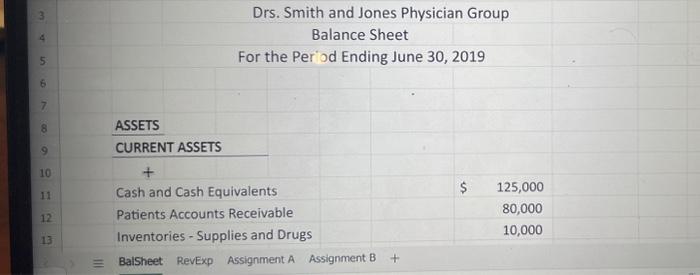

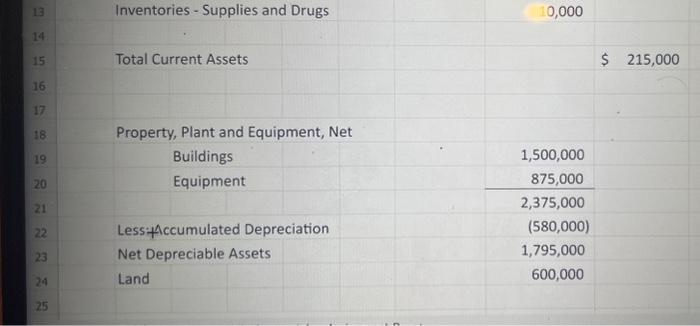

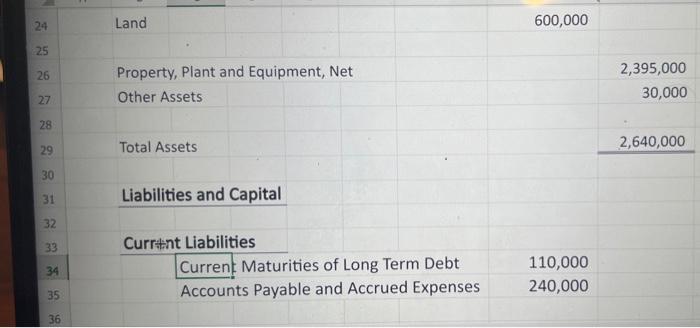

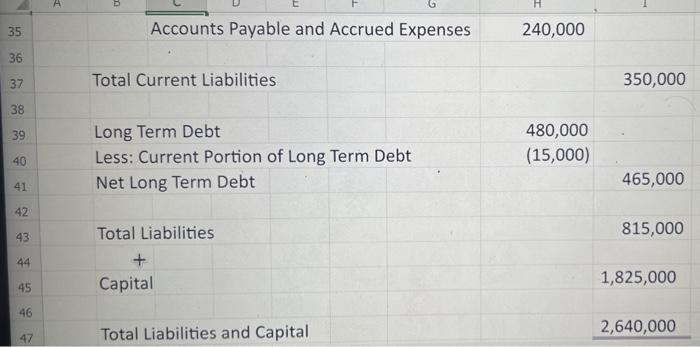

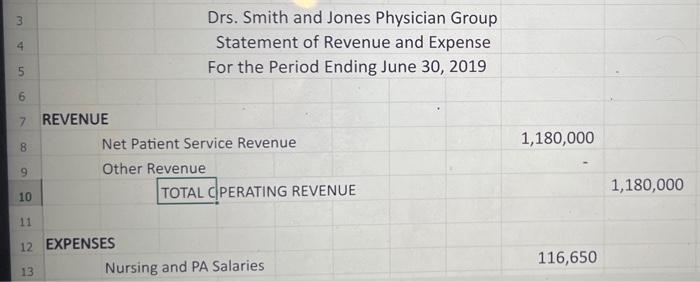

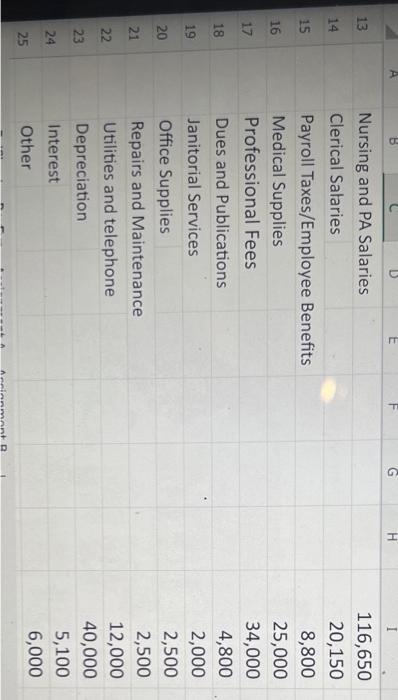

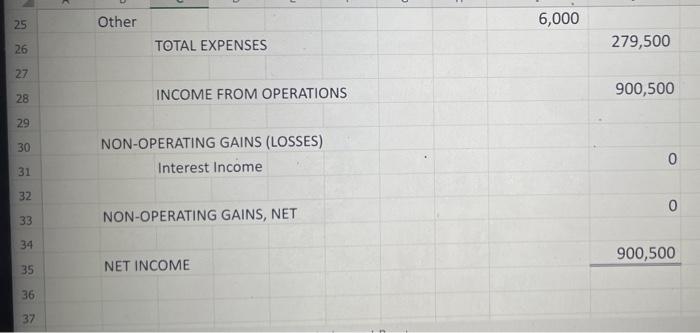

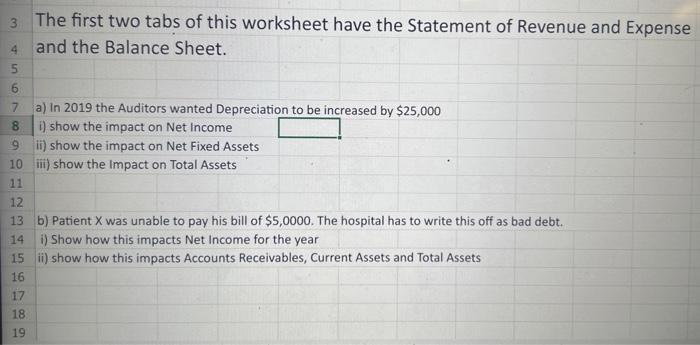

Drs. Smith and Jones Physician Group Balance Sheet For the Period Ending June 30, 2019 ASSETS CURRENT ASSETS Inventories - Supplies and Drugs 10,000 Total Current Assets $215,000 Property, Plant and Equipment, Net \begin{tabular}{lr|} \hline Buildings & \\ \hline Equipment & 1,500,000 \\ & 875,000 \\ \hline Less:Accumulated Depreciation & 2,375,000 \\ Net Depreciable Assets & (580,000) \\ Land & 1,795,000 \\ & 600,000 \end{tabular} 600,000 Property, Plant and Equipment, Net Other Assets Total Assets Liabilities and Capital Curratant Liabilities \begin{tabular}{|ll} \hline Current: Maturities of Long Term Debt & 110,000 \\ \hline Accounts Payable and Accrued Expenses & 240,000 \end{tabular} Total Current Liabilities 350,000 Long Term Debt Less: Current Portion of Long Term Debt 480,000 (15,000) Net Long Term Debt 465,000 Total Liabilities 815,000 Capital 1,825,000 Total Liabilities and Capital 2,640,000 Drs. Smith and Jones Physician Group Statement of Revenue and Expense For the Period Ending June 30, 2019 REVENUE Net