Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Due by September 19, 2019 ACCT 2101 - Fall 2019 Comprehensive Problem 1 On January 1, 2019, John Smith launched a computer services company. Technology

Due by September 19, 2019

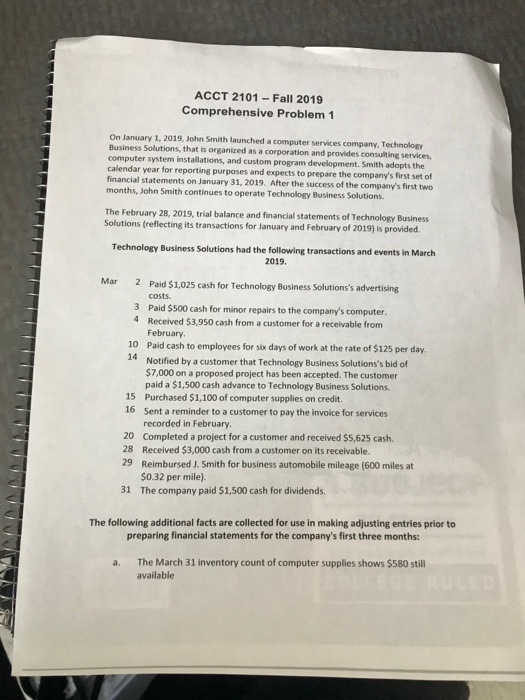

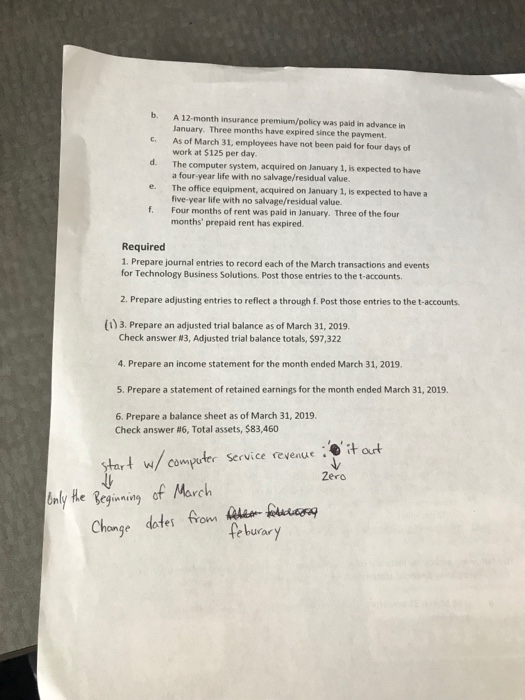

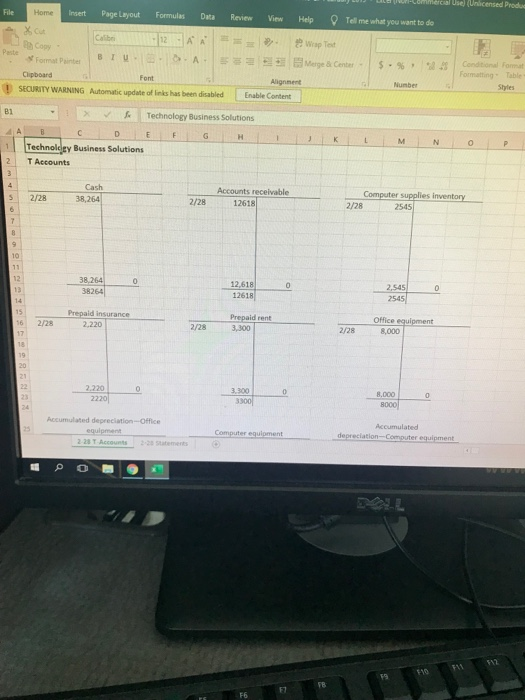

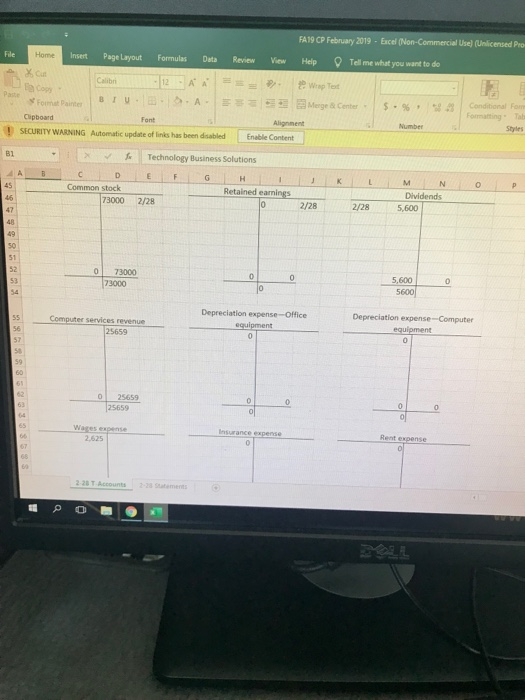

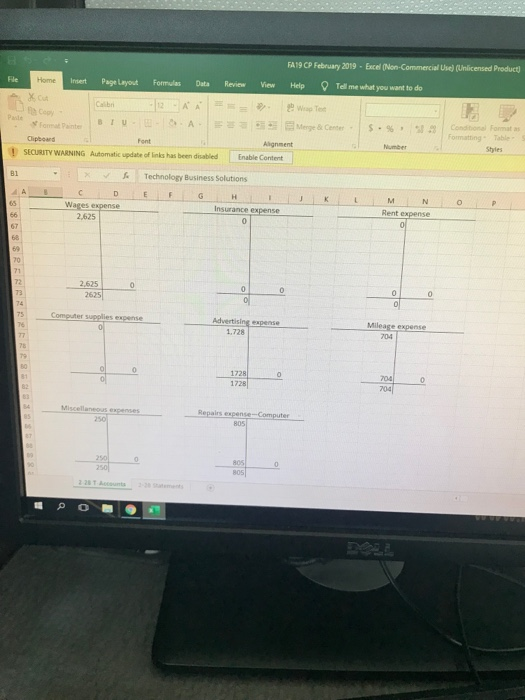

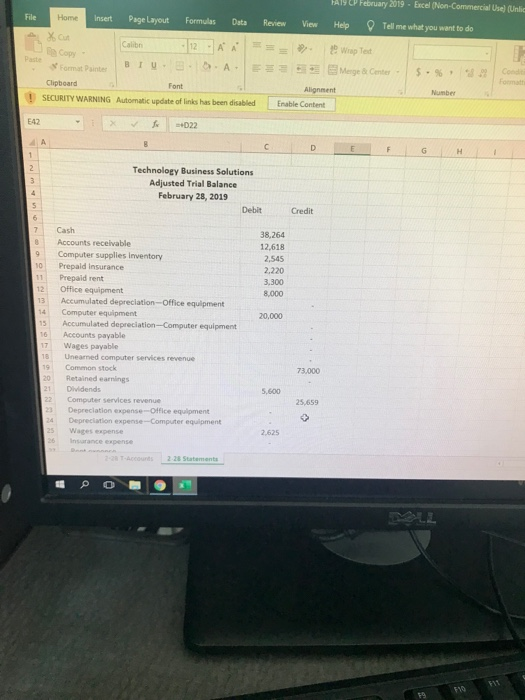

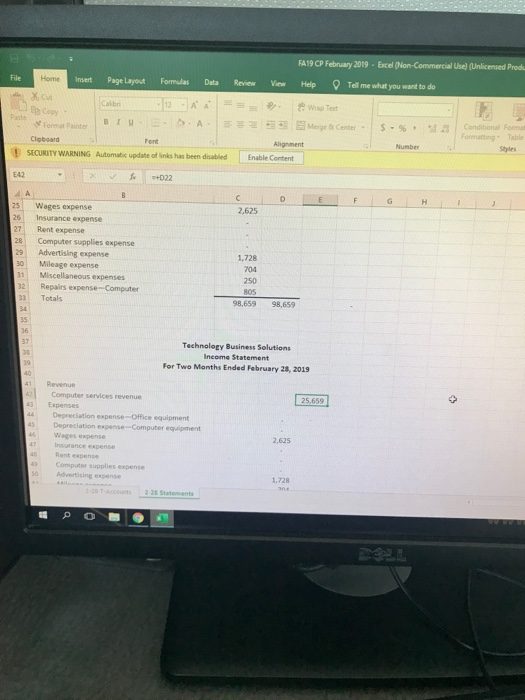

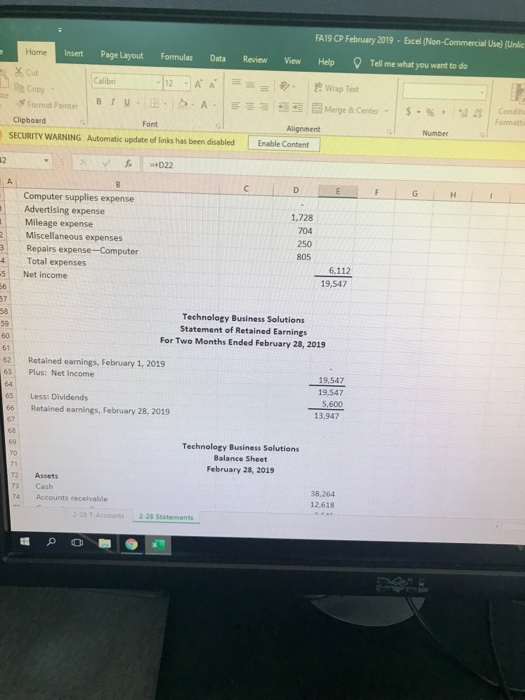

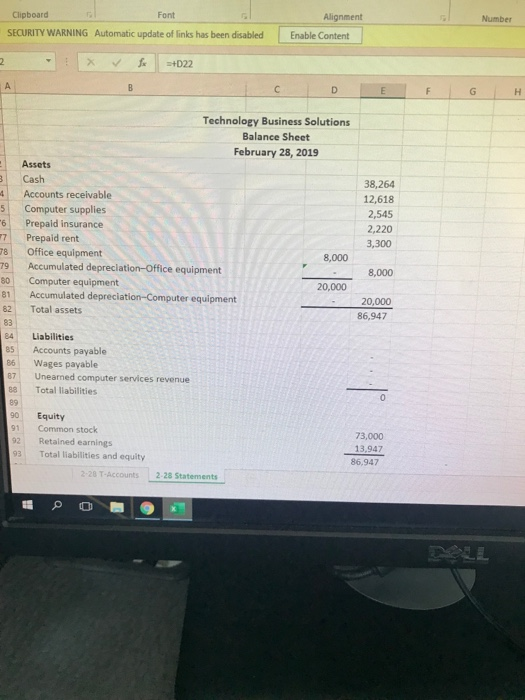

ACCT 2101 - Fall 2019 Comprehensive Problem 1 On January 1, 2019, John Smith launched a computer services company. Technology Business Solutions, that is organized as a corporation and provides consulting services, computer system installations, and custom program development. Smith adopts the calendar year for reporting purposes and expects to prepare the company's first set of financial statements on January 31, 2019. After the success of the company's first two months, John Smith continues to operate Technology Business Solutions. The February 28, 2019, trial balance and financial statements of Technology Business Solutions (reflecting its transactions for January and February of 2019) is provided. Technology Business Solutions had the following transactions and events in March 2019. NALALALALALL Mar 2 Paid $1,025 cash for Technology Business Solutions's advertising costs. 3 Paid $500 cash for minor repairs to the company's computer. 4 Received $3,950 cash from a customer for a receivable from February 10 Paid cash to employees for six days of work at the rate of $125 per day 14 Notified by a customer that Technology Business Solutions's bid of $7,000 on a proposed project has been accepted. The customer paid a $1,500 cash advance to Technology Business Solutions 15 Purchased $1,100 of computer supplies on credit 16 Sent a reminder to a customer to pay the invoice for services recorded in February. 20 Completed a project for a customer and received $5,625 cash. 28 Received $3,000 cash from a customer on its receivable. 29 Reimbursed J. Smith for business automobile mileage (600 miles at $0.32 per mile) 31 The company paid $1,500 cash for dividends. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: The March 31 inventory count of computer supplies shows $580 still available C. A 12-month insurance premium/policy was paid in advance in January. Three months have expired since the payment. As of March 31, employees have not been paid for four days of work at $125 per day. The computer system, acquired on January 1, is expected to have a four year life with no salvage/residual value. The office equipment, acquired on January 1, is expected to have a five-year life with no salvage/residual value. Four months of rent was paid in January. Three of the four months' prepaid rent has expired. e. Required 1. Prepare journal entries to record each of the March transactions and events for Technology Business Solutions. Post those entries to the t-accounts. 