Answered step by step

Verified Expert Solution

Question

1 Approved Answer

dsu 2 AIVIR - American Airlines Chapter 6: Bond Valuation AMR is the parent company of American Airlines. In addition to its prin AMR also

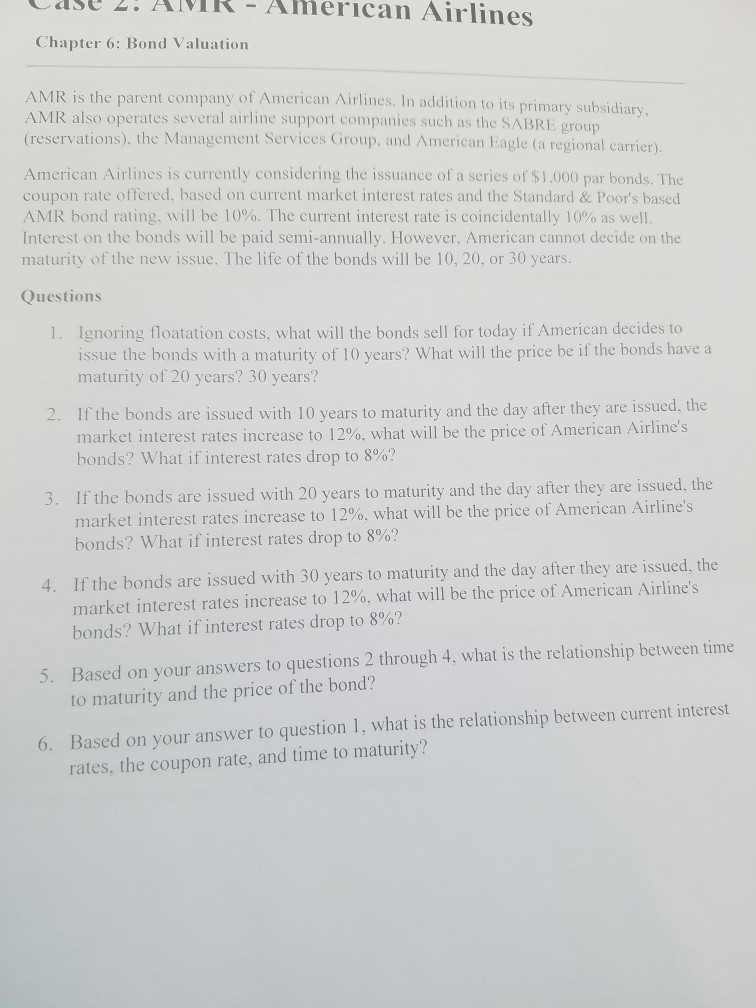

dsu 2 AIVIR - American Airlines Chapter 6: Bond Valuation AMR is the parent company of American Airlines. In addition to its prin AMR also operates several airline support companies such as the SABRE group (reservations). the Management Services Group, and American Eagle (a regional carrier) ary subsidiary American Airlines is currently considering the issuance of a series of $1,000 par bonds. The coupon rate offered, based on current market interest rates and the Standard & Poor's based AMR bond rating, will be 10%. The current interest rate is coincidentally 10% as well Interest on the bonds will be paid semi-annually. However, American cannot decide on the maturity of the new issue. The life of the bonds will be 10, 20, or 30 years Questions Ignoring floatation costs, what will the bonds sell for today if American decides to issue the bonds with a maturity of 10 years? What will the price be if the bonds have a maturity of 20 years? 30 years? I. 2. If the bonds are issued with 10 years to maturity and the day after they are issued, the market interest rates increase to 12%, what will be the price of American Airlines bonds? What if interest rates drop to 8%? the bonds are issued with 20 years to maturity and the day after they are issued, the market interest rates increase to 12%, what will be the price ofAmerican Airlines bonds? What if interest rates drop to 8%? 5. If If the bonds are issued with 30 years to maturity and the day after they are issued, the market interest rates increase to 12%, what will be the price of American Airlines bonds? What if interest rates drop to 8%? 4. Based on your answers to questions 2 through 4, what is the relationship between time to maturity and the price of the bond? 5. Based on your answer to question 1, what is the relationship between current interest rates, the coupon rate, and time to maturity? 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started