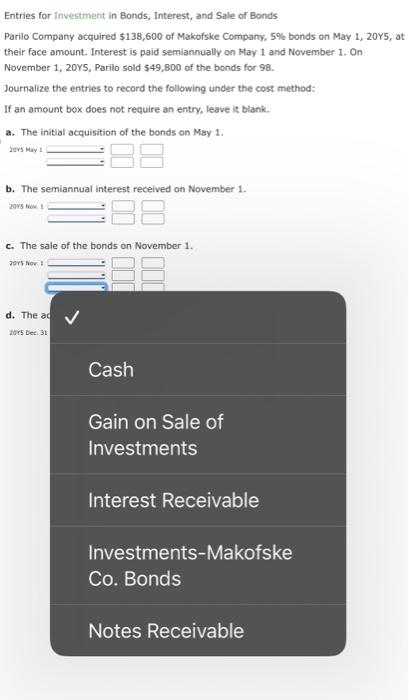

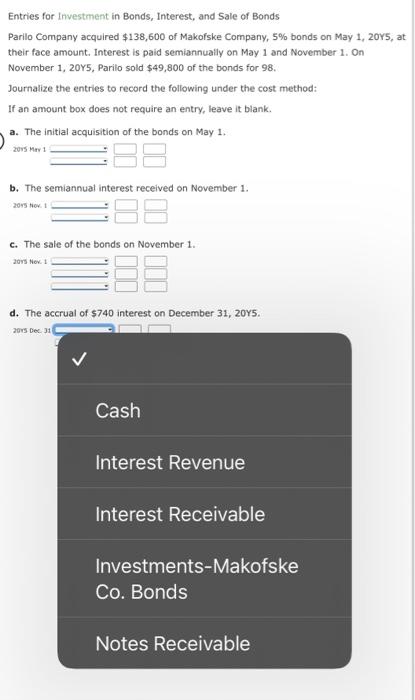

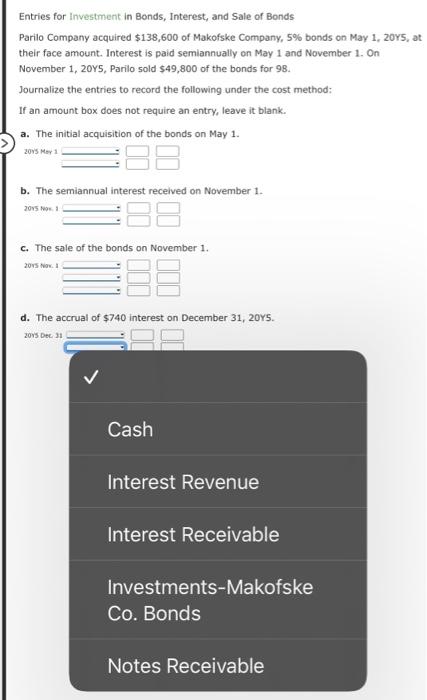

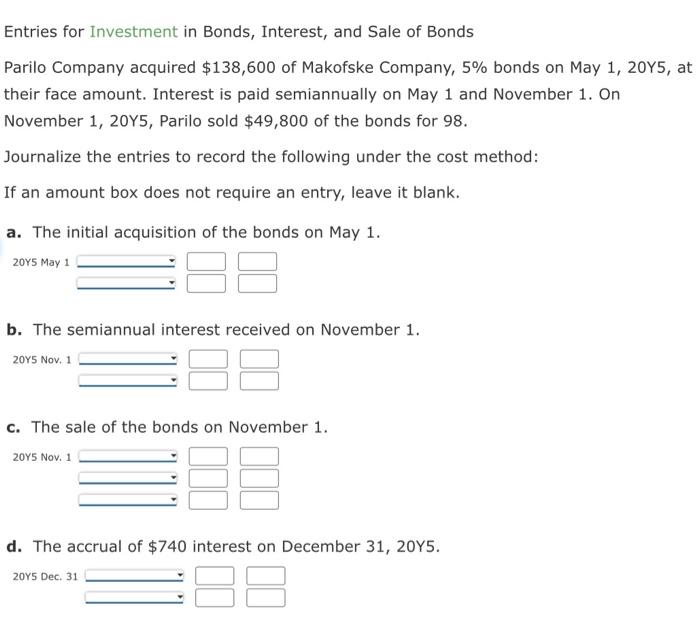

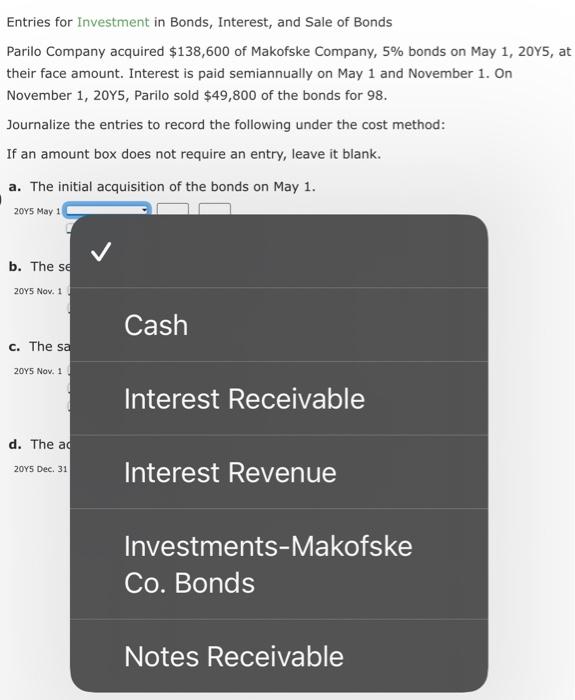

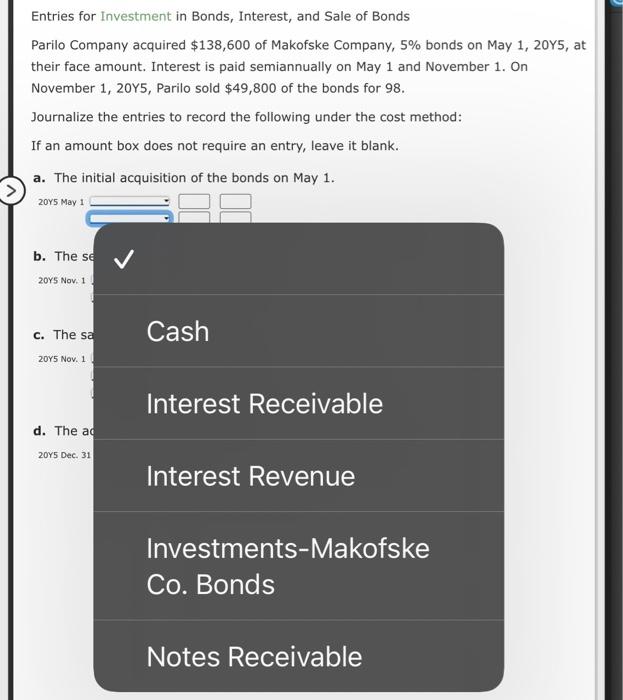

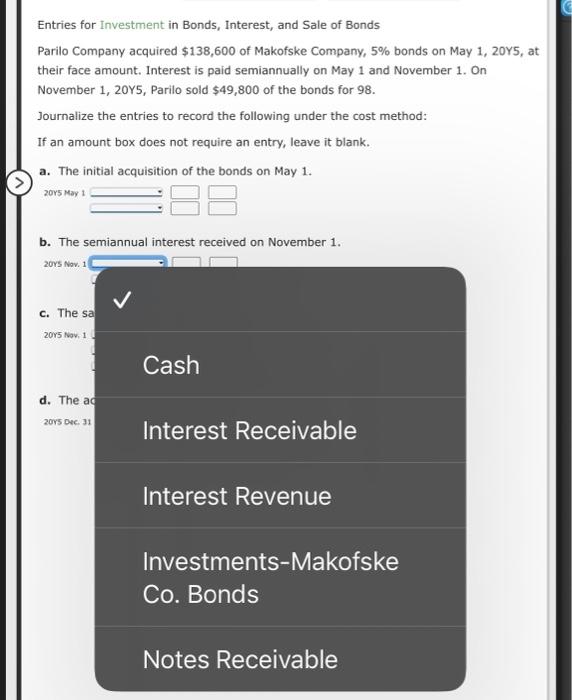