2. Prepare adjusting entries to reflect a through f. Post those entries to the t-accounts. (1) 3. Prepare an adjusted trial balance as of March 31, 2019 Check answer N3, Adjusted trial balance totals, $97,322 4. Prepare an income statement for the month ended March 31, 2019 5. Prepare a statement of retained earnings for the month ended March 31, 2019. 6. Prepare a balance sheet as of March 31, 2019. Check answer #6, Total assets, $83,460 0 it out Zero start w/ computer service revenue Only the Beginning of March Change dates from the flagg feburary rcial Use) (Unlicensed Produa File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to de Cut Calibr 12 A A Wrap Test h Copy Peste 8IU Fomat Painte A Merge & Center $ % Conditional Fomat Formatting Table Clipboard Font Alignment Number Styles SECURITY WARNING Automatic update of leks has been disabled Enable Content B1 Technology Business Solutions D E G MI Technology Business Solutions T Accounts Cash Accounts receivable 12618 Computer supplies inventory 2/28 2/28 38.264 2/28 2545 10 11 38,264 38264 12 C 12,618 12618 2,545 13 2545 14 15 Prepald insurance 2,220 Prepaid rent 3,300 Office equipment 16 2/28 2/28 2/28 8,000 17 18 19 20 21 2.220 3,300 8,000 23 2220 3300 8000 24 Accumulated depreciation-Office Accumulated 25 equipment Computer equipment depreciation-Computer equipment 228 T Accounts 2-28 Statemerts www.va DOLL 12 $10 FA19 CP February 2019 - Excel (Non-Commercial Use) (Unlicensed Produ Help Tell me what you want to do Home Insert Page Layout Formulas Data_Review View Merge Center BLUESA Clipboard SECURITY WABUNG Autom o de of has been disabled Enable Content Technology Business Solutions Office Accumulated depreciation equipment Accumulated depreciation Computer equipment 2/28 Computer equipment 20,000 2/28 2/28 20.000 20000 Wages payable 5.600 FA19 CP February 2019 - Excel (Non-Commercial Use) (Unlicensed Pro Home Insert Page Layout Formulas Data Review View Help Tell me what you want to de BTUA SECURITY WARNING Automatic update of links has been disabled Enable Content Technology Business Solutions F G L O Retained earnings M N Dividends 5,600 73000 2/28 2/28 0 73000 5.600 5600 73000 Depreciation expense Office Depreciation expense - Computer File Insert Page Layout Formulas FA19 CP February 2019 - Excel (Non-Commercial Use) (Unlicensed Product) H elp Tell me what you want to do Data Reviews View tonal Format Agent 1 SECURITY WARNING Automatic update of lines has been disabled Styles Enable Content Technola n a Solutions O Wages expense M N Rent expense 2.625 Advertising expense Mileage expense 250 O