Answered step by step

Verified Expert Solution

Question

1 Approved Answer

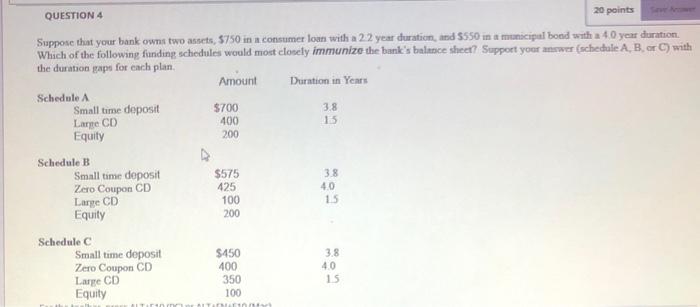

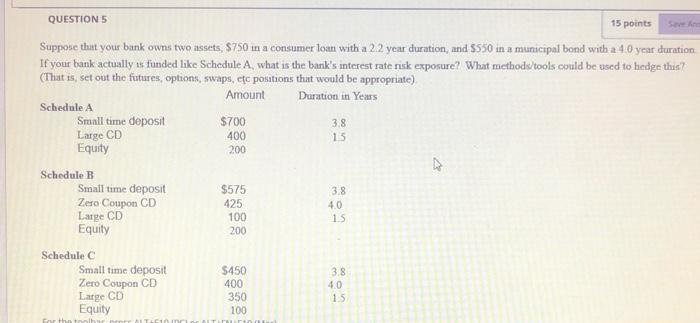

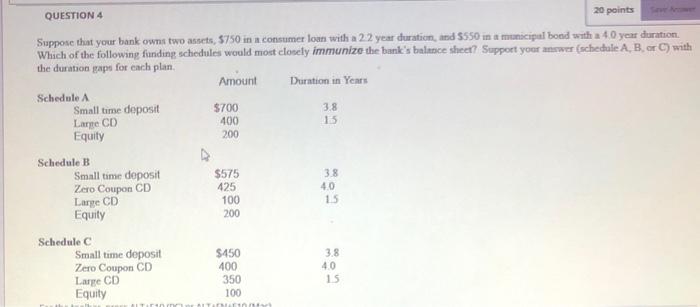

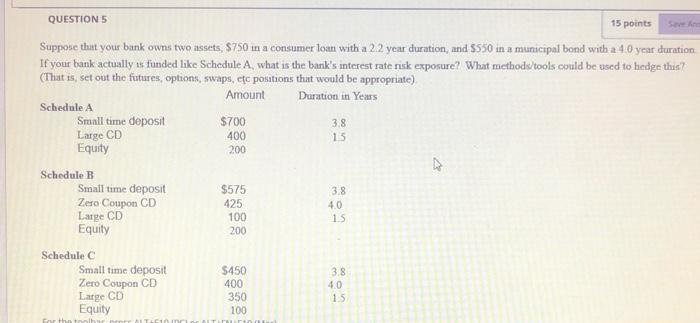

due soon!! please help! show work!! QUESTION 4 20 points Suppose that your bank owns two assets, 5750 in a consumer loan with a 22

due soon!! please help! show work!!

QUESTION 4 20 points Suppose that your bank owns two assets, 5750 in a consumer loan with a 22 year duration, and $550 in a municipal bond with a 40 year duration Which of the following funding schedules would most closely immunize the bank's balance sheet? Support your answer (schedule A, B, C) with the duration graps for each plan Amount Duration in Years Schedule A Smalltime deposit $700 3.8 Large CD 400 15 Equity 200 Schedule B Small time deposit Zero Coupon CD Large CD Equity $575 425 100 200 3.8 4.0 15 38 Schedule C Small time deposit Zero Coupon CD Large CD Equity 4.0 $450 400 350 100 15 SA QUESTIONS 15 points Suppose that your bank owns two assets. $750 in a consumer loan with a 2.2 year duration, and $550 in a municipal bond with a 40 year duration If your bank actually is funded like Schedule A, what is the bank's interest rate risk exposure? What methods/tools could be used to hedge this? (That is, set out the futures, options, swaps, etc positions that would be appropriate) Amount Duration in Years Schedule Small time deposit $700 3.8 Large CD 400 15 Equity 200 Schedule B Smalltime deposit Zero Coupon CD Large CD Equity $575 425 100 200 38 40 15 Schedule C Smalltime deposit Zero Coupon CD Large CD Equity $450 400 350 100 3.8 4.0 15 For the Discuss briefly how securities with embedded options affect mearuing interest rate risk and thus using the GAP and DGAP models For the toolbar, press ALT+F10 (P) or ALT+FN+F10 (Mac). BI VS Paragraph Arial 10pt E A V a Does a bank with a measured interest rate risk exposure have to hedge/work to eliminate that exposure? What does it mean that bank management does not hedge an exposure? For the toolbar, press ALT F10 (PC) Or ALT+FN+F10 (Mac). BIVS Paragraph 10pt LI Arial yo QUESTION 4 20 points Suppose that your bank owns two assets, 5750 in a consumer loan with a 22 year duration, and $550 in a municipal bond with a 40 year duration Which of the following funding schedules would most closely immunize the bank's balance sheet? Support your answer (schedule A, B, C) with the duration graps for each plan Amount Duration in Years Schedule A Smalltime deposit $700 3.8 Large CD 400 15 Equity 200 Schedule B Small time deposit Zero Coupon CD Large CD Equity $575 425 100 200 3.8 4.0 15 38 Schedule C Small time deposit Zero Coupon CD Large CD Equity 4.0 $450 400 350 100 15 SA QUESTIONS 15 points Suppose that your bank owns two assets. $750 in a consumer loan with a 2.2 year duration, and $550 in a municipal bond with a 40 year duration If your bank actually is funded like Schedule A, what is the bank's interest rate risk exposure? What methods/tools could be used to hedge this? (That is, set out the futures, options, swaps, etc positions that would be appropriate) Amount Duration in Years Schedule Small time deposit $700 3.8 Large CD 400 15 Equity 200 Schedule B Smalltime deposit Zero Coupon CD Large CD Equity $575 425 100 200 38 40 15 Schedule C Smalltime deposit Zero Coupon CD Large CD Equity $450 400 350 100 3.8 4.0 15 For the Discuss briefly how securities with embedded options affect mearuing interest rate risk and thus using the GAP and DGAP models For the toolbar, press ALT+F10 (P) or ALT+FN+F10 (Mac). BI VS Paragraph Arial 10pt E A V a Does a bank with a measured interest rate risk exposure have to hedge/work to eliminate that exposure? What does it mean that bank management does not hedge an exposure? For the toolbar, press ALT F10 (PC) Or ALT+FN+F10 (Mac). BIVS Paragraph 10pt LI Arial yo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started