Answered step by step

Verified Expert Solution

Question

1 Approved Answer

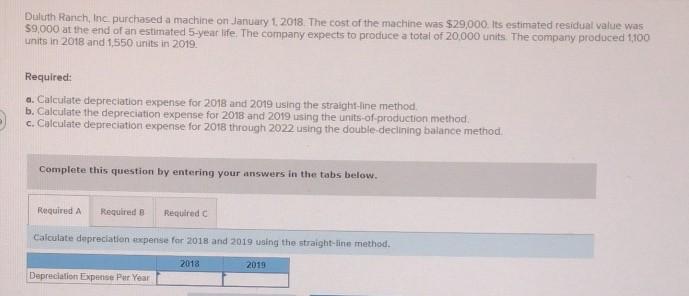

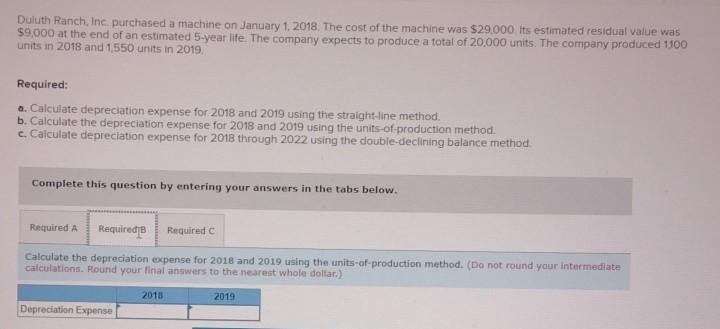

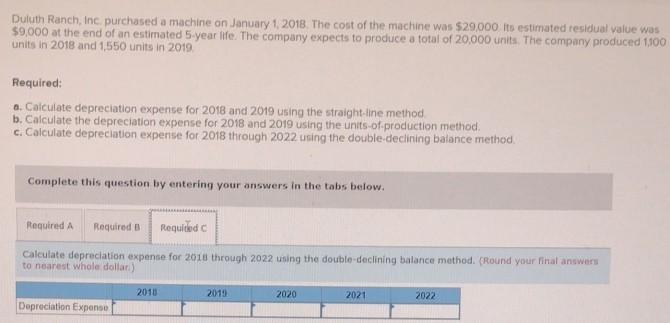

Duluth Ranch, Inc purchased a machine on January 1, 2018. The cost of the machine was $29,000. Its estimated residual value was $9.000 at the

Duluth Ranch, Inc purchased a machine on January 1, 2018. The cost of the machine was $29,000. Its estimated residual value was $9.000 at the end of an estimated 5-year life. The company expects to produce a total of 20,000 units. The company produced 1100 units in 2018 and 1550 units in 2019. Required: a. Calculate depreciation expense for 2018 and 2019 using the straight-line method b. Calculate the depreciation expense for 2018 and 2019 using the units-of-production method c. Calculate depreciation expense for 2018 through 2022 using the double declining balance method Complete this question by entering your answers in the tabs below. Required A Required B Required Calculate depreciation expense for 2018 and 2019 using the straight-line method. 2018 2019 Depreciation Expense Per Year Duluth Ranch, Inc purchased a machine on January 1, 2018. The cost of the machine was $29.000 Its estimated residual value was $9.000 at the end of an estimated 5-year life. The company expects to produce a total of 20,000 units. The company produced 1100 units in 2018 and 1,550 units in 2019. Required: a. Calculate depreciation expense for 2018 and 2019 using the straight-line method. b. Calculate the depreciation expense for 2018 and 2019 using the units-of-production method. c. Calculate depreciation expense for 2018 through 2022 using the double-declining balance method Complete this question by entering your answers in the tabs below. Required A Required Required Calculate the depreciation expense for 2018 and 2019 using the units-of-production method. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar) 2018 2019 Depreciation Expense Duluth Ranch, Inc. purchased a machine on January 1, 2018. The cost of the machine was $29,000 its estimated residual value was $9,000 at the end of an estimated 5 year life. The company expects to produce a total of 20,000 units. The company produced 1100 units in 2018 and 1,550 units in 2019 Required: a. Calculate depreciation expense for 2018 and 2019 using the straight line method b. Calculate the depreciation expense for 2018 and 2019 using the units of production method. c. Calculate depreciation expense for 2018 through 2022 using the double-declining balance method Complete this question by entering your answers in the tabs below. Required A Required B Requided Calculate depreciation expense for 2018 through 2022 using the double declining balance method. (Round your final answers to nearest whole dollar) 2010 2010 2020 2021 2022 Depreciation Expanse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started