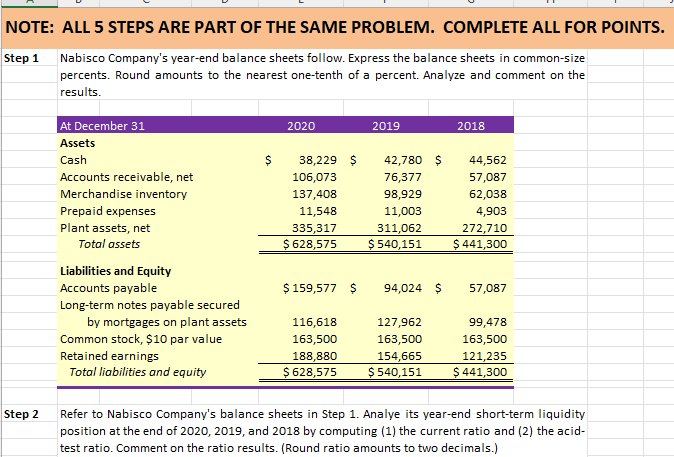

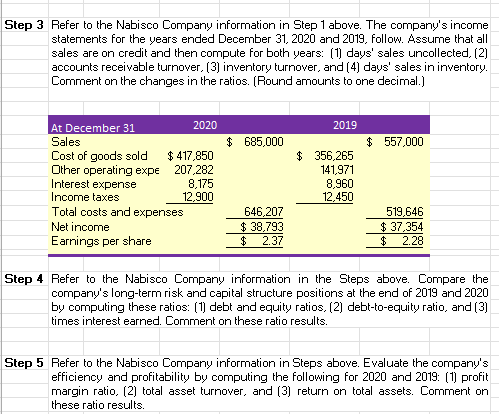

DTE: ALL 5 STEPS ARE PART OF THE SAME PROBLEM. COMPLETE ALL FOR POINTS. o 1 Nabisco Company's year-end balance sheets follow. Express the balance sheets in common-size percents. Round amounts to the nearest one-tenth of a percent. Analyze and comment on the results. 2 Refer to Nabisco Company's balance sheets in Step 1. Analye its year-end short-term liquidity position at the end of 2020,2019 , and 2018 by computing (1) the current ratio and (2) the acidtest ratio. Comment on the ratio results. (Round ratio amounts to two decimals.) Step 3 Refer to the Nabisco Company information in Step 1 above. The company's income statements for the years ended December 31, 2020 and 2019 , follow. Assume that all sales are on credit and then compute for both years: (1) days' sales uncollected. (2) accounts receivable turnover, (3) inventory turnover, and (4) days' sales in inventory. Comment on the changes in the ratios. [Round amounts to one decimal.) Step 4 Refer to the Nabisco Company information in the Steps above. Compare the company's long-term risk and capital structure positions at the end of 2019 and 2020 by computing these ratios: [1] debt and equity ratios, [2] debt-to-equity ratio, and (3) rimes interest earnet Finmment nn these ratin resi lte Step 5 Refer to the Nabisco Company information in Steps above. Evaluate the company's efficiency and profitability by computing the following for 2020 and 2019 : (1) profit margin ratio, (2) total asset turnover, and [3) return on total assets. Comment on these ratio results. DTE: ALL 5 STEPS ARE PART OF THE SAME PROBLEM. COMPLETE ALL FOR POINTS. o 1 Nabisco Company's year-end balance sheets follow. Express the balance sheets in common-size percents. Round amounts to the nearest one-tenth of a percent. Analyze and comment on the results. 2 Refer to Nabisco Company's balance sheets in Step 1. Analye its year-end short-term liquidity position at the end of 2020,2019 , and 2018 by computing (1) the current ratio and (2) the acidtest ratio. Comment on the ratio results. (Round ratio amounts to two decimals.) Step 3 Refer to the Nabisco Company information in Step 1 above. The company's income statements for the years ended December 31, 2020 and 2019 , follow. Assume that all sales are on credit and then compute for both years: (1) days' sales uncollected. (2) accounts receivable turnover, (3) inventory turnover, and (4) days' sales in inventory. Comment on the changes in the ratios. [Round amounts to one decimal.) Step 4 Refer to the Nabisco Company information in the Steps above. Compare the company's long-term risk and capital structure positions at the end of 2019 and 2020 by computing these ratios: [1] debt and equity ratios, [2] debt-to-equity ratio, and (3) rimes interest earnet Finmment nn these ratin resi lte Step 5 Refer to the Nabisco Company information in Steps above. Evaluate the company's efficiency and profitability by computing the following for 2020 and 2019 : (1) profit margin ratio, (2) total asset turnover, and [3) return on total assets. Comment on these ratio results