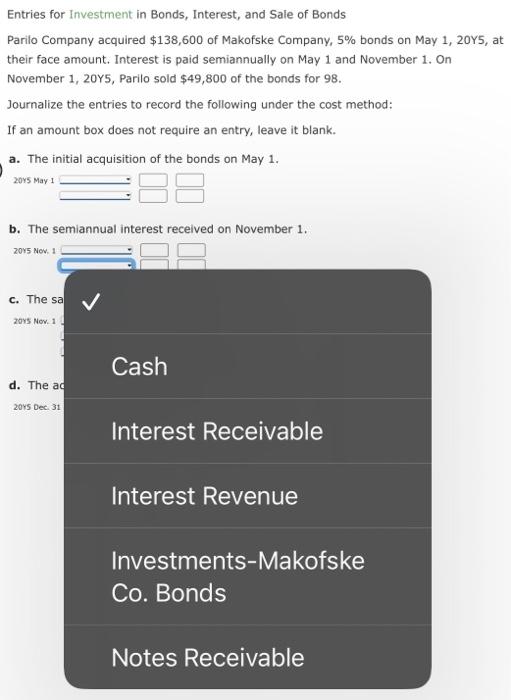

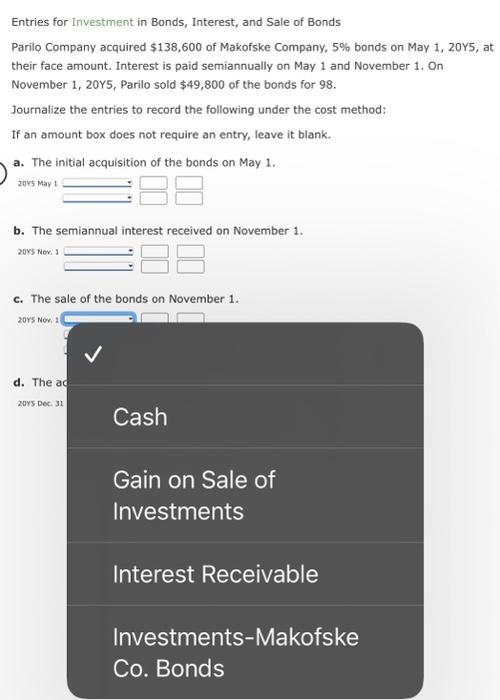

Dropbox on the left and fill in the blanks on the right. Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired

Dropbox on the left and fill in the blanks on the right.