February 2019- Excel (Non-Commercial Use) (Unlic File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Cut 12-A A Calibn tWrap Tet Copy Paste BIU- A NFormat Painter Merge & Center $-% w.2 Conditi Formati - Clipboard Font Alignment Number SECURITY WARNING Automatic update of links has been disabled Enable Content E42 022 C D E G H Technology Business Solutions Adjusted Trial Balance February 28, 2019 Debit Credit 7 Cash 38,264 12,618 Accounts receivable Computer supples inventory 2,545 10 Prepald Insurance 2,220 Prepaid rent Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Accounts payable 11 3.300 12 8,000 13 14 20,000 15 16 17 Wages payable Unearned computer services revenue Common stock 18 19 73,000 Retained earnings 20 21 Dividends 5,600 22 Computer services revenue Depreclation expense-Office equipment Depreciation expense-Computer equipment Wages expense Insurance expense 25.659 23 24 25 2,625 26 Bent 2-28 T-Accounts 2-28 Statements OLL FIt F10 5419 Help February 2019 - Excel on-Commercial Use) (Unlicensed Prod Tell me what you want to do Insert Page Layout Formulas Data Review View BI S A Mega Center - 59 Clipboard SECURITY WARNING Automa Alignment Enable Cont t e of ink has been disabled E42 27 Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Totals 98,659 98,659 Technology Business Solutions Income Statement For Two Months Ended February 20, 2019 25.659 Revenue Computer services revenue Expenses Depreciation expense Office equipment Depreciation Computer Computer supplies expense FA19 CP February 2019 Excel (Non-Commercial Use) (Unlic Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do XCut 12A A | Calibri bWrap Text Copy te Format Painter A BIU Merge & Center FE Conditie w. Formatti Clipboard Font Alignment Number SECURITY WARNING Automatic update of links has been disabled Enable Content 2 +022 A B C E D G Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses 1,728 704 250 Repairs expense-Computer Total expenses 805 4 6.112 Net income 19,547 6 57 58 Technology Business Solutions Statement of Retained Earnings For Two Months Ended February 28, 2019 59 60 61 Retained eanings, February 1, 2019 67 Plus: Net Income 63 19,547 64 19,547 Less: Dividends 65 5,600 66 Retained earnings, February 28, 2019 13,947 67 68 69 Technology Business Solutions 70 Balance Sheet 71 February 28, 2019 Assets 72 Cash 73 38,264 Accounts receivable 74 12,618 2-20 TAccounts 2 28 Statements Alignment Clipboard Font SECURITY WARNING Automatic update of links has been disabled Number Enable Content X =+D22 LA G H Technology Business Solutions Balance Sheet February 28, 2019 Assets Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment 8,000 Accumulated depreciation-Office equipment Computer equipment 20,000 Accumulated depreciation-Computer equipment Total assets 38,264 12,618 2,545 2,220 3,300 78 79 80 81 8,000 