Answered step by step

Verified Expert Solution

Question

1 Approved Answer

due tonight! please help omework Financial planning case 12-6 A Married couple with Children Address Their Life Insurance Needs Joseph and Marcia Michael of Athens,

due tonight! please help

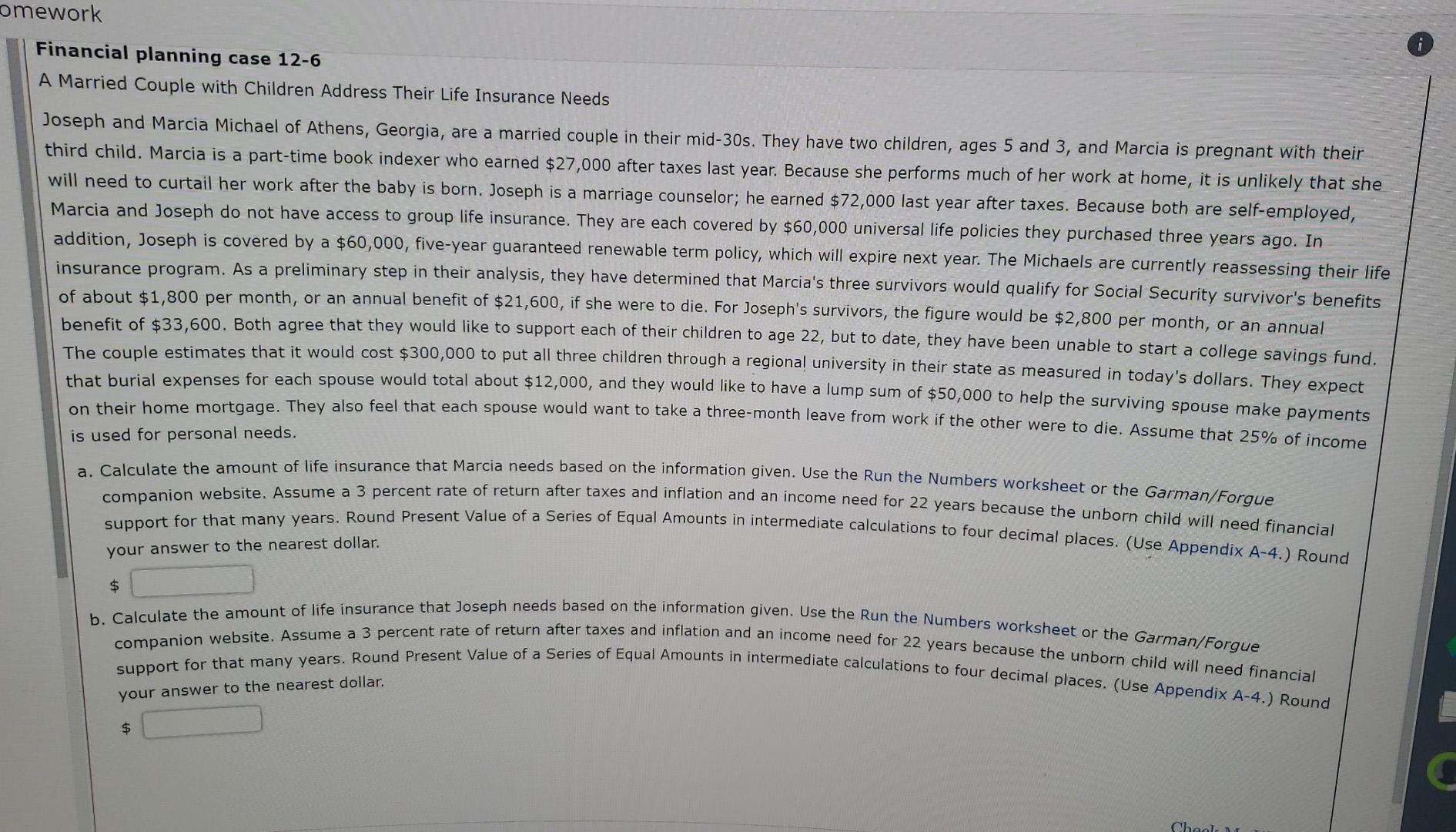

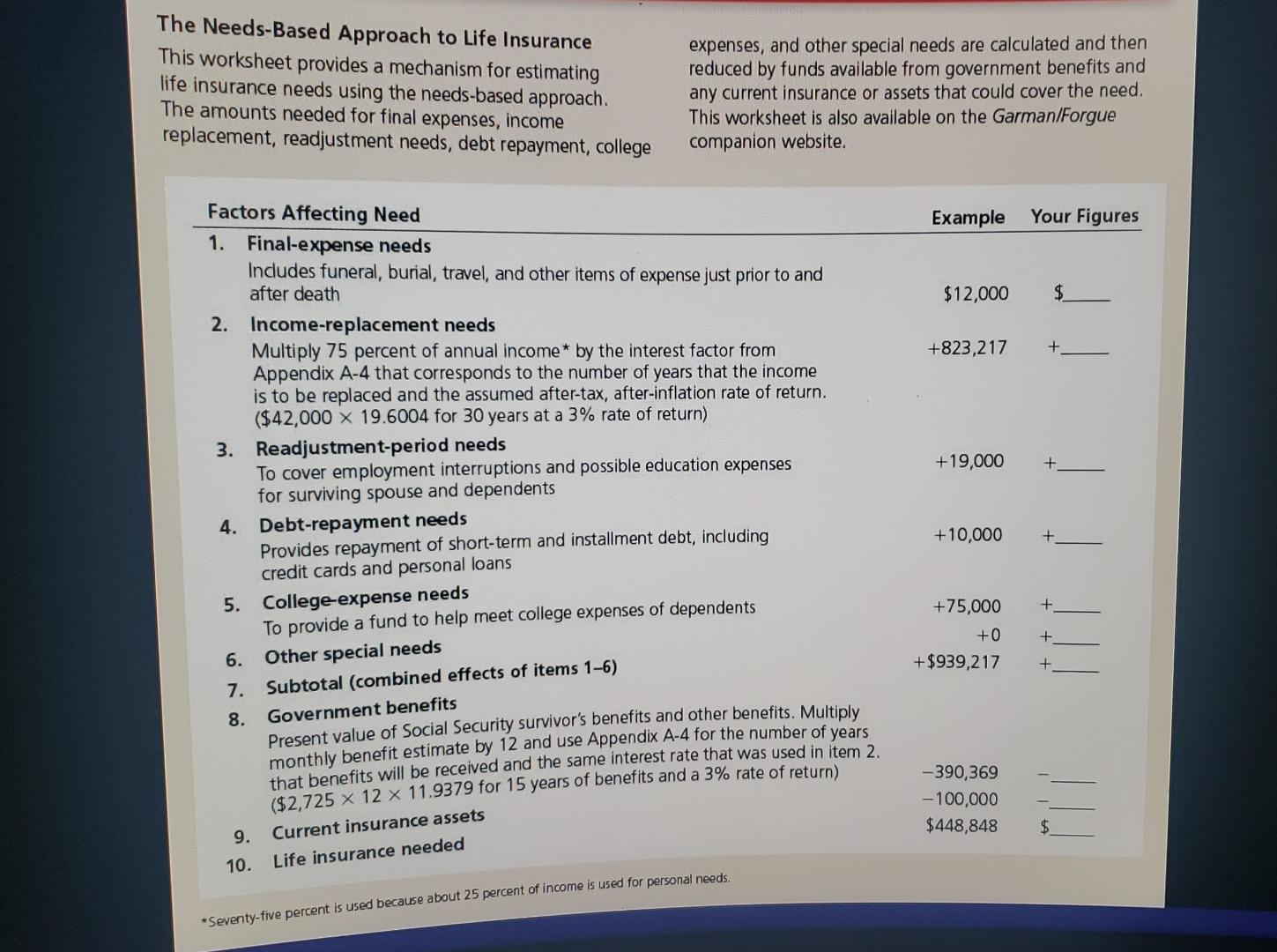

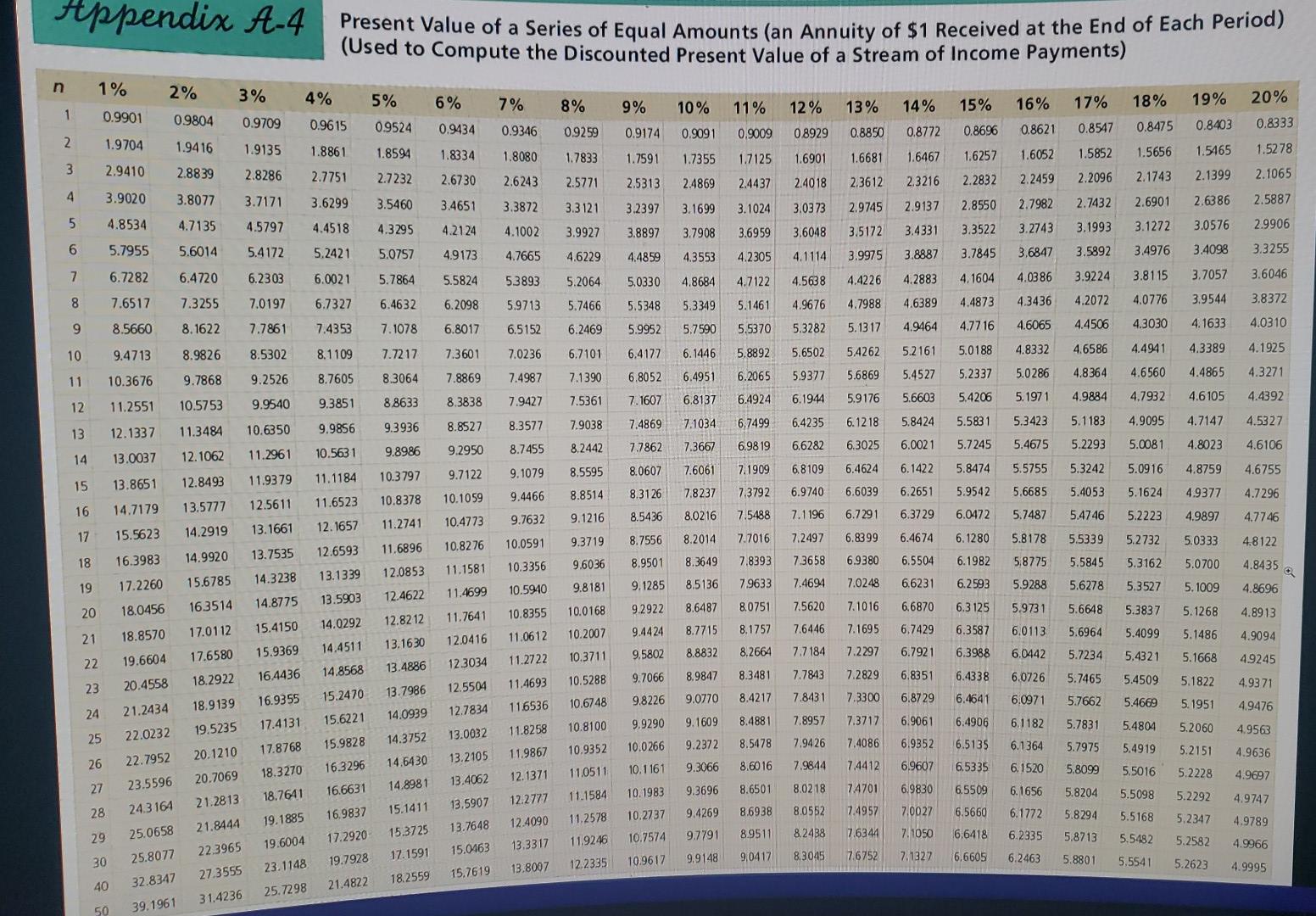

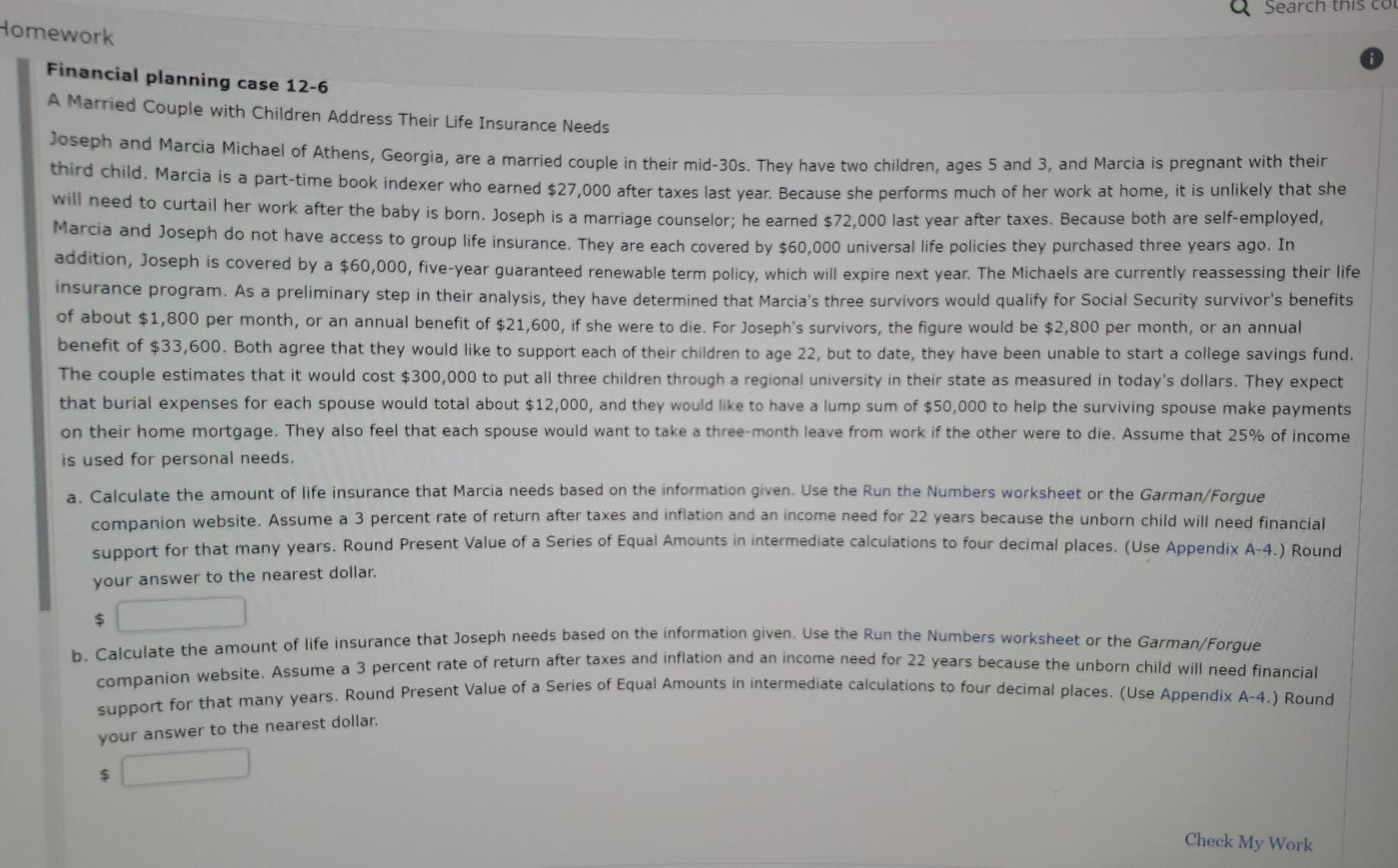

omework Financial planning case 12-6 A Married couple with Children Address Their Life Insurance Needs Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $27,000 after taxes last year. Because she performs much of her work at home, it is unlikely that she will need to curtail her work after the baby is born. Joseph is a marriage counselor; he earned $72,000 last year after taxes. Because both are self-employed, Marcia and Joseph do not have access to group life insurance. They are each covered by $60,000 universal life policies they purchased three years ago. In addition, Joseph is covered by a $60,000, five-year guaranteed renewable term policy, which will expire next year. The Michaels are currently reassessing their life insurance program. As a preliminary step in their analysis, they have determined that Marcia's three survivors would qualify for Social Security survivor's benefits of about $1,800 per month, or an annual benefit of $21,600, if she were to die. For Joseph's survivors, the figure would be $2,800 per month, or an annual benefit of $33,600. Both agree that they would like to support each of their children to age 22, but to date, they have been unable to start a college savings fund. The couple estimates that it would cost $300,000 to put all three children through a regional university in their state as measured in today's dollars. They expect that burial expenses for each spouse would total about $12,000, and they would like to have a lump sum of $50,000 to help the surviving spouse make payments on their home mortgage. They also feel that each spouse would want to take a three-month leave from work if the other were to die. Assume that 25% of income is used for personal needs. a. Calculate the amount of life insurance that Marcia needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present Value of a series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ b. Calculate the amount of life insurance that Joseph needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present Value of a Series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ Chaal The Needs-Based Approach to Life Insurance This worksheet provides a mechanism for estimating life insurance needs using the needs-based approach. The amounts needed for final expenses, income replacement, readjustment needs, debt repayment, college expenses, and other special needs are calculated and then reduced by funds available from government benefits and any current insurance or assets that could cover the need. This worksheet is also available on the Garman/Forgue companion website. Example Your Figures $12,000 $ +823,217 + +19,000 Factors Affecting Need 1. Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death 2. Income-replacement needs Multiply 75 percent of annual income* by the interest factor from Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return. ($42,000 X 19.6004 for 30 years at a 3% rate of return) 3. Readjustment-period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including credit cards and personal loans 5. College-expense needs To provide a fund to help meet college expenses of dependents 6. Other special needs 7. Subtotal (combined effects of items 1-6) 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will received and the same interest rate that was used in item 2. ($2,725 x 12 x 11.9379 for 15 years of benefits and a 3% rate of return) Current insurance assets Life insurance needed +10,000 + +75,000 +0 +$939,217 + + -390,369 -100,000 $448,848 $ 9. 10. *Seventy-five percent is used because about 25 percent of income is used for personal needs. Appendix A-4 Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period) (Used to compute the Discounted Present Value of a Stream of Income Payments) n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 20% 12% 13% 14% 15% 16% 17% 18% 19% 1 0.9901 09804 0.9709 0.9615 09524 0.9434 0.9346 0.9259 0.9174 0.8333 0.9091 0.9009 0.8403 08929 0.8850 0.8772 0.8696 0.8621 0.8547 0.8475 2 1.9704 1.9416 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.5278 1.7591 1.5465 1.7355 1.7125 1.6901 1.6681 1.6467 1.6257 1.6052 3 2.9410 2.8839 1.5852 2.2096 1.5656 2.1743 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.1065 2.4869 2.4437 2.4018 2.3612 2.1399 2.3216 2.2832 2.2459 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 2.5887 3.1024 3.0373 2.9745 2.9137 2.8550 2.7982 2.7432 2.6386 2.6901 5 4.8534 4.7135 4.5797 4.4518 4.3295 4.2124 3.9927 4.1002 3.8897 3.7908 3.1272 3.0576 3.4331 3.6959 2.9906 3.3522 3.6048 3.2743 3.1993 3.5172 3.9975 6 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.3255 3.8887 3.4098 3.7845 3.6847 3.5892 3.4976 7 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 53893 5.2064 5.0330 3.7057 4.8684 3.6046 4.7122 4.5638 4.2883 4.4226 4.1604 4.0386 3.9224 3.8115 4.0776 8 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.7466 5.3349 5.5348 4.9676 4.7988 4.6389 4.4873 4.3436 3.9544 4.2072 3.8372 5.9713 6.5152 5.1461 5.5370 9 8.5660 8.1622 7.7861 7.4353 6.8017 6.2469 5.9952 5.7590 5.3282 