Answered step by step

Verified Expert Solution

Question

1 Approved Answer

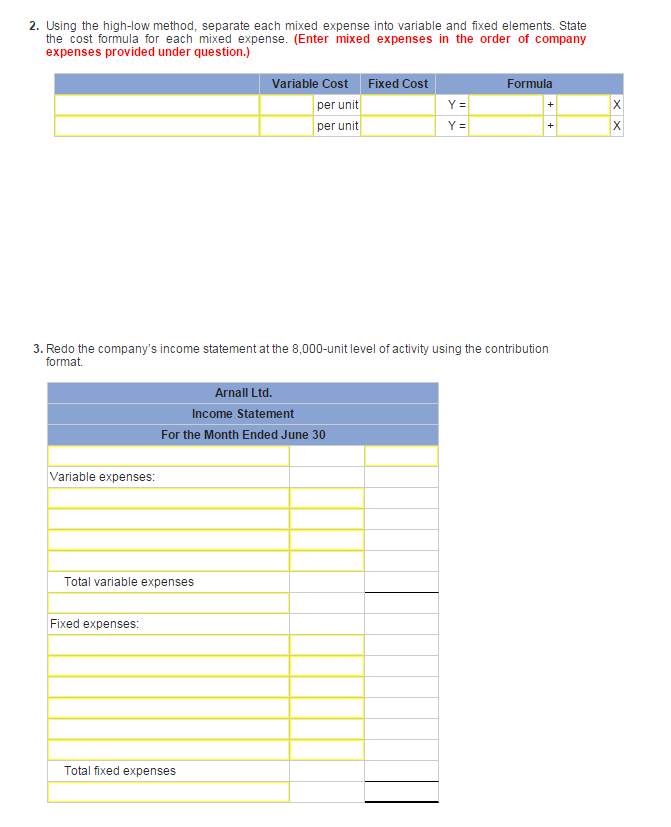

Drop-down Options to choose: -Advertising expense -Cost of goods sold -Depreciation -Insurance -Salaries and commission expense -Sales revenue -Sales salaries -Shipping expense Drop-down Options to

Drop-down Options to choose:

-Advertising expense

-Cost of goods sold

-Depreciation

-Insurance

-Salaries and commission expense

-Sales revenue

-Sales salaries

-Shipping expense

Drop-down Options to choose:

-Contribution margin

-Net profit

Drop-down Options to choose:

-Net operating income

-Net operating loss

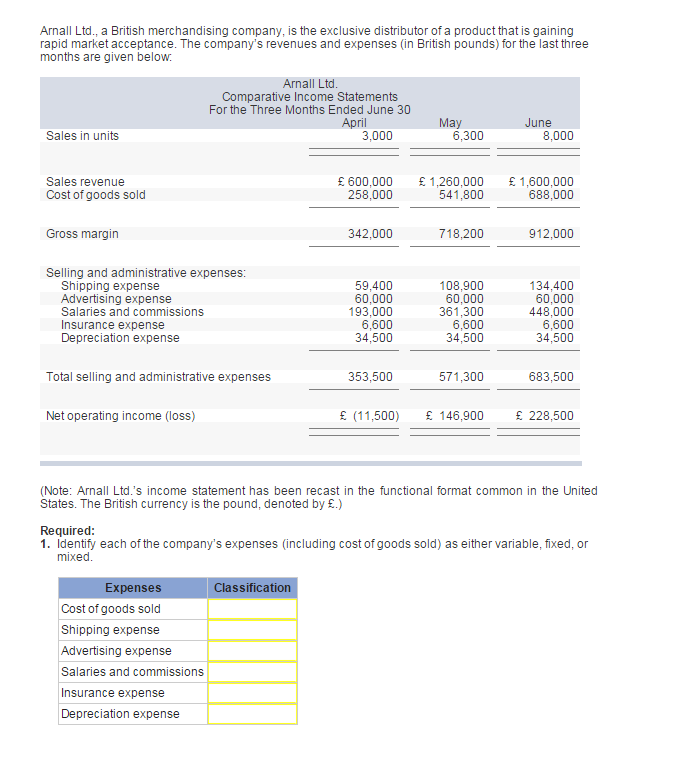

Arnall Ltd., a British merchandising company, is the exclusive distributor of a product that is gaining rapid market acceptance. The company's revenues and expenses (in British pounds) for the last three months are given below Arnall Ltd Comparative Income Statements For the Three Months Ended June 30 April May June Sales in units 3,000 6,300 8,000 Sales revenue Cost of goods sold 600,000 1,260,000 1,600,000 541,800 258,000 688,000 Gross margin 342,000 718,200 912,000 Selling and administrative expenses: Shipping expense Advertising expense Salaries and commissions Insurance expense Depreciation expense 59,400 60,000 193,000 6,600 34,500 108,900 60,000 361,300 6,600 34,500 134,400 60,000 448,000 6,600 34,500 Total selling and administrative expenses 353,500 571,300 683,500 Net operating income (loss) E (11,500) 146,900 228,500 (Note: Arnall Ltd.'s income statement has been recast in the functional format common in the United States. The British currency is the pound, denoted by E.) Required: 1. Identify each of the company's expenses (including cost of goods sold) as either variable, fixed, or mixed Expenses Classification Cost of goods sold Shipping expense Advertising expense Salaries and commissions Insurance expense Depreciation expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started