Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DUCIULIUI Walu, page 33.) 32. Inky Inc. reported the following financial information in 2015. Operating income (EBIT) $650,000 Interest $430,000 Dividends from Printers Inc. not

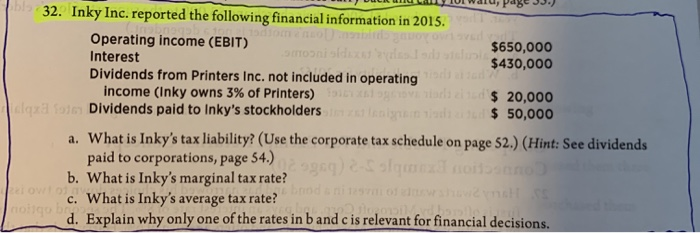

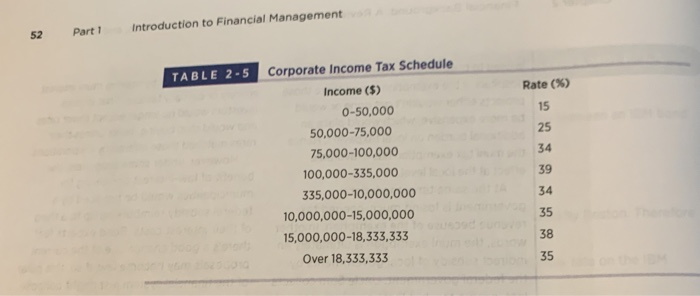

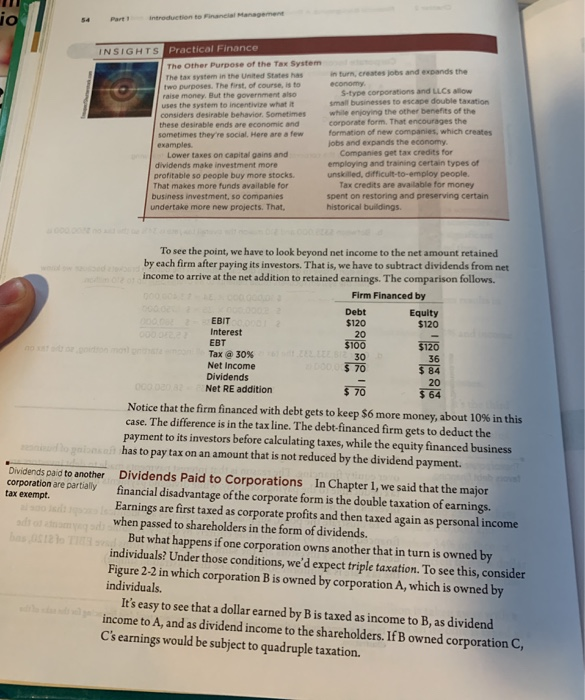

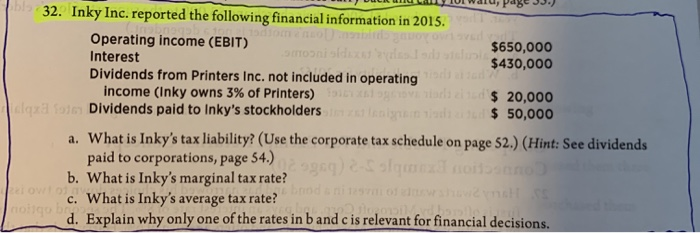

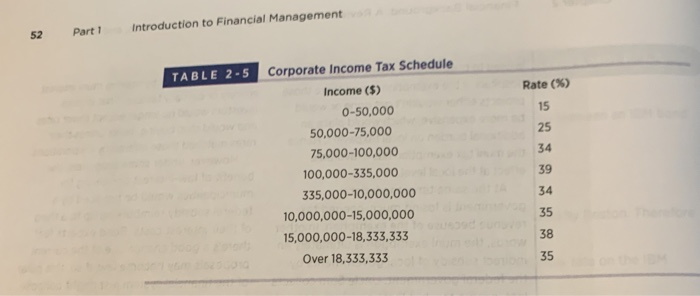

DUCIULIUI Walu, page 33.) 32. Inky Inc. reported the following financial information in 2015. Operating income (EBIT) $650,000 Interest $430,000 Dividends from Printers Inc. not included in operating income (Inky owns 3% of Printers) var $ 20,000 la Dividends paid to Inky's stockholders an d $ 50,000 a. What is Inky's tax liability? (Use the corporate tax schedule on page 52.) (Hint: See dividends paid to corporations, page 54.) b. What is Inky's marginal tax rate? c. What is Inky's average tax rate? d. Explain why only one of the rates in band c is relevant for financial decisions. 52 Part 1 introduction to Financial Management TABLE 2-5 Rate (%) Corporate Income Tax Schedule Income (5) 0-50,000 50,000-75,000 75,000-100,000 100,000-335,000 335,000-10,000,000 10,000,000-15,000,000 15,000,000-18,333,333 Over 18,333,333 54 Part Introduction to Financial Management INSIGHTS Practical Finance The Other Purpose of the Tax System The tax system in the United States has two purposes. The first of course, to raise money. But the government also uses the system to incentivire what it considers desirable behavior. Sometimes these desirable ends are economic and sometimes they're social. Here are a few examples Lower takes on capital gains and dividends make investment more profitable so people buy more stocks. That makes more funds available for business investment, so companies undertake more new projects. That in turn, creates jobs and expands the economy. S-type corporations and LLCS low small businesses to escape double taxation while enjoying the other benefits of the corporate formThat encourages the formation of new companies, which creates jobs and expands the economy Companies get tax credits for employing and training certain types of unskilled, difficult-to-employ people. Tax credits are available for money spent on restoring and preserving certain historical buildings. To see the point, we have to look beyond net income to the net amount retained by each firm after paying its investors. That is, we have to subtract dividends from net income to arrive at the net addition to retained earnings. The comparison follows. Firm Financed by Debt Equity EBIT $120 $120 Interest 20 EBT $100 $120 Tax a 30% 30 36 Net Income 0 $ 70 $ 84 Dividends 20 Net RE addition $ 64 Notice that the firm financed with debt gets to keep $6 more money, about 10% in this case. The difference is in the tax line. The debt-financed firm gets to deduct the payment to its investors before calculating taxes, while the equity financed business has to pay tax on an amount that is not reduced by the dividend payment. Dividends paid to another Dividends Paid to Corporations in Chapter 1, we said that the major corporation are partially financial disadvantage of the corporate form is the double taxation of earnings. tax exempt. Earnings are first taxed as corporate profits and then taxed again as personal income when passed to shareholders in the form of dividends. CITE But what happens if one corporation owns another that in turn is owned by individuals? Under those conditions, we'd expect triple taxation. To see this, consider Figure 2-2 in which corporation B is owned by corporation A, which is owned by individuals. It's easy to see that a dollar earned by B is taxed as income to B, as dividend income to A, and as dividend income to the shareholders. If B owned corporation C, C's earnings would be subject to quadruple taxation

