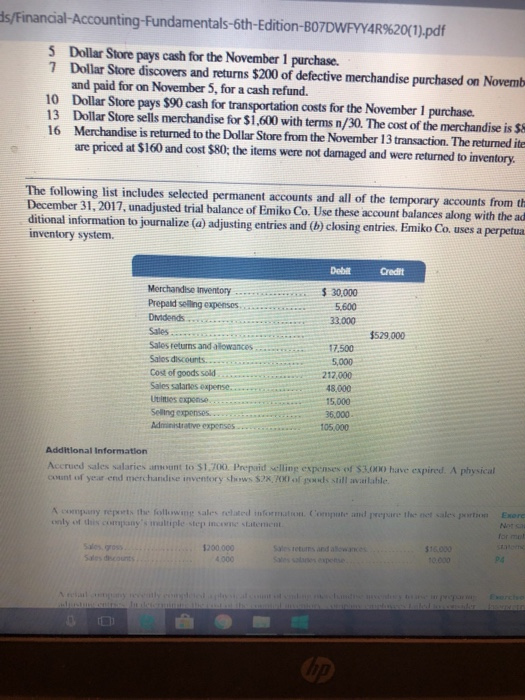

ds/Financial-Accounting-Fundamentals-6th-Edition-BO7DWFYAR %20(1),pdf S Dollar Store pays cash for the November 1 purchase. 7 Dollar Store discovers and returns $200 of defective merchandise purchased on Novemb and paid for on November 5, for a cash refund. 10 Dollar Store pays $90 cash for transportation costs for the November 1 purchase. 13 Dollar Store sells merchandise for $1,600 with terms n/30. The cost of the merchandise is $8 16 Merchandise is returned to the Dollar Store from the November 13 transaction. The returned ites are priced at $160 and cost $80; the items were not damaged and were returned to inventory The following list includes selected permanent accounts and all of the temporary accounts from th December 31, 2017, unadjusted trial balance of Emiko Co. Use these account balances along with the ad ditional information to journalize (a) adjusting entries and (b) closing entries. Emiko Co. uses a perpetual inventory system. Dobit Credit Merchandse inventory Prepaid selling expenses $ 30.000 5,600 Dendends 33.000 Sales $529.000 Sales returns and alowances Salos discounts 17.500 5,000 Cost of goods sold Sales salartes expense.. Utitses exponse 212,000 48,000 15,000 36,000 Selling expenses Administrative expensos 105,000 Additional Information Accrued sales salaries amount to $1,700. Prepaid selling expenses of $3,000 have expired. A physical count of year end merchandise inventory shows $2x, PO0 of goods still availafhle. A company reports the following sales related infomation Compate and prepare the net sales portion only of this Company's maltiple step income stateient Exerc Not sa for mot $16.000 Statome Sales retuns and alowances Sates salanes expense Sales, gross Sales dscounts $200,000 P4 10.000 4.000 Ntelal pay eetly eongliod tosical t d distue entrs eppar Exerctso e oserpectre Ju sletermne the oid the l nnony nmcet aledtoso der ds/Financial-Accounting-Fundamentals-6th-Edition-BO7DWFYAR %20(1),pdf S Dollar Store pays cash for the November 1 purchase. 7 Dollar Store discovers and returns $200 of defective merchandise purchased on Novemb and paid for on November 5, for a cash refund. 10 Dollar Store pays $90 cash for transportation costs for the November 1 purchase. 13 Dollar Store sells merchandise for $1,600 with terms n/30. The cost of the merchandise is $8 16 Merchandise is returned to the Dollar Store from the November 13 transaction. The returned ites are priced at $160 and cost $80; the items were not damaged and were returned to inventory The following list includes selected permanent accounts and all of the temporary accounts from th December 31, 2017, unadjusted trial balance of Emiko Co. Use these account balances along with the ad ditional information to journalize (a) adjusting entries and (b) closing entries. Emiko Co. uses a perpetual inventory system. Dobit Credit Merchandse inventory Prepaid selling expenses $ 30.000 5,600 Dendends 33.000 Sales $529.000 Sales returns and alowances Salos discounts 17.500 5,000 Cost of goods sold Sales salartes expense.. Utitses exponse 212,000 48,000 15,000 36,000 Selling expenses Administrative expensos 105,000 Additional Information Accrued sales salaries amount to $1,700. Prepaid selling expenses of $3,000 have expired. A physical count of year end merchandise inventory shows $2x, PO0 of goods still availafhle. A company reports the following sales related infomation Compate and prepare the net sales portion only of this Company's maltiple step income stateient Exerc Not sa for mot $16.000 Statome Sales retuns and alowances Sates salanes expense Sales, gross Sales dscounts $200,000 P4 10.000 4.000 Ntelal pay eetly eongliod tosical t d distue entrs eppar Exerctso e oserpectre Ju sletermne the oid the l nnony nmcet aledtoso der