4.0310 5.1317 4.9464 4.7716 4.6065 4.3030 4.4506 4.1633 7.1078 7.7217 7.3601 10 9.4713 8.1109 7.0236 8.9826 8.5302 6.4177 6.1446 5.8892 4.8332 4.6586 5.6502 6.7101 54262 4.4941 4.3389 5.2161 5.0188 4.1925 8.3064 9.2526 7.8869 11 8.7605 7.4987 7.1390 9.7868 6.8052 6.4951 6.2065 5.6869 5.9377 10.3676 5.2337 5.4527 5.0286 4.6560 4.8364 4.4865 4.3271 7.9427 7.5361 88633 6.8137 9.9540 8.3838 7.1607 6.4924 6.1944 5.6603 9.3851 5.9176 10.5753 5.1971 4.7932 12 11.2551 5.4206 4.9884 4.6105 4.4392 8.3577 9.3936 7.9038 7.1034 7.4869 6.7499 6.4235 6.12 18 5.8424 5.5831 5.3423 8.8527 5.1183 4.7147 4.5327 10.6350 9.9856 13 12.1337 11.3484 4.9095 5.0081 8.7455 7.7862 9.2950 8.2442 7.3667 6.98 19 6.6282 6.3025 6.0021 5.7245 9.8986 5.4675 5.2293 4.8023 4.6106 14 12.1062 11.2961 10.5631 13.0037 6.8109 9.1079 8.5595 8.0607 6.4624 6.1422 5.8474 5.5755 5.3242 5.0916 9.7122 4.8759 10.3797 11.1184 4.6755 11.9379 15 13.8651 12.8493 13.5777 7.6061 7.8237 7.1909 7.3792 8.8514 8.3126 9.4466 6.9740 6.6039 6.2651 5.9542 5.6685 5.4053 10.1059 5.1624 4.9377 4.7296 11.6523 10.8378 12.5611 16 14.7179 9.7632 9.1216 8.5436 8.0216 7.5488 7.1196 6.7291 6.3729 10.4773 6.0472 5.7487 5.4746 5.2223 4.9897 11.2741 4.7746 12.1657 13.1661 17 15.5623 14.2919 9.3719 8.2014 7.7016 7.2497 6.8399 6.4674 10.0591 6.1280 5.8178 5.5339 5.2732 5.0333 4.8122 11.6896 12.6593 18 16.3983 14.9920 13.7535 9.6036 8.7556 8.9501 9.1285 10.3356 8.3649 73658 6.9380 6.1982 58775 5.5845 10.8276 11.1581 11.4699 5.3162 5.0700 12.0853 13.1339 7.8393 7.9633 4.8435 6.5504 6.6231 14.3238 19 17.2260 15.6785 9.8181 8.5136 7.4694 7.0248 6.2593 10.5940 5.9288 5.6278 5.3527 5.1009 4.8696 12.4622 13.5903 14.8775 163514 18.0456 20 10.0168 9.2922 8.6487 7.5620 7.1016 10.8355 8.0751 6.6870 5.9731 5.6648 5.3837 5.1268 4.8913 14.0292 12.8212 6.3125 6.3587 17.0112 11.7641 12.0416 8.7715 9.4424 8.1757 7.6446 18.8570 10.2007 7.1695 6.7429 11.0612 21 6.0113 15.4150 15.9369 5.6964 5.4099 5.1486 4.9094 14.4511 13.1630 17.6580 10.3711 8.8832 8.2664 7.7184 7.2297 6.7921 6.3988 6.0442 19.6604 22 11.2722 5.4321 12.3034 49245 13.4886 14,8568 9.5802 9.7066 5.7234 5.7465 16.4436 18.2922 7.7843 8.9847 8.3481 7.2829 5.1668 5.1822 11.4693 20.4558 5.4509 23 6.8351 6.8729 4.9371 13.7986 6.4338 6.4641 10.5288 10.6748 6.0726 6.0971 12.5504 12.7834 15.2470 16.9355 9.0770 9.8226 8.4217 18.9139 7.8431 7.3300 116536 5.7662 5.4669 5.1951 4.9476 24 21.2434 15.6221 14.0939 17.4131 7.3717 9.1609 9.9290 10.8100 6.9061 19.5235 22.0232 8.4881 8.5478 5.2060 13.0032 7.8957 7.9426 25 6.4906 6.5135 4.9563 11.8258 11.9867 15.9828 7.4086 5.7831 5.7975 14.3752 14.6430 17.8768 5.4804 5.4919 20.1210 6.1182 6.1364 6.1520 5.2151 13.2105 9.2372 9.3066 4.9636 10.0266 10.1161 10.9352 11.0511 26 16.3296 8.60 16 7.9844 18.3270 7.4412 5.8099 5.5016 12.1371 5.2228 20.7069 22.7952 23.5596 24.3164 4.9697 6.5335 6.5509 13.4062 27 14.8981 16.6631 8.6501 8,0218 74701 6.9852 6.9607 6.9830 7.0027 7. 