DUCIULIUI Walu, page 33.) 32. Inky Inc. reported the following financial information in 2015. Operating income (EBIT) $650,000 Interest $430,000 Dividends from Printers Inc. not included in operating income (Inky owns 3% of Printers) var $ 20,000 la Dividends paid to Inky's stockholders an d $ 50,000 a. What is Inky's tax liability? (Use the corporate tax schedule on page 52.) (Hint: See dividends paid to corporations, page 54.) b. What is Inky's marginal tax rate? c. What is Inky's average tax rate? d. Explain why only one of the rates in band c is relevant for financial decisions. 52 Part 1 introduction to Financial Management TABLE 2-5 Rate (%) Corporate Income Tax Schedule Income (5) 0-50,000 50,000-75,000 75,000-100,000 100,000-335,000 335,000-10,000,000 10,000,000-15,000,000 15,000,000-18,333,333 Over 18,333,333 54 Part Introduction to Financial Management INSIGHTS Practical Finance The Other Purpose of the Tax System The tax system in the United States has two purposes. The first of course, to raise money. But the government also uses the system to incentivire what it considers desirable behavior. Sometimes these desirable ends are economic and sometimes they're social. Here are a few examples Lower takes on capital gains and dividends make investment more profitable so people buy more stocks. That makes more funds available for business investment, so companies undertake more new projects. That in turn, creates jobs and expands the economy. S-type corporations and LLCS low small businesses to escape double taxation while enjoying the other benefits of the corporate formThat encourages the formation of new companies, which creates jobs and expands the economy Companies get tax credits for employing and training certain types of unskilled, difficult-to-employ people. Tax credits are available for money spent on restoring and preserving certain historical buildings. To see the point, we have to look beyond net income to the net amount retained by each firm after paying its investors. That is, we have to subtract dividends from net income to arrive at the net addition to retained earnings. The comparison follows. Firm Financed by Debt Equity EBIT $120 $120 Interest 20 EBT $100 $120 Tax a 30% 30 36 Net Income 0 $ 70 $ 84 Dividends 20 Net RE addition $ 64 Notice that the firm financed with debt gets to keep $6 more money, about 10% in this case. The difference is in the tax line. The debt-financed firm gets to deduct the payment to its investors before calculating taxes, while the equity financed business has to pay tax on an amount that is not reduced by the dividend payment. Dividends paid to another Dividends Paid to Corporations in Chapter 1, we said that the major corporation are partially financial disadvantage of the corporate form is the double taxation of earnings. tax exempt. Earnings are first taxed as corporate profits and then taxed again as personal income when passed to shareholders in the form of dividends. CITE But what happens if one corporation owns another that in turn is owned by individuals? Under those conditions, we'd expect triple taxation. To see this, consider Figure 2-2 in which corporation B is owned by corporation A, which is owned by individuals. It's easy to see that a dollar earned by B is taxed as income to B, as dividend income to A, and as dividend income to the shareholders. If B owned corporation C, C's earnings would be subject to quadruple taxation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started