Answered step by step

Verified Expert Solution

Question

1 Approved Answer

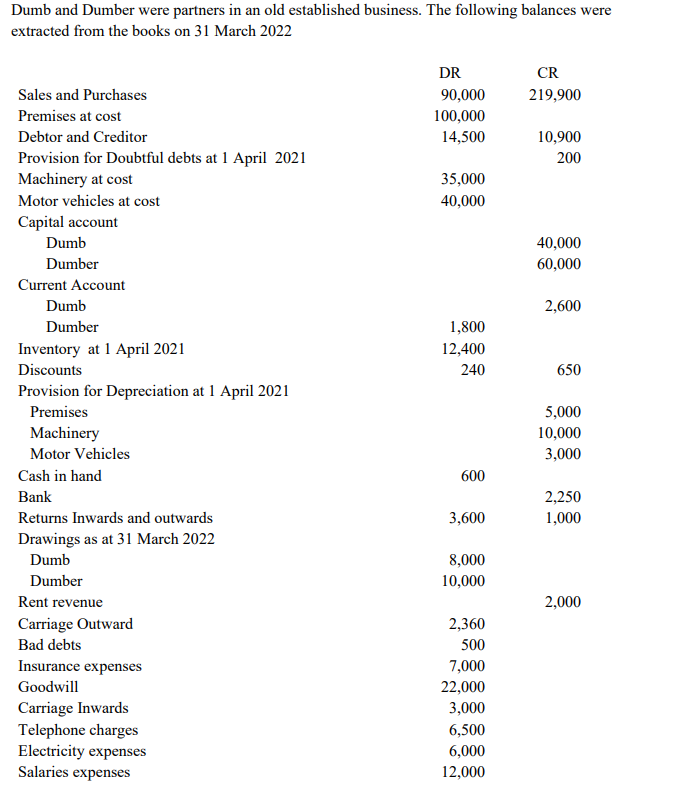

Dumb and Dumber were partners in an old established business. The following balances were extracted from the books on 31 March 2022 Sales and

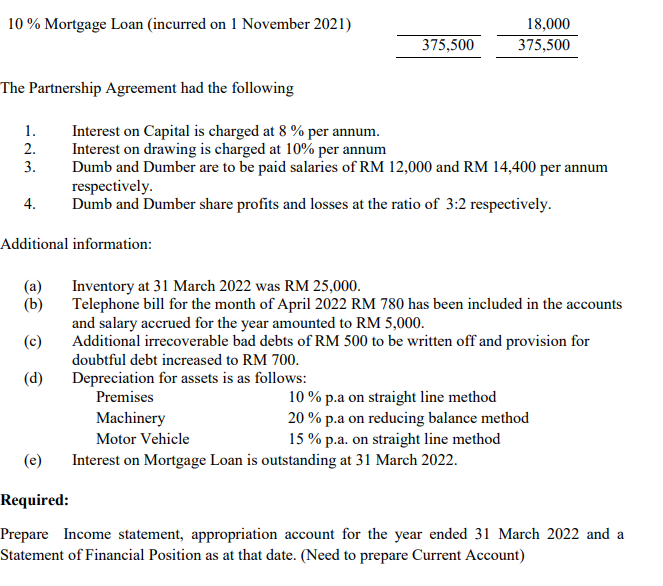

Dumb and Dumber were partners in an old established business. The following balances were extracted from the books on 31 March 2022 Sales and Purchases Premises at cost Debtor and Creditor Provision for Doubtful debts at 1 April 2021 Machinery at cost Motor vehicles at cost Capital account Dumb Dumber Current Account Dumb Dumber Inventory at 1 April 2021 Discounts Provision for Depreciation at 1 April 2021 Premises Machinery Motor Vehicles Cash in hand Bank Returns Inwards and outwards Drawings as at 31 March 2022 Dumb Dumber Rent revenue Carriage Outward Bad debts Insurance expenses Goodwill Carriage Inwards Telephone charges Electricity expenses Salaries expenses DR 90,000 100,000 14,500 35,000 40,000 1,800 12,400 240 600 3,600 8,000 10,000 2,360 500 7,000 22,000 3,000 6,500 6,000 12,000 CR 219,900 10,900 200 40,000 60,000 2,600 650 5,000 10,000 3,000 2,250 1,000 2,000 10% Mortgage Loan (incurred on 1 November 2021) The Partnership Agreement had the following 1. 2. 3. 4. Additional information: (a) (b) (c) (d) 375,500 18,000 375,500 Interest on Capital is charged at 8 % per annum. Interest on drawing is charged at 10% per annum Dumb and Dumber are to be paid salaries of RM 12,000 and RM 14,400 per annum respectively. Dumb and Dumber share profits and losses at the ratio of 3:2 respectively. Inventory at 31 March 2022 was RM 25,000. Telephone bill for the month of April 2022 RM 780 has been included in the accounts and salary accrued for the year amounted to RM 5,000. Additional irrecoverable bad debts of RM 500 to be written off and provision for doubtful debt increased to RM 700. Depreciation for assets is as follows: Premises Machinery Motor Vehicle Interest on Mortgage Loan is outstanding at 31 March 2022. 10% p.a on straight line method 20% p.a on reducing balance method 15% p.a. on straight line method (e) Required: Prepare Income statement, appropriation account for the year ended 31 March 2022 and a Statement of Financial Position as at that date. (Need to prepare Current Account)

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Income Statement for the year ended 31 March 2022 Particulars RM Sales 219900 Less Cost of Go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started