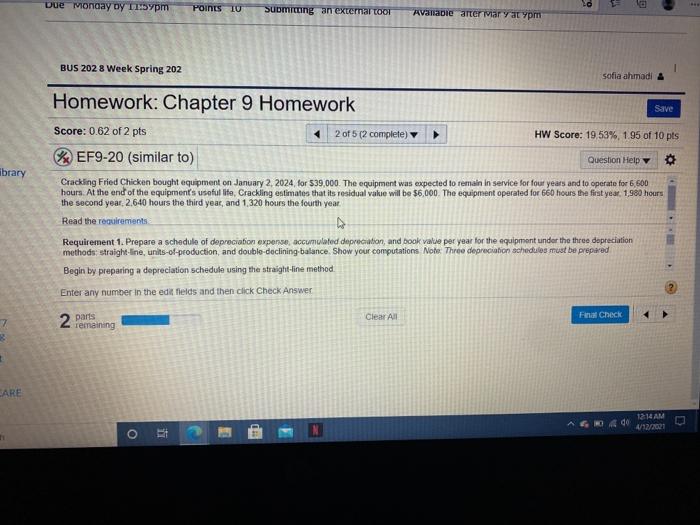

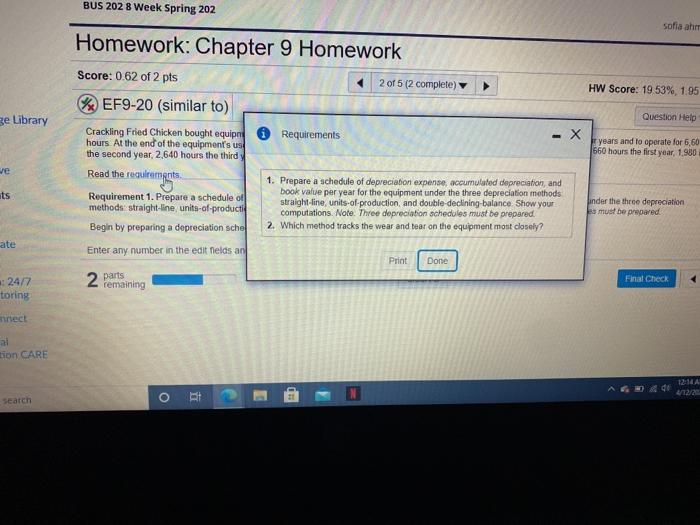

Due Monday Dy 11:5pm POINTS IU Submitting an extcmar tool Avanale arter Mary atypm BUS 202 8 Week Spring 202 sofia ahmadi A ibrary Homework: Chapter 9 Homework Save Score: 0.62 of 2 pts 2 of 5 (2 complete) HW Score: 19.53%, 1 95 of 10 pts EF9-20 (similar to) Question Help Cracking Fried Chicken bought equipment on January 2, 2024, for 539,000. The equipment was expected to remain in service for four years and to operate for 6,500 hours. At the end of the equipment's useful lite, Crackling estimates that its residual value will be $6,000. The equipment operated for 660 hours the first year 1980 hours the second year 2.640 hours the third year, and 1,320 hours the fourth year. Read the requirements Requirement 1. Prepare a schedule of depreciation expense accumulated depreciation, and book vale per year for the equipment under the three depreciation methods: straight-line, units-of-production, and double-declining balance. Show your computations Note: Three depreciation schedules must be prepared Begin by preparing a depreciation schedule using the straight-line method Enter any number in the edit Melds and then click Check Answer Clear All Final Check 2 parts remaining SARE 12:14 AM 4/12/2021 dh LE o BUS 202 8 Week Spring 202 sofia ah Homework: Chapter 9 Homework HW Score: 19 53%, 1.95 ge Library Question Help years and to operate for 5,60 660 hours the first year, 1.980 Score: 0.62 of 2 pts 2 of 5 (2 complete) % EF9-20 (similar to) Crackling Fried Chicken bought equipe Requirements hours. At the end of the equipment's us the second year, 2,640 hours the third Read the requirements 1. Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciation methods Requirement 1. Prepare a schedule of straight-line, units of production, and double-declining balance. Show your methods straight-line units-of-productie computations. Note. Three depreciation schedules must be prepared Begin by preparing a depreciation sche 2. Which method tracks the wear and tear on the equipment molt closely? Enter any number in the edit hields an Print Done ve ts under the three depreciation es must be prepared 24/7 2 parts remaining Final Check toring rect tion CARE a de o Search RE