20,000 86,947 83 BA 85 Liabilities Accounts payable Wages payable Unearned computer services revenue Total liabilities Equity Common stock Retained earnings Total liabilities and equity 2-28 T-Accounts 73,000 13.947 86.947 2.28 Statements DUE By: Thursday September 19, 2019 ACCT 2101 - Fall 2019 Comprehensive Problem 1 On January 1, 2019, John Smith launched a computer services company. Technology Business Solutions, that is organized as a corporation and provides consulting services, computer system installations, and custom program development. Smith adopts the calendar year for reporting purposes and expects to prepare the company's first set of financial statements on January 31, 2019. After the success of the company's first two months, John Smith continues to operate Technology Business Solutions. The February 28, 2019, trial balance and financial statements of Technology Business Solutions (reflecting its transactions for January and February of 2019) is provided. Technology Business Solutions had the following transactions and events in March 2019. NALALALALALL Mar 2 Paid $1,025 cash for Technology Business Solutions's advertising costs. 3 Paid $500 cash for minor repairs to the company's computer. 4 Received $3,950 cash from a customer for a receivable from February 10 Paid cash to employees for six days of work at the rate of $125 per day 14 Notified by a customer that Technology Business Solutions's bid of $7,000 on a proposed project has been accepted. The customer paid a $1,500 cash advance to Technology Business Solutions 15 Purchased $1,100 of computer supplies on credit 16 Sent a reminder to a customer to pay the invoice for services recorded in February. 20 Completed a project for a customer and received $5,625 cash. 28 Received $3,000 cash from a customer on its receivable. 29 Reimbursed J. Smith for business automobile mileage (600 miles at $0.32 per mile) 31 The company paid $1,500 cash for dividends. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: The March 31 inventory count of computer supplies shows $580 still available C. A 12-month insurance premium/policy was paid in advance in January. Three months have expired since the payment. As of March 31, employees have not been paid for four days of work at $125 per day. The computer system, acquired on January 1, is expected to have a four year life with no salvage/residual value. The office equipment, acquired on January 1, is expected to have a five-year life with no salvage/residual value. Four months of rent was paid in January. Three of the four months' prepaid rent has expired. e. Required 1. Prepare journal entries to record each of the March transactions and events for Technology Business Solutions. Post those entries to the t-accounts. 