Question

Due to the macroeconomic factors prevailing in the Egyptian economy, Egypt Gas Corporation (EGC) has changed its inventory method from Average Cost to the FIFO

Due to the macroeconomic factors prevailing in the Egyptian economy, Egypt Gas Corporation (EGC) has changed its inventory method from Average Cost to the FIFO method in 2019. EGC started its operations in January 2017. The share capital at the start-up was $1,000,000

Required:

In line with the Retrospective Accounting Change method, develop a scenario on the effects of change from the ACM to FIFO method on income statement, balance sheet and the cashflow statement, provided that the company is operating business in the Free-zone.

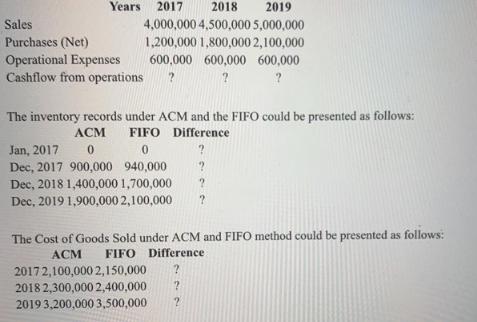

Years 2017 2018 2019 Sales Purchases (Net) Operational Expenses Cashflow from operations 4,000,000 4,500,000 5,000,000 1,200,000 1,800,000 2,100,000 600,000 600,000 600,000 ? The inventory records under ACM and the FIFO could be presented as follows: FIFO Difference Jan, 2017 Dec, 2017 900,000 940,000 Dec, 2018 1,400,000 1,700,000 Dec, 2019 1,900,000 2,100,000 ? The Cost of Goods Sold under ACM and FIFO method could be presented as follows: ACM FIFO Difference 20172,100,000 2,150,000 2018 2,300,000 2,400,000 2019 3,200,000 3,500,000

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answers 2017 2018 2019 a Sales 4000000 4500000 5000000 b Purchase 1200000 1800000 21000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started