Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dumax Company completed the following transactions during 2024. The company's fiscal year ends on December 31, 2024. Jan. 2 Paid accrued interest in the amount

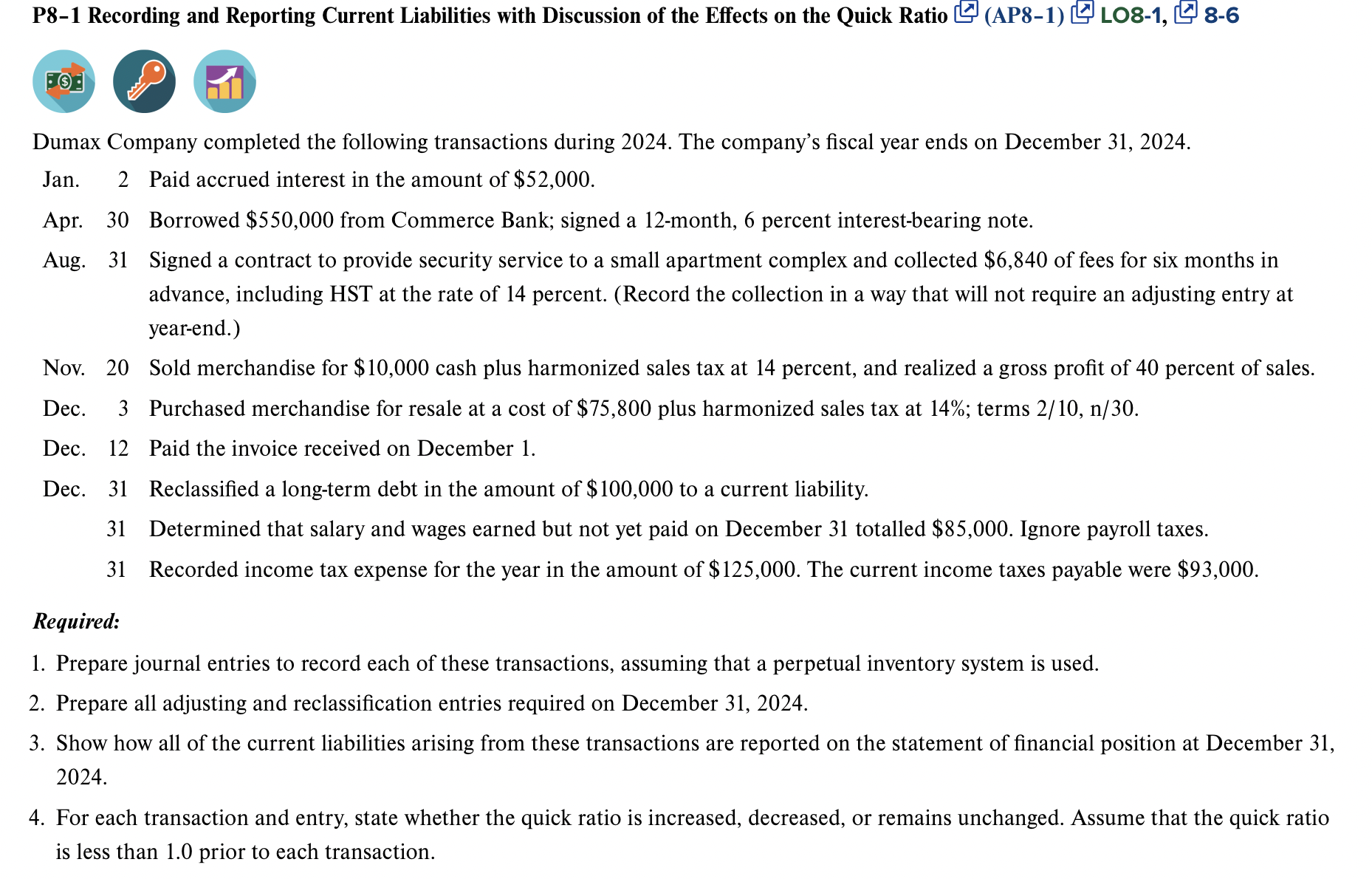

Dumax Company completed the following transactions during 2024. The company's fiscal year ends on December 31, 2024. Jan. 2 Paid accrued interest in the amount of $52,000. Apr. 30 Borrowed \$550,000 from Commerce Bank; signed a 12-month, 6 percent interest-bearing note. Aug. 31 Signed a contract to provide security service to a small apartment complex and collected $6,840 of fees for six months in advance, including HST at the rate of 14 percent. (Record the collection in a way that will not require an adjusting entry at year-end.) Nov. 20 Sold merchandise for $10,000 cash plus harmonized sales tax at 14 percent, and realized a gross profit of 40 percent of sales. Dec. 3 Purchased merchandise for resale at a cost of $75,800 plus harmonized sales tax at 14%; terms 2/10,n/30. Dec. 12 Paid the invoice received on December 1. Dec. 31 Reclassified a long-term debt in the amount of $100,000 to a current liability. 31 Determined that salary and wages earned but not yet paid on December 31 totalled $85,000. Ignore payroll taxes. 31 Recorded income tax expense for the year in the amount of $125,000. The current income taxes payable were $93,000. Required: 1. Prepare journal entries to record each of these transactions, assuming that a perpetual inventory system is used. 2. Prepare all adjusting and reclassification entries required on December 31, 2024. 3. Show how all of the current liabilities arising from these transactions are reported on the statement of financial position at December 31 , 2024. 4. For each transaction and entry, state whether the quick ratio is increased, decreased, or remains unchanged. Assume that the quick ratio

Dumax Company completed the following transactions during 2024. The company's fiscal year ends on December 31, 2024. Jan. 2 Paid accrued interest in the amount of $52,000. Apr. 30 Borrowed \$550,000 from Commerce Bank; signed a 12-month, 6 percent interest-bearing note. Aug. 31 Signed a contract to provide security service to a small apartment complex and collected $6,840 of fees for six months in advance, including HST at the rate of 14 percent. (Record the collection in a way that will not require an adjusting entry at year-end.) Nov. 20 Sold merchandise for $10,000 cash plus harmonized sales tax at 14 percent, and realized a gross profit of 40 percent of sales. Dec. 3 Purchased merchandise for resale at a cost of $75,800 plus harmonized sales tax at 14%; terms 2/10,n/30. Dec. 12 Paid the invoice received on December 1. Dec. 31 Reclassified a long-term debt in the amount of $100,000 to a current liability. 31 Determined that salary and wages earned but not yet paid on December 31 totalled $85,000. Ignore payroll taxes. 31 Recorded income tax expense for the year in the amount of $125,000. The current income taxes payable were $93,000. Required: 1. Prepare journal entries to record each of these transactions, assuming that a perpetual inventory system is used. 2. Prepare all adjusting and reclassification entries required on December 31, 2024. 3. Show how all of the current liabilities arising from these transactions are reported on the statement of financial position at December 31 , 2024. 4. For each transaction and entry, state whether the quick ratio is increased, decreased, or remains unchanged. Assume that the quick ratio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started