Patient Service Revenue 1,180,000 Other Revenue TOTAL CPERATING REVENUE 1,180,000 EXPENSES Nursing and PA Salaries 116,650 \begin{tabular}{|r|r|r|} \hline 13 & Nursing and PA Salaries & 116,650 \\ \hline 14 & Clerical Salaries & 20,150 \\ \hline 15 & Payroll Taxes/Employee Benefits & 8,800 \\ \hline 16 & Medical Supplies & 25,000 \\ \hline 17 & Professional Fees & 34,000 \\ \hline 18 & Dues and Publications & 4,800 \\ \hline 19 & Janitorial Services & 2,000 \\ \hline 20 & Office Supplies & 2,500 \\ \hline 21 & Repairs and Maintenance & 2,500 \\ \hline 22 & Utilities and telephone & 12,000 \\ \hline 23 & Depreciation & 40,000 \\ \hline 24 & Interest & 5,100 \\ \hline 25 & Other & 6,000 \\ \hline \end{tabular} TOTAL EXPENSES 279,500 INCOME FROM OPERATIONS 900,500 NON-OPERATING GAINS (LOSSES) Interest Income NON-OPERATING GAINS, NET NET INCOME 900,500 3. The first two tabs of this worksheet have the Statement of Revenue and Expense and the Balance Sheet. a) In 2019 the Auditors wanted Depreciation to be increased by $25,000 i) show the impact on Net Income ii) show the impact on Net Fixed Assets iii) show the Impact on Total Assets b) Patient X was unable to pay his bill of $5,0000. The hospital has to write this off as bad debt. i) Show how this impacts Net Income for the year ii) show how this impacts Accounts Receivables, Current Assets and Total Assets