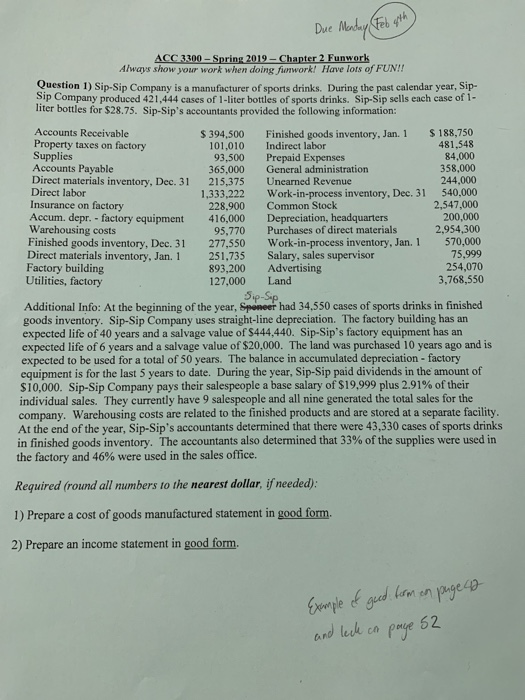

Due ed ACC 3300-Spring 2019-Chapter 2 Funwork Always show your work when doing fnwork! Have lots of FUN!! Question 1) Sip-Sip Company is a manufacturer of sports drinks. During the past calendar year, Sip- Sip Company produced 421,444 cases of 1-liter bottles of sports drinks. Sip-Sip sells each case of 1- liter bottles for $28.75. Sip-Sip's accountants provided the following information: Accounts Receivable Property taxes on factory Supplies Accounts Payable Direct materials inventory, Dec. 31 215,375 Direct labor Insurance on factory $ 394,500 Finished goods inventory, Jan. 1 188,750 101,010 Indirect labor 93,500 Prepaid Expenses 365,000 General administration 481,548 84,000 358,000 244.000 1,333,222 Work-in-process inventory, Dec. 31 540,000 Unearned Revenue Accum. depr. - factory equipment Warehousing costs Finished goods inventory, Dec. 31 Direct materials inventory, Jan. 1 Factory building Utilities, factory 228,900 Common Stock 416,000 95,770 277,550 251,735 893,200 Advertising Depreciation, headquarters Purchases of direct materials Work-in-process inventory, Jan. 1 Salary, sales supervisor 2,547,000 200,000 2,954,300 570,000 75,999 254,070 3,768,550 127,000 Land Additional Info: At the beginning of the year, Sponeer had 34,550 cases of sports drinks in finished expected life of 6 years and a salvage value of $20,000. The land was purchased 10 years ago and is equipment is for the last 5 years to date. During the year, Sip-Sip paid dividends in the amount of Sip-Sip goods inventory. Sip-Sip Company uses straight-line depreciation. The factory building has an expected life of 40 years and a salvage value of $444,440. Sip-Sip's factory equipment has an expected to be used for a total of 50 years. The balance in accumulated depreciation - factory $10,000. Sip-Sip Company pays their salespeople a base salary of $19,999 plus 2.91% of their individual sales. They currently have 9 salespeople and all nine generated the total sales for the company. Warehousing costs are related to the finished products and are stored at a separate facility. At the end of the year, Sip-Sip's accountants determined that there were 43,330 cases of sports drinks in finished goods inventory. The accountants also determined that 33% of the supplies were used in the factory and 46% were used in the sales office. Required (round all numbers to the nearest dollar, if needed): 1) Prepare a cost of goods manufactured statement in good form. 2) Prepare an income statement in good form Pve 52