Question

Due to flood in the area of Kane Sdn Bhd's business, an impairment review was conducted on 31 December 2021. The recoverable amount of the

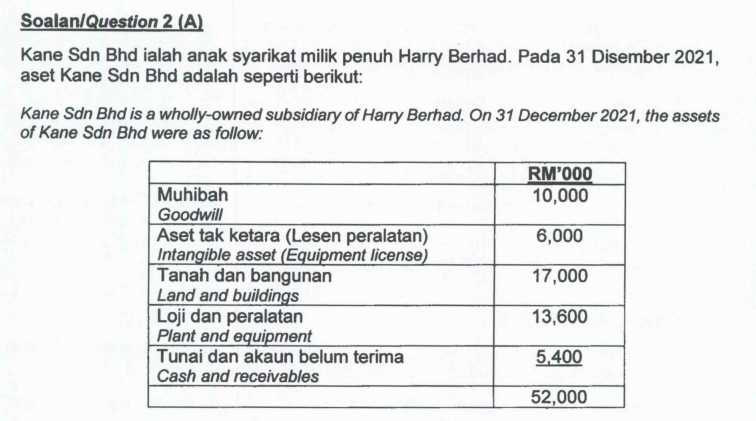

Due to flood in the area of Kane Sdn Bhd's business, an impairment review was conducted on 31 December 2021. The recoverable amount of the business was determined to be RM28 million. The flood damaged some plant and equipment with a carrying value of RM2.6 million and there was no option but to scrap it. The intangible asset consists of a license to operate Kane Sdn Bhd's equipment. Due to scrapping option of some plant and equipment, a competitor offered to purchase the license for RM3 million. The cash and receivables tile stated at their realisable values and do not require impairment reviews. \ 1.Discuss how Harry Berhad shall treat the above impairment of assets in its financial statements for the year ended 31 December 2021 based on the provisions contained in MRFS 136 impairment of Assets. Justify your discussions by presenting supporting and relevant calculations. ( 10 marks) \ 2. Soalan/ Question 2(B)\ \ On 31 December 2021, Mason Berhad borrowed RM6,000,000 at 12% payable annually to finance the construction of a new building. In 2022, the company made the following expenditures related to this building: 1 March, RM720,000; 1 July, RM3,000,000; and 1 December, RM2,400,000. Additional information is provided as follows:\ \ Pada 31 December 2021, Mason Berhad meminjam RM6000, 000 pada 12% yang perlu dibayar setiap tahun untuk membiayai pembinaan bangunan Baharu. Pada 2022, Syarikat membuat perbelanjaan berikut berkaitan bangunan ini: 1 Mac, RM720, 000; 1 Jun, RM1,200,000; and 1 December, RM 2,400,000. Adiitional information is provided as follows:\ \ 1. Other general loan arrangements:\ \ a)6 year, 10% loan notes, drawn down on 31 December 2019 is \ RM8,000,000\ b) 10 year, 11% bonds, issued on 31 December 2015 RM3,200,000. \ 2. Interest revenue earned in 2022 on funds related to specific borrowing adalah RM98, 000\ \ a) Determine the amount of borrowing cost to be capitalized in 2022 in relation to the construction of the building. ( 10 marks)\ b)Prepare the journal entry to record the capitalization of borrowing costs and the recognition of interest expense, if any, at 31 December 2022. ( 5 marks\ \ \ \

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started