Answered step by step

Verified Expert Solution

Question

1 Approved Answer

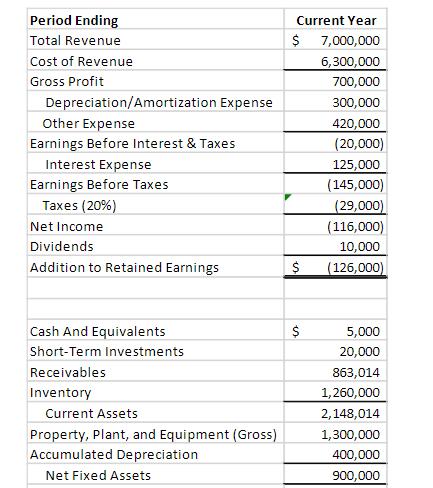

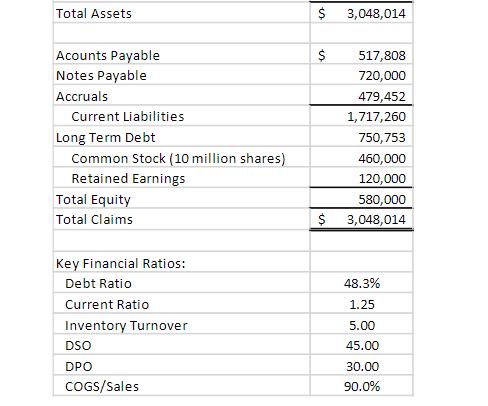

Assume sales increase by 10% next year, and COGS (costs of goods sold) drops to 80% of sales. If the company increases its inventory ratio

Assume sales increase by 10% next year, and COGS (costs of goods sold) drops to 80% of sales. If the company increases its inventory ratio to 5:4, how much cash is generated from the reduction in inventory?

Period Ending Total Revenue Cost of Revenue Gross Profit Depreciation/Amortization Expense Other Expense Earnings Before Interest & Taxes Interest Expense Earnings Before Taxes Taxes (20%) Net Income Dividends Addition to Retained Earnings Cash And Equivalents Short-Term Investments Receivables Inventory Current Assets Property, Plant, and Equipment (Gross) Accumulated Depreciation Net Fixed Assets Current Year 7,000,000 $ 6,300,000 700,000 300,000 420,000 (20,000) 125,000 (145,000) (29,000) $ $ (116,000) 10,000 (126,000) 5,000 20,000 863,014 1,260,000 2,148,014 1,300,000 400,000 900,000

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Current inventory turnover ratio T 1 Cost of goods ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started