2. Prepare adjusting entries to reflect a through f. Post those entries to the t-accounts. (1) 3. Prepare an adjusted trial balance as of March 31, 2019 Check answer N3, Adjusted trial balance totals, $97,322 4. Prepare an income statement for the month ended March 31, 2019 5. Prepare a statement of retained earnings for the month ended March 31, 2019. 6. Prepare a balance sheet as of March 31, 2019. Check answer #6, Total assets, $83,460 0 it out Zero start w/ computer service revenue Only the Beginning of March Change dates from the flagg feburary rcial Use) (Unlicensed Produa File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to de Cut Calibr 12 A A Wrap Test h Copy Peste 8IU Fomat Painte A Merge & Center $ % Conditional Fomat Formatting Table Clipboard Font Alignment Number Styles SECURITY WARNING Automatic update of leks has been disabled Enable Content B1 Technology Business Solutions D E G MI Technology Business Solutions T Accounts Cash Accounts receivable 12618 Computer supplies inventory 2/28 2/28 38.264 2/28 2545 10 11 38,264 38264 12 C 12,618 12618 2,545 13 2545 14 15 Prepald insurance 2,220 Prepaid rent 3,300 Office equipment 16 2/28 2/28 2/28 8,000 17 18 19 20 21 2.220 3,300 8,000 23 2220 3300 8000 24 Accumulated depreciation-Office Accumulated 25 equipment Computer equipment depreciation-Computer equipment 228 T Accounts 2-28 Statemerts www.va DOLL 12 $10 FA19 CP February 2019 - Excel (Non-Commercial Use) (Unlicensed Produ Help Tell me what you want to do Home Insert Page Layout Formulas Data_Review View Merge Center BLUESA Clipboard SECURITY WABUNG Autom o de of has been disabled Enable Content Technology Business Solutions Office Accumulated depreciation equipment Accumulated depreciation Computer equipment 2/28 Computer equipment 20,000 2/28 2/28 20.000 20000 Wages payable 5.600 FA19 CP February 2019 - Excel (Non-Commercial Use) (Unlicensed Pro Home Insert Page Layout Formulas Data Review View Help Tell me what you want to de BTUA SECURITY WARNING Automatic update of links has been disabled Enable Content Technology Business Solutions F G L O Retained earnings M N Dividends 5,600 73000 2/28 2/28 0 73000 5.600 5600 73000 Depreciation expense Office Depreciation expense - Computer File Insert Page Layout Formulas FA19 CP February 2019 - Excel (Non-Commercial Use) (Unlicensed Product) H elp Tell me what you want to do Data Reviews View tonal Format Agent 1 SECURITY WARNING Automatic update of lines has been disabled Styles Enable Content Technola n a Solutions O Wages expense M N Rent expense 2.625 Advertising expense Mileage expense 250 O February 2019- Excel (Non-Commercial Use) (Unlic File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Cut 12-A A Calibn tWrap Tet Copy Paste BIU- A NFormat Painter Merge & Center $-% w.2 Conditi Formati - Clipboard Font Alignment Number SECURITY WARNING Automatic update of links has been disabled Enable Content E42 022 C D E G H