Answered step by step

Verified Expert Solution

Question

1 Approved Answer

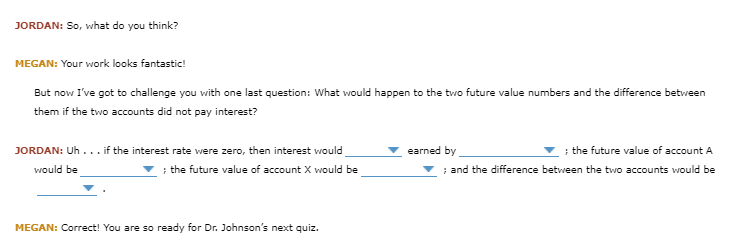

Dropdown menu options: Question 1 - Not be or Be Question 2 - Account X, Either Account, Account A Question 3 - $2660.00 or $2,000.00

Dropdown menu options:

Question 1 - Not be or Be

Question 2 - Account X, Either Account, Account A

Question 3 - $2660.00 or $2,000.00

Question 4 - $2,000.00 or $2,735.26

Question 5 - $0.00 or $75.26

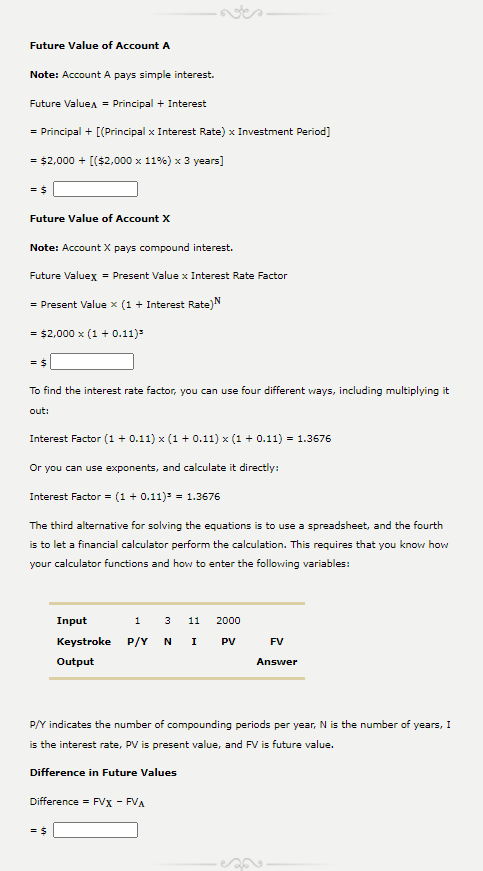

Future Value of Account A Note: Account A pays simple interest. Future Value A = Principal + Interest = Principal + [(Principal x Interest Rate) x Investment Period] = $2,000 + [($2,000 x 11%) x 3 years] = $ Future Value of Account X Note: Account X pays compound interest. Future Valuex = Present Value x Interest Rate Factor = Present Value *(1 + Interest Rate) = $2,000 x (1 + 0.11) = $ To find the interest rate factor, you can use four different ways, including multiplying it out: Interest Factor (1 + 0.11) x (1 +0.11) x (1 + 0.11) = 1.3576 Or you can use exponents, and calculate it directly: Interest Factor = (1 + 0.11)* = 1.3676 The third alternative for solving the equations is to use a spreadsheet, and the fourth is to let a financial calculator perform the calculation. This requires that you know how your calculator functions and how to enter the following variables: 1 3 11 2000 Input Keystroke Output P/Y N I PV FV Answer D/Y indicates the number of compounding periods per year, N is the number of years, I is the interest rate, PV is present value, and FV is future value. Difference in Future Values Difference = FVX - FVA = $ JORDAN: So, what do you think? MEGAN: Your work looks fantastic! But now I've got to challenge you with one last question: What would happen to the two future value numbers and the difference between them if the two accounts did not pay interest? JORDAN: Uh... if the interest rate were zero, then interest would would be ; the future value of account X would be earned by the future value of account A ; and the difference between the two accounts would be MEGAN: Correct! You are so ready for Dr. Johnson's next quiz

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started