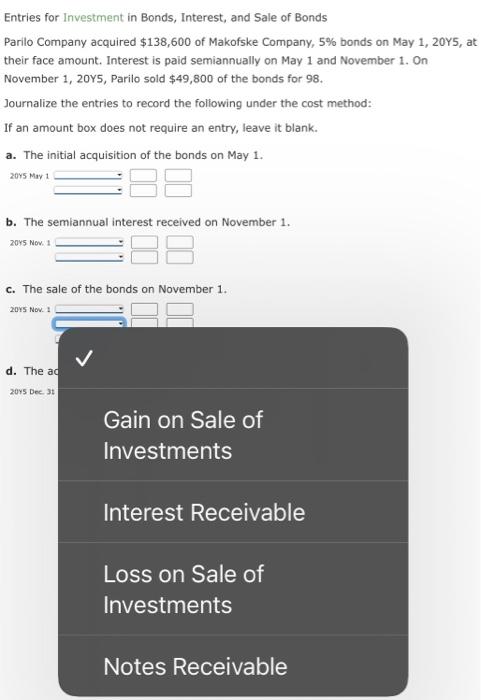

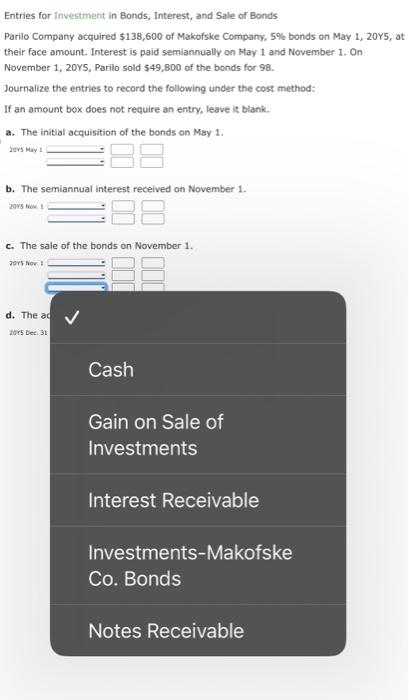

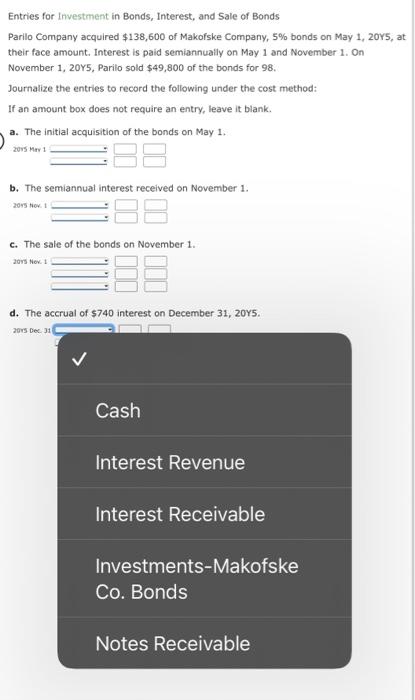

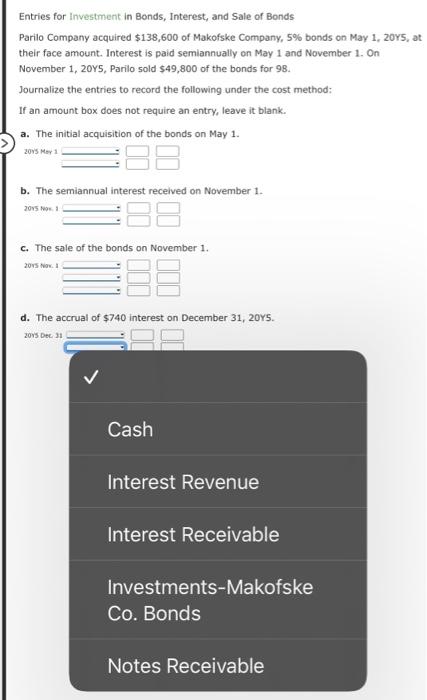

Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1, 20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1 , 20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. 20Y5 May 1 b. The semiannual interest received on November 1 . 20Y5 Nov, 1 c. The sale of the bonds on November 1 . 20Y5 Nov. 1 d. The accrual of $740 interest on December 31,20Y5. 20Y5 Dec. 31 Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1 , 20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1,20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. 20Y5 May 1 b. The st 20Y5 Nov. 1 c. The sa 20Y5 Nov. 1 d. The ar 20Y5 Dec. 31 Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1,20 , at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1, 20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. 20 May 1 b. The se 20 2o Nov: 1 c. The sa Cash 20Y5 Nov. 1 Interest Receivable d. The ac 20Y5 Dec. 31 Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1,20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1,20 , Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1 . 20r5 May 1 b. The semiannual interest received on November 1 . 20r5 Nov. 1 c. The sa 20K5 Now, 1 Cash d. The ac 2ors Dec. 31 Interest Receivable Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1,20 , 5 , at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1, 20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. 20y5 May 1 b. The semiannual interest received on November 1 . 205 Now, 1 Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1,20 , 5 , at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1, 20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. 20 M May 1 b. The semiannual interest received on November 1 . 