Technology Business Solutions Adjusted Trial Balance February 28, 2019 Debit Credit 7 Cash 38,264 12,618 Accounts receivable Computer supples inventory 2,545 10 Prepald Insurance 2,220 Prepaid rent Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Accounts payable 11 3.300 12 8,000 13 14 20,000 15 16 17 Wages payable Unearned computer services revenue Common stock 18 19 73,000 Retained earnings 20 21 Dividends 5,600 22 Computer services revenue Depreclation expense-Office equipment Depreciation expense-Computer equipment Wages expense Insurance expense 25.659 23 24 25 2,625 26 Bent 2-28 T-Accounts 2-28 Statements OLL FIt F10 5419 Help February 2019 - Excel on-Commercial Use) (Unlicensed Prod Tell me what you want to do Insert Page Layout Formulas Data Review View BI S A Mega Center - 59 Clipboard SECURITY WARNING Automa Alignment Enable Cont t e of ink has been disabled E42 27 Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Totals 98,659 98,659 Technology Business Solutions Income Statement For Two Months Ended February 20, 2019 25.659 Revenue Computer services revenue Expenses Depreciation expense Office equipment Depreciation Computer Computer supplies expense FA19 CP February 2019 Excel (Non-Commercial Use) (Unlic Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do XCut 12A A | Calibri bWrap Text Copy te Format Painter A BIU Merge & Center FE Conditie w. Formatti Clipboard Font Alignment Number SECURITY WARNING Automatic update of links has been disabled Enable Content 2 +022 A B C E D G Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses 1,728 704 250 Repairs expense-Computer Total expenses 805 4 6.112 Net income 19,547 6 57 58 Technology Business Solutions Statement of Retained Earnings For Two Months Ended February 28, 2019 59 60 61 Retained eanings, February 1, 2019 67 Plus: Net Income 63 19,547 64 19,547 Less: Dividends 65 5,600 66 Retained earnings, February 28, 2019 13,947 67 68 69 Technology Business Solutions 70 Balance Sheet 71 February 28, 2019 Assets 72 Cash 73 38,264 Accounts receivable 74 12,618 2-20 TAccounts 2 28 Statements Alignment Clipboard Font SECURITY WARNING Automatic update of links has been disabled Number Enable Content X =+D22 LA G H Technology Business Solutions Balance Sheet February 28, 2019 Assets Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment 8,000 Accumulated depreciation-Office equipment Computer equipment 20,000 Accumulated depreciation-Computer equipment Total assets 38,264 12,618 2,545 2,220 3,300 78 79 80 81 8,000 20,000 86,947 83 BA 85 Liabilities Accounts payable Wages payable Unearned computer services revenue Total liabilities Equity Common stock Retained earnings Total liabilities and equity 2-28 T-Accounts 73,000 13.947 86.947 2.28 Statements DUE By: Thursday September 19, 2019 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started