1050 6.1656 18.7641 5.8204 21.2813 11.1584 12.2777 5.5098 5.2292 4.9747 13.5907 28 15.1411 9.3696 9.4269 9.7791 8.6938 10.1983 10.2737 10.7574 8.0552 6.5660 19.1885 6.1772 5.8294 16.9837 17.2920 12.4090 5.5168 21.8444 5.2347 7.4957 7.6344 13.7648 11.2578 11.9246 4.9789 29 25.0658 15.3725 8.9511 8.2438 6.2335 5.8713 19.6004 5.5482 22.3965 13.3317 4.9966 66418 6,6605 15.0163 17.1591 25.8077 19.7928 5.2582 5.2623 30 9,0417 83045 10.9617 9.9148 7.6752 7.1327 6.2463 23.1148 12.2335 5.8801 13.8007 5.5541 4.9995 27.3555 15.7619 32.8347 40 18.2559 25.7298 21.4822 31.4236 50 39.1961 Q Search this COL Homework Financial planning case 12-6 A Married couple with Children Address Their Life Insurance Needs Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $27,000 after taxes last year. Because she performs much of her work at home, it is unlikely that she will need to curtail her work after the baby is born. Joseph is a marriage counselor; he earned $72,000 last year after taxes. Because both are self-employed, Marcia and Joseph do not have access to group life insurance. They are each covered by $60,000 universal life policies they purchased three years ago. In addition, Joseph is covered by a $60,000, five-year guaranteed renewable term policy, which will expire next year. The Michaels are currently reassessing their life insurance program. As a preliminary step in their analysis, they have determined that Marcia's three survivors would qualify for Social Security survivor's benefits of about $1,800 per month, or an annual benefit of $21,600, if she were to die. For Joseph's survivors, the figure would be $2,800 per month, or an annual benefit of $33,600. Both agree that they would like to support each of their children to age 22, but to date, they have been unable to start a college savings fund. The couple estimates that it would cost $300,000 to put all three children through a regional university in their state as measured in today's dollars. They expect that burial expenses for each spouse would total about $12,000, and they would like to have a lump sum of $50,000 to help the surviving spouse make payments on their home mortgage. They also feel that each spouse would want to take a three-month leave from work if the other were to die. Assume that 25% of income is used for personal needs. a. Calculate the amount of life insurance that Marcia needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years, Round Present Value of a series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ b. Calculate the amount of life insurance that Joseph needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present Value of a Series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ Check My Work omework Financial planning case 12-6 A Married couple with Children Address Their Life Insurance Needs Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $27,000 after taxes last year. Because she performs much of her work at home, it is unlikely that she will need to curtail her work after the baby is born. Joseph is a marriage counselor; he earned $72,000 last year after taxes. Because both are self-employed, Marcia and Joseph do not have access to group life insurance. They are each covered by $60,000 universal life policies they purchased three years ago. In addition, Joseph is covered by a $60,000, five-year guaranteed renewable term policy, which will expire next year. The Michaels are currently reassessing their life insurance program. As a preliminary step in their analysis, they have determined that Marcia's three survivors would qualify for Social Security survivor's benefits of about $1,800 per month, or an annual benefit of $21,600, if she were to die. For Joseph's survivors, the figure would be $2,800 per month, or an annual benefit of $33,600. Both agree that they would like to support each of their children to age 22, but to date, they have been unable to start a college savings fund. The couple estimates that it would cost $300,000 to put all three children through a regional university in their state as measured in today's dollars. They expect that burial expenses for each spouse would total about $12,000, and they would like to have a lump sum of $50,000 to help the surviving spouse make payments on their home mortgage. They also feel that each spouse would want to take a three-month leave from work if the other were to die. Assume that 25% of income is used for personal needs. a. Calculate the amount of life insurance that Marcia needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present Value of a series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ b. Calculate the amount of life insurance that Joseph needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present Value of a Series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ Chaal The Needs-Based Approach to Life Insurance This worksheet provides a mechanism for estimating life insurance needs using the needs-based approach. The amounts needed for final expenses, income replacement, readjustment needs, debt repayment, college expenses, and other special needs are calculated and then reduced by funds available from government benefits and any current insurance or assets that could cover the need. This worksheet is also available on the Garman/Forgue companion website. Example