Question

D*Tunes is a ballroom studio in Pocatello, Idaho. The studios owner has collected data regarding the studios sales for lessons in January 2025. You are

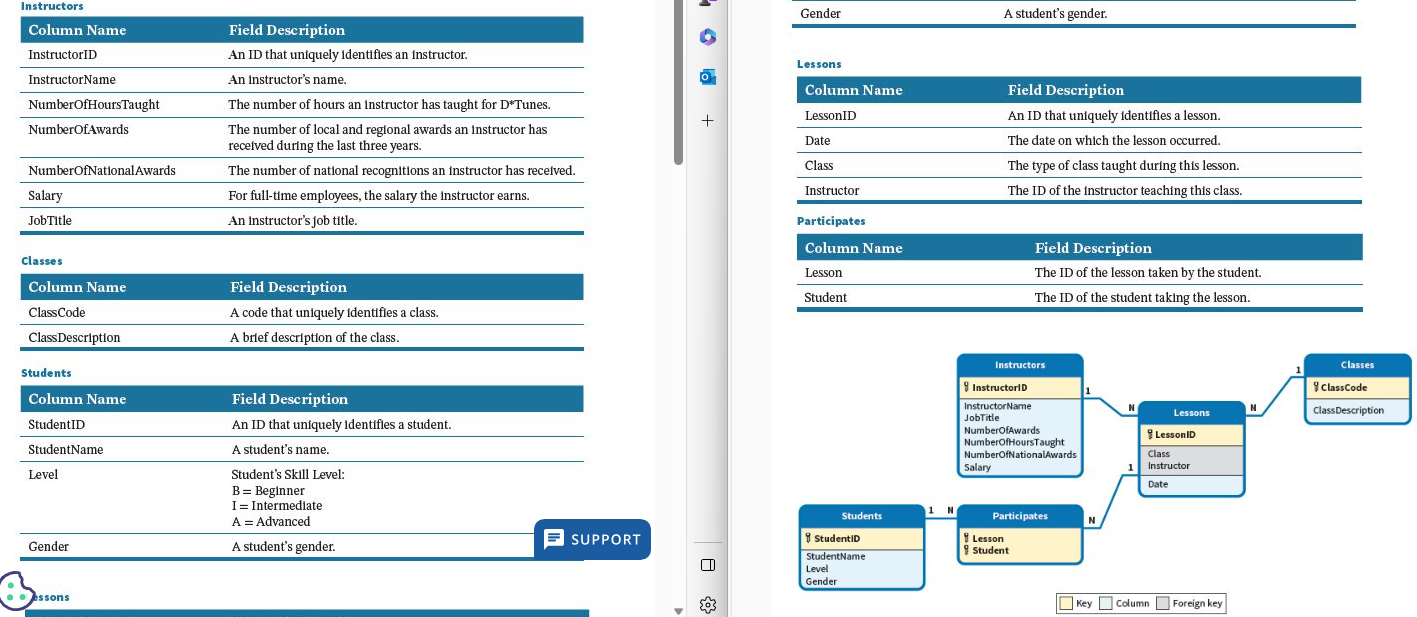

D*Tunes is a ballroom studio in Pocatello, Idaho. The studios owner has collected data regarding the studios sales for lessons in January 2025. You are interning with them as an accountant. The owner has a series of questions that can be answered using data that has already been given to you. You have already developed the data dictionary and the data model for the data set.

| Month | Deduction | ||

| Salary | 200,000 | Jan | 1,275.00 |

| FICA% | 0.0765 | Feb | 1,275.00 |

| SocialSecurity% | 0.062 | March | 1,275.00 |

| Medicare% | 0.0145 | April | 1,275.00 |

| SocialSecurityMaximum | 168,900 | May | 1,275.00 |

| June | 1,275.00 | ||

| July | 1,275.00 | ||

| Aug | 1,275.00 | ||

| Sept | 1,275.00 | ||

| Oct | 1,275.00 | ||

| Nov | 380.13 | ||

| Dec | 241.67 |

For the two salaried employees, D*Tunes must withhold the employer portion of FICA taxes every month from their wages. FICA tax is a combination of Social Security tax and Medicare tax. The 2025 FICA tax rate is 7.65%, which includes Social Security tax of 6.2% and Medicare tax of 1.45%. The owner does not need to withhold Social Security tax for any earnings above $168,900. Therefore, the studio must only withhold Medicare tax on wages above this amount. Create an information model that will allow you to design a worksheet similar to the one shown that will help the studio determine the FICA tax payments for each month.

Upload a word file that includes your analysis and answers and an excel file with your calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started