20y5 Ner: I c. The sale of the bonds on November 1 . zors Nori 1 Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1, 20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1, 20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the foliowing under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. 20ys May 1 b. The semiannual interest received on November 1 . 2085 Now. 1 c. The sale of the bonds on November 1 . 20y5 Nov. 1 Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired 5138,600 of Makofske Company, 5\% bonds on May 1, 20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1 . On November 1,20 , P Parilo sold $49,800 of the bends for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1 . 2ars May 1 b. The semiannual interest received on November 1 . 2015 fow. 1 c. The sale of the bonds on November 1 . Jars hovi I Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1,20r5, at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, 20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1 . 2015 Mar 1 b. The semiannual interest received on November 1 . 3045 tion. 1 c. The sale of the bonds on November 1 . atirt Nov. 1 d. The accrual of $740 interest on December 31,20Y5. 30rs Der.31 Entries for Investment in Bonds, Interest, and Sale of Bonds Parilo Company acquired $138,600 of Makofske Company, 5% bonds on May 1,20Y5, at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, 20Y5, Parilo sold $49,800 of the bonds for 98 . Journalize the entries to record the following under the cost method: If an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. 2013 Mer 1 b. The semiannual interest received on November 1 . 20v5 heps i c. The sale of the bonds on November 1 . 20 N. . 1 d. The accrual of $740 interest on December 31,20 . 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started