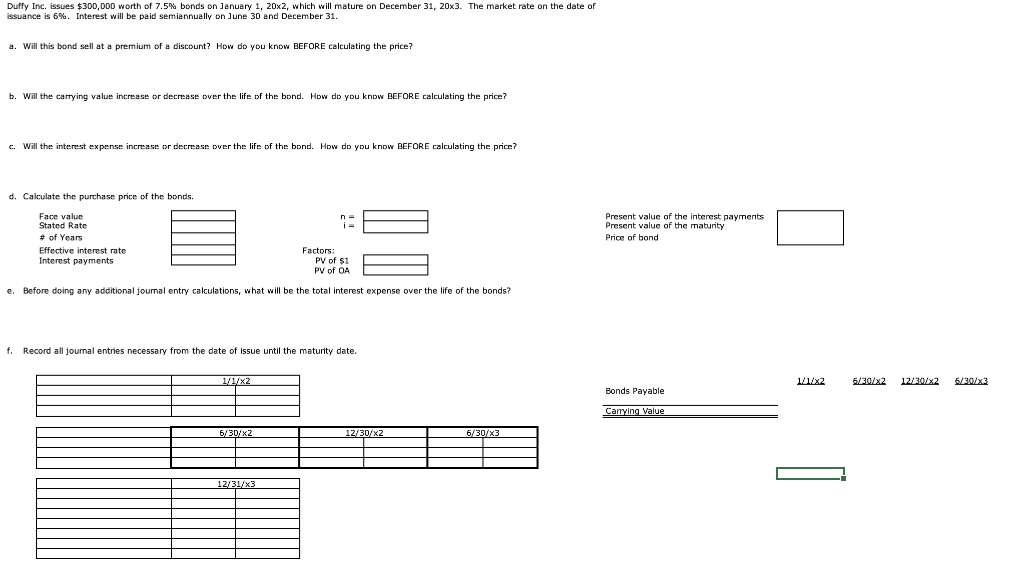

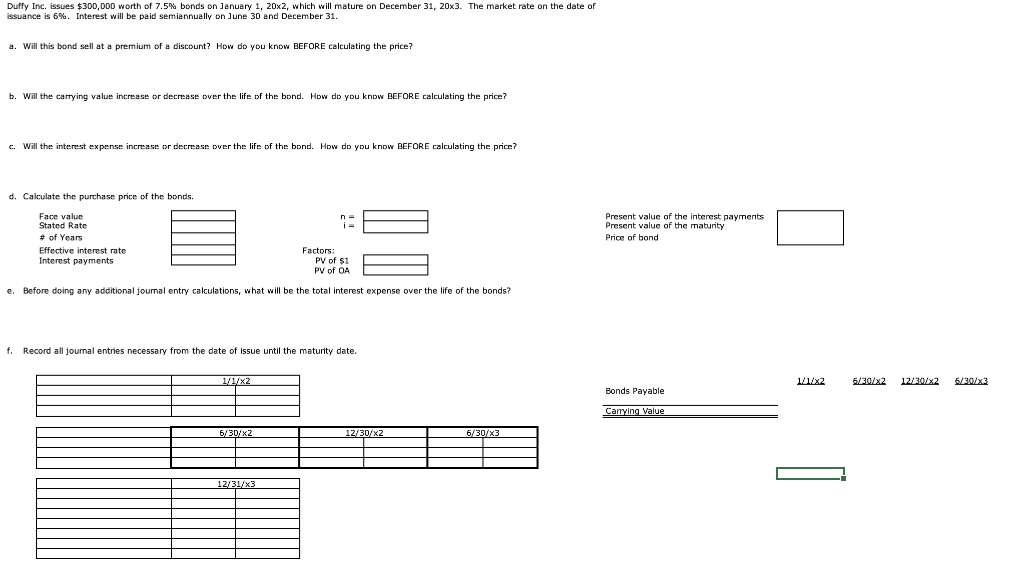

Duffy Inc. issues $300,000 worth of 7.5% bonds on January 1, 20x2, which will mature on December 31, 20x3. The market rate on the date of issuance is 6%. Interest will be paid semiannually on June 30 and December 31. a. Will this bond sell at a premium of a discount? How do you know BEFORE calculating the price? b. Will the carrying value increase or decrease over the life of the bond. How do you know BEFORE calculating the price? c. Will the interest expense increase or decrease over the life of the bond. How do you know BEFORE calculating the price? d. Calculate the purchase price of the bonds. Face value Stated Rate # of Years Effective interest rate Interest payments Present value of the interest payments Present value of the maturity Price of bond Factors PV of si PV of OA e. Before doing any additional joumal entry calculations, what will be the total interest expense over the life of the bonds? f. Record all joumal entries necessary from the date of issue until the maturity date. 1/1/X2 6/30/x2 12/30/x2 6/30/22 Bonds Payable Carrying Value 5/30/X2 12/30/x2 6/30/3 12/31/x: Duffy Inc. issues $300,000 worth of 7.5% bonds on January 1, 20x2, which will mature on December 31, 20x3. The market rate on the date of issuance is 6%. Interest will be paid semiannually on June 30 and December 31. a. Will this bond sell at a premium of a discount? How do you know BEFORE calculating the price? b. Will the carrying value increase or decrease over the life of the bond. How do you know BEFORE calculating the price? c. Will the interest expense increase or decrease over the life of the bond. How do you know BEFORE calculating the price? d. Calculate the purchase price of the bonds. Face value Stated Rate # of Years Effective interest rate Interest payments Present value of the interest payments Present value of the maturity Price of bond Factors PV of si PV of OA e. Before doing any additional joumal entry calculations, what will be the total interest expense over the life of the bonds? f. Record all joumal entries necessary from the date of issue until the maturity date. 1/1/X2 6/30/x2 12/30/x2 6/30/22 Bonds Payable Carrying Value 5/30/X2 12/30/x2 6/30/3 12/31/x