Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dropdown on 1st description: state and local government bonds, us treasury notes, us treasury bills 2nd:bankers acceptances, commercial papers, money market mutual funds 3rd: eurodollar

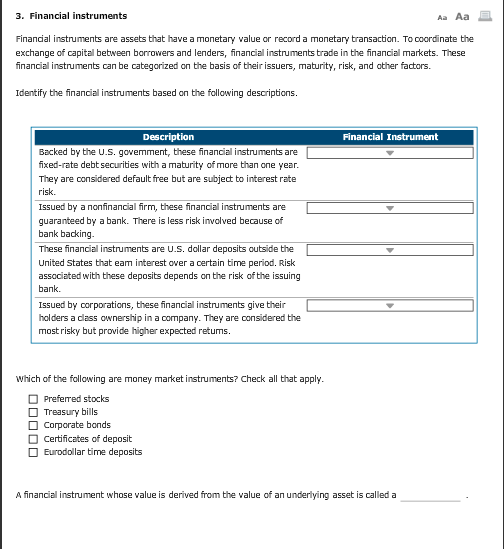

Dropdown on 1st description: state and local government bonds, us treasury notes, us treasury bills

2nd:bankers acceptances, commercial papers, money market mutual funds

3rd: eurodollar time deposits, consumer credit, money market mutual funds

4th: common stocks, preferred stocks, corporate bonds

3. Financial instruments Aa Aa Financial instruments are assets that have a monetary value or record a monetary transaction. To coordinate the exchange of capital between borrowers and lenders, financial instruments trade in the financial markets. These inancial instruments can be categorized on the basis of their issuers, maturity, risk, and other factors. Identify the financial instruments based on the following descriptions. Description Financial Instrument Backed by the U.S. govemment, these financial instruments are fixed-rate debt securities with a maturity of more than one yean They are considered default free but are subjedt to interest rate risk Issued by a nonfinancial firm, these financial instruments are guaranteed by a bank. There is less risk ivolved because of bank backing. These financial instruments are U.S. dollar deposits outside the United States that eam interest over a certain time period. Risk associated with these deposits depends on the risk of the issuing bank. Issued by corporations, these financial instruments give their holders a class ownership in a company. They are considered the mostrisky but provide higher expected retums. which of the following are money market instruments? Check all that apply preferred stocks Treasury bills Corporate bonds Certificates of deposit Eurodollar time deposits A financial instrument whose value is derived from the value of an underlying asset is called aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started