Your Figures $12,000 $ +823,217 + +19,000 Factors Affecting Need 1. Final-expense needs Includes funeral, burial, travel, and other items of expense just prior to and after death 2. Income-replacement needs Multiply 75 percent of annual income* by the interest factor from Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return. ($42,000 X 19.6004 for 30 years at a 3% rate of return) 3. Readjustment-period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including credit cards and personal loans 5. College-expense needs To provide a fund to help meet college expenses of dependents 6. Other special needs 7. Subtotal (combined effects of items 1-6) 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will received and the same interest rate that was used in item 2. ($2,725 x 12 x 11.9379 for 15 years of benefits and a 3% rate of return) Current insurance assets Life insurance needed +10,000 + +75,000 +0 +$939,217 + + -390,369 -100,000 $448,848 $ 9. 10. *Seventy-five percent is used because about 25 percent of income is used for personal needs. Appendix A-4 Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period) (Used to compute the Discounted Present Value of a Stream of Income Payments) n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 20% 12% 13% 14% 15% 16% 17% 18% 19% 1 0.9901 09804 0.9709 0.9615 09524 0.9434 0.9346 0.9259 0.9174 0.8333 0.9091 0.9009 0.8403 08929 0.8850 0.8772 0.8696 0.8621 0.8547 0.8475 2 1.9704 1.9416 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.5278 1.7591 1.5465 1.7355 1.7125 1.6901 1.6681 1.6467 1.6257 1.6052 3 2.9410 2.8839 1.5852 2.2096 1.5656 2.1743 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.1065 2.4869 2.4437 2.4018 2.3612 2.1399 2.3216 2.2832 2.2459 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 2.5887 3.1024 3.0373 2.9745 2.9137 2.8550 2.7982 2.7432 2.6386 2.6901 5 4.8534 4.7135 4.5797 4.4518 4.3295 4.2124 3.9927 4.1002 3.8897 3.7908 3.1272 3.0576 3.4331 3.6959 2.9906 3.3522 3.6048 3.2743 3.1993 3.5172 3.9975 6 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.3255 3.8887 3.4098 3.7845 3.6847 3.5892 3.4976 7 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 53893 5.2064 5.0330 3.7057 4.8684 3.6046 4.7122 4.5638 4.2883 4.4226 4.1604 4.0386 3.9224 3.8115 4.0776 8 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.7466 5.3349 5.5348 4.9676 4.7988 4.6389 4.4873 4.3436 3.9544 4.2072 3.8372 5.9713 6.5152 5.1461 5.5370 9 8.5660 8.1622 7.7861 7.4353 6.8017 6.2469 5.9952 5.7590 5.3282 4.0310 5.1317 4.9464 4.7716 4.6065 4.3030 4.4506 4.1633 7.1078 7.7217 7.3601 10 9.4713 8.1109 7.0236 8.9826 8.5302 6.4177 6.1446 5.8892 4.8332 4.6586 5.6502 6.7101 54262 4.4941 4.3389 5.2161 5.0188 4.1925 8.3064 9.2526 7.8869 11 8.7605 7.4987 7.1390 