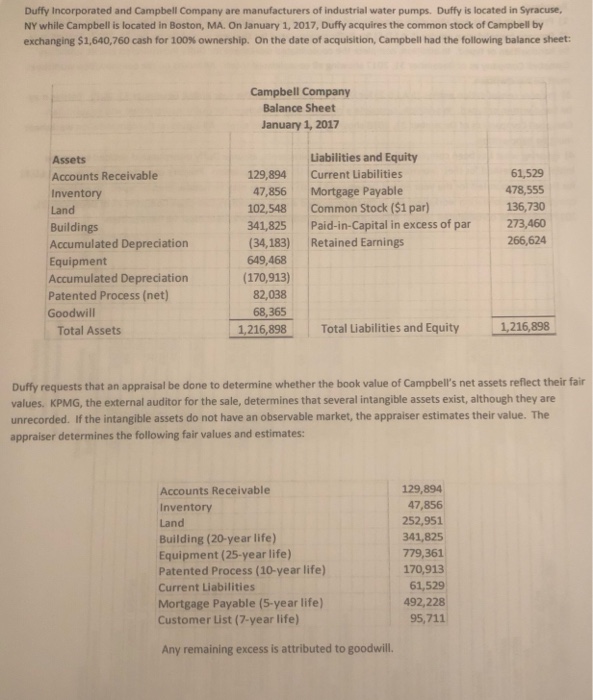

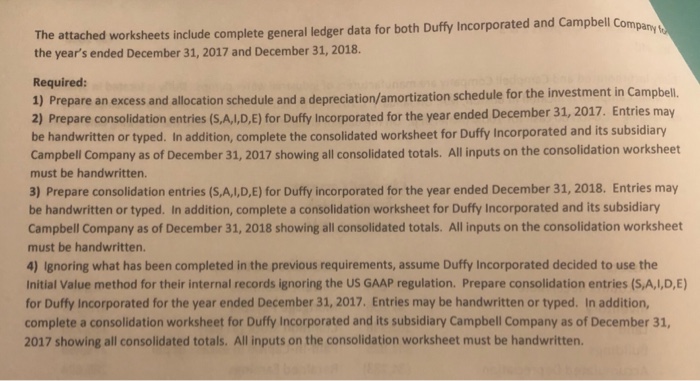

Duffy Incorporated and Campbell Company are manufacturers of industrial water pumps. Duffy is located in Syracuse NY while Campbell is located in Boston, MA. On January 1, 2017, Duffy acquires the common stock of Campbell by exchanging $1,640,760 cash for 100% ownership. On the date of acquisition, Campbell had the following balance sheet: Campbell Company Balance Sheet January 1, 2017 Liabilities and Equity Assets Accounts Receivable Inventory Land Buildings Accumulated Depreciation Equipment Accumulated Depreciation Patented Process (net) Goodwill 129,894 Current Liabilities 47,856 Mortgage Payable 102,548 Common Stock ($1 par) 341,825 Paid-in-Capital in excess of par 273,460 (34,183) Retained Earnings 649,468 61,529 478,555 136,730 266,624 (170,913) 82,038 68,365 Total Assets 1,216,898Total Liabilities and Equity1,216,898 Duffy requests that an appraisal be done to determine whether the book value of Campbell's net assets reflect their fair values. KPMG, the external auditor for the sale, determines that several intangible assets exist, although they are unrecorded. If the intangible assets do not have an observable market, the appraiser estimates their value. The appraiser determines the following fair values and estimates: Accounts Receivable Inventory Land Building (20-year life) Equipment (25-year life) Patented Process (10-year life) Current Liabilities Mortgage Payable (5-year life) Customer List (7-year life) 129,894 47,856 252,951 341,825 779,361 170,913 61,529 492,228 95,711 Any remaining excess is attributed to goodwill. Duffy Incorporated and Campbell Company are manufacturers of industrial water pumps. Duffy is located in Syracuse NY while Campbell is located in Boston, MA. On January 1, 2017, Duffy acquires the common stock of Campbell by exchanging $1,640,760 cash for 100% ownership. On the date of acquisition, Campbell had the following balance sheet: Campbell Company Balance Sheet January 1, 2017 Liabilities and Equity Assets Accounts Receivable Inventory Land Buildings Accumulated Depreciation Equipment Accumulated Depreciation Patented Process (net) Goodwill 129,894 Current Liabilities 47,856 Mortgage Payable 102,548 Common Stock ($1 par) 341,825 Paid-in-Capital in excess of par 273,460 (34,183) Retained Earnings 649,468 61,529 478,555 136,730 266,624 (170,913) 82,038 68,365 Total Assets 1,216,898Total Liabilities and Equity1,216,898 Duffy requests that an appraisal be done to determine whether the book value of Campbell's net assets reflect their fair values. KPMG, the external auditor for the sale, determines that several intangible assets exist, although they are unrecorded. If the intangible assets do not have an observable market, the appraiser estimates their value. The appraiser determines the following fair values and estimates: Accounts Receivable Inventory Land Building (20-year life) Equipment (25-year life) Patented Process (10-year life) Current Liabilities Mortgage Payable (5-year life) Customer List (7-year life) 129,894 47,856 252,951 341,825 779,361 170,913 61,529 492,228 95,711 Any remaining excess is attributed to goodwill