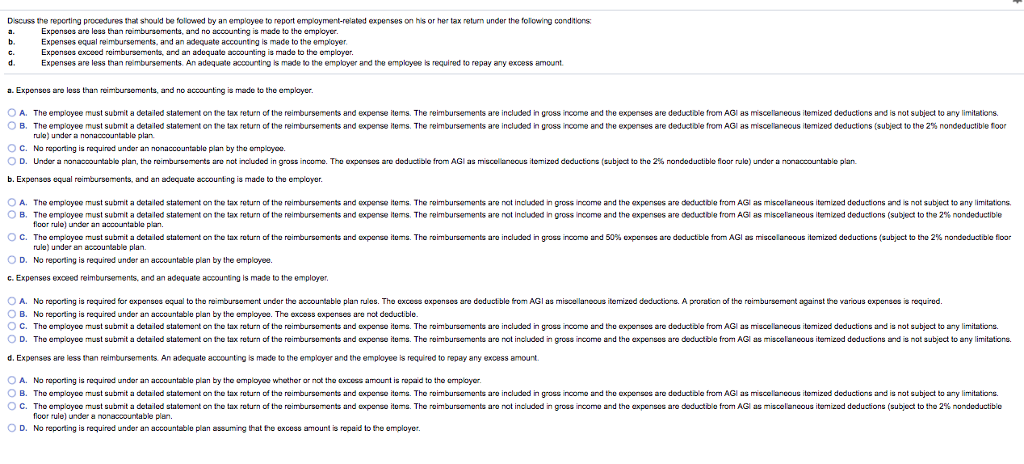

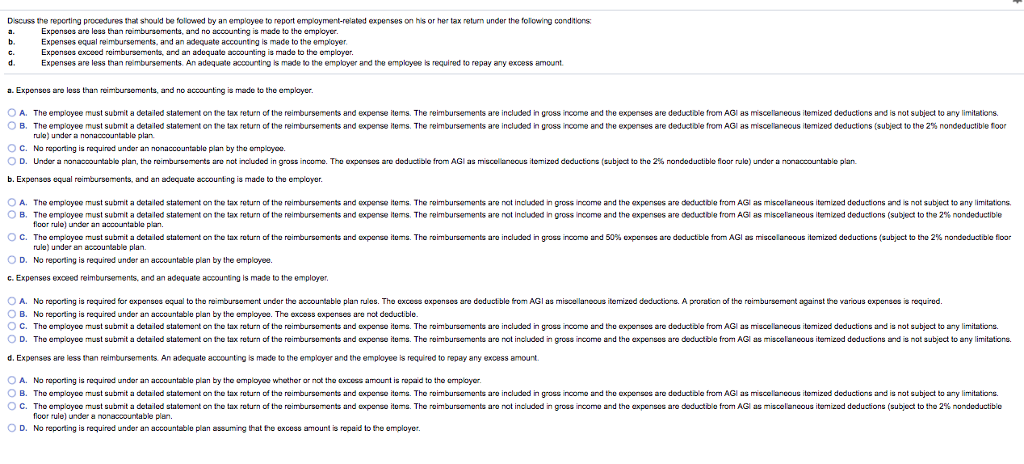

Dscuss the reporting procedures that should be followed by an employee to report employment-related expenses on hsor her tax return under the folowing conditions Expenses are less than reimbursoments, and no accounting is made to the emplcyer Expenses equal reimbursements, and an adequate accountng is made to the emplcyer Expenses axceed reimbursemonts, and an adoquate accounting is made to the employor. Expenses are less than re mbursements. An adequate accounting is made to the employer and the emplayee is required to repay any excess amount a. Expensos are loss than reimbursoments, and no accounting is made to the emplcyer. O A. The employee must submit a deta led statement on the tax return of the reimbursements and expense items. The reimbursements are included in gross income and the expenses are deductibie from AGl as miscellaneous itemized deductions and is not subject to any limitations. ust submit a detailed statement on the ta nonaccountable plan eturn of the reimbursements and expense s. The eimburse gross norme and the expenses are deductble 0 m A l as scena e us itemized deductions sub to he 2% nondeductible too B. The employee rulo) under e ents are nclude C. No reporting is roquired undor an nonaccountable plan by tho cmpoyo. O D Ur dr nonaooou tablo plan, tho ro m urso ants aro not nduded in grossnco me. Tho 0 po sos aro dodu b. Exponsos equal reimbursements, and an adequate accounting is made to the employor ble rom AGI as muco ancous to izod deductions sub oct to the 2% nondoductible floor rulo under nonaccountabio plan. A B. The employee must submit a detailed s a emer on he The employee must submit a detailed statement on the ta floor rulo) under an accountable plan return of the m urse ents and e ense item s The er urs rents are not included n gross eturn c e reimbursements and expense i s. The e burse ents are ot included n gross me and the expenses are edu be come and he expenses are deductble om A as mis el aneous i g ized deductions and not su ect to any i itations AGl as scellaneous ite ized deductions su ect to the 2% no deductible C. Tho Qmployce must submit a do aled s a mont on no ta utu n o o ro r ursom nts and co no ito s The or burs morts aro includa n gross mo and 5 % ponses aro do uctible o m A as miscelan o s tom od doduction sub c to ho 2% nondo ctit fioor rule) under en accountable plan No reporting is required under an accounteble plan by the employee. O D. C. Expenses exceed reimbursements, and an adequate accounting is made to the employer A o report ng 13 required foraxpenses oqua to ho ro m ursoment under te accountable plan r es The excess oxponses aru doductible from as ms o ano us itemized deductor s A proration o he ruim ursemar a ains the var ous expenses requred O B. No reporting is required under an accountable plan by the employee. The occoss expenses aru not deductible. O C. The emplayee must submit a detailed statemant on the tax return of the reimbursoments and expense itoms. The reimbursemonts are included in gross income and the expenses are doductble from AGl as misceluncous itomized deductions and is not subject to any limitations. D Tho cmployce ust submi a det led stateman on o ux rtu n o he rim urso ents and ex ense items. The ormburser onts ano induded n gross noor and he expenses are deducti o om A ais is laneous om zed deductions and not sub ect to any imitations. d. Expenses are less than reimbursements. An adequate accounting is made to the employer and the employee is required to repay any excess amount A No reporting is roquired under an accountable plan by the omplo oo wnother or not tho coccus amount is ropad to thomplo er O B. The emplayce must submit a detailed statemont on the tax roturn of the reimbursoments and expense itoms. The roimbursemants are included in gross income and the axpenses are doductbe from AGl as miscelancous itemizod deductions and is not subject to any limitations C. Tho cma us submi a de a ed sta a mon on t e tax ret n o ho r urso ents and u n ito ms. The or bur marts aro not included n gross no mo and he expenses are doductbo om as mis ela cous m zed deductions sub oct o tho 2% nondeductible ficor tule) under a nonaccountable plen. No reporting is required under an accountable plan assuming that D. excess amount is repaid to the ployer