9.7868 6.8052 6.4951 6.2065 5.6869 5.9377 10.3676 5.2337 5.4527 5.0286 4.6560 4.8364 4.4865 4.3271 7.9427 7.5361 88633 6.8137 9.9540 8.3838 7.1607 6.4924 6.1944 5.6603 9.3851 5.9176 10.5753 5.1971 4.7932 12 11.2551 5.4206 4.9884 4.6105 4.4392 8.3577 9.3936 7.9038 7.1034 7.4869 6.7499 6.4235 6.12 18 5.8424 5.5831 5.3423 8.8527 5.1183 4.7147 4.5327 10.6350 9.9856 13 12.1337 11.3484 4.9095 5.0081 8.7455 7.7862 9.2950 8.2442 7.3667 6.98 19 6.6282 6.3025 6.0021 5.7245 9.8986 5.4675 5.2293 4.8023 4.6106 14 12.1062 11.2961 10.5631 13.0037 6.8109 9.1079 8.5595 8.0607 6.4624 6.1422 5.8474 5.5755 5.3242 5.0916 9.7122 4.8759 10.3797 11.1184 4.6755 11.9379 15 13.8651 12.8493 13.5777 7.6061 7.8237 7.1909 7.3792 8.8514 8.3126 9.4466 6.9740 6.6039 6.2651 5.9542 5.6685 5.4053 10.1059 5.1624 4.9377 4.7296 11.6523 10.8378 12.5611 16 14.7179 9.7632 9.1216 8.5436 8.0216 7.5488 7.1196 6.7291 6.3729 10.4773 6.0472 5.7487 5.4746 5.2223 4.9897 11.2741 4.7746 12.1657 13.1661 17 15.5623 14.2919 9.3719 8.2014 7.7016 7.2497 6.8399 6.4674 10.0591 6.1280 5.8178 5.5339 5.2732 5.0333 4.8122 11.6896 12.6593 18 16.3983 14.9920 13.7535 9.6036 8.7556 8.9501 9.1285 10.3356 8.3649 73658 6.9380 6.1982 58775 5.5845 10.8276 11.1581 11.4699 5.3162 5.0700 12.0853 13.1339 7.8393 7.9633 4.8435 6.5504 6.6231 14.3238 19 17.2260 15.6785 9.8181 8.5136 7.4694 7.0248 6.2593 10.5940 5.9288 5.6278 5.3527 5.1009 4.8696 12.4622 13.5903 14.8775 163514 18.0456 20 10.0168 9.2922 8.6487 7.5620 7.1016 10.8355 8.0751 6.6870 5.9731 5.6648 5.3837 5.1268 4.8913 14.0292 12.8212 6.3125 6.3587 17.0112 11.7641 12.0416 8.7715 9.4424 8.1757 7.6446 18.8570 10.2007 7.1695 6.7429 11.0612 21 6.0113 15.4150 15.9369 5.6964 5.4099 5.1486 4.9094 14.4511 13.1630 17.6580 10.3711 8.8832 8.2664 7.7184 7.2297 6.7921 6.3988 6.0442 19.6604 22 11.2722 5.4321 12.3034 49245 13.4886 14,8568 9.5802 9.7066 5.7234 5.7465 16.4436 18.2922 7.7843 8.9847 8.3481 7.2829 5.1668 5.1822 11.4693 20.4558 5.4509 23 6.8351 6.8729 4.9371 13.7986 6.4338 6.4641 10.5288 10.6748 6.0726 6.0971 12.5504 12.7834 15.2470 16.9355 9.0770 9.8226 8.4217 18.9139 7.8431 7.3300 116536 5.7662 5.4669 5.1951 4.9476 24 21.2434 15.6221 14.0939 17.4131 7.3717 9.1609 9.9290 10.8100 6.9061 19.5235 22.0232 8.4881 8.5478 5.2060 13.0032 7.8957 7.9426 25 6.4906 6.5135 4.9563 11.8258 11.9867 15.9828 7.4086 5.7831 5.7975 14.3752 14.6430 17.8768 5.4804 5.4919 20.1210 6.1182 6.1364 6.1520 5.2151 13.2105 9.2372 9.3066 4.9636 10.0266 10.1161 10.9352 11.0511 26 16.3296 8.60 16 7.9844 18.3270 7.4412 5.8099 5.5016 12.1371 5.2228 20.7069 22.7952 23.5596 24.3164 4.9697 6.5335 6.5509 13.4062 27 14.8981 16.6631 8.6501 8,0218 74701 6.9852 6.9607 6.9830 7.0027 7. 1050 6.1656 18.7641 5.8204 21.2813 11.1584 12.2777 5.5098 5.2292 4.9747 13.5907 28 15.1411 9.3696 9.4269 9.7791 8.6938 10.1983 10.2737 10.7574 8.0552 6.5660 19.1885 6.1772 5.8294 16.9837 17.2920 12.4090 5.5168 21.8444 5.2347 7.4957 7.6344 13.7648 11.2578 11.9246 4.9789 29 25.0658 15.3725 8.9511 8.2438 6.2335 5.8713 19.6004 5.5482 22.3965 13.3317 4.9966 66418 6,6605 15.0163 17.1591 25.8077 19.7928 5.2582 5.2623 30 9,0417 83045 10.9617 9.9148 7.6752 7.1327 6.2463 23.1148 12.2335 5.8801 13.8007 5.5541 4.9995 27.3555 15.7619 32.8347 40 18.2559 25.7298 21.4822 31.4236 50 39.1961 Q Search this COL Homework Financial planning case 12-6 A Married couple with Children Address Their Life Insurance Needs Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $27,000 after taxes last year. Because she performs much of her work at home, it is unlikely that she will need to curtail her work after the baby is born. Joseph is a marriage counselor; he earned $72,000 last year after taxes. Because both are self-employed, Marcia and Joseph do not have access to group life insurance. They are each covered by $60,000 universal life policies they purchased three years ago. In addition, Joseph is covered by a $60,000, five-year guaranteed renewable term policy, which will expire next year. The Michaels are currently reassessing their life insurance program. As a preliminary step in their analysis, they have determined that Marcia's three survivors would qualify for Social Security survivor's benefits of about $1,800 per month, or an annual benefit of $21,600, if she were to die. For Joseph's survivors, the figure would be $2,800 per month, or an annual benefit of $33,600. Both agree that they would like to support each of their children to age 22, but to date, they have been unable to start a college savings fund. The couple estimates that it would cost $300,000 to put all three children through a regional university in their state as measured in today's dollars. They expect that burial expenses for each spouse would total about $12,000, and they would like to have a lump sum of $50,000 to help the surviving spouse make payments on their home mortgage. They also feel that each spouse would want to take a three-month leave from work if the other were to die. Assume that 25% of income is used for personal needs. a. Calculate the amount of life insurance that Marcia needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years, Round Present Value of a series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ b. Calculate the amount of life insurance that Joseph needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present Value of a Series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A-4.) Round your answer to the nearest dollar. $ Check My WorkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started