Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an economy with three dates {t=0, 1, 2}. A firm has assets in place that generate an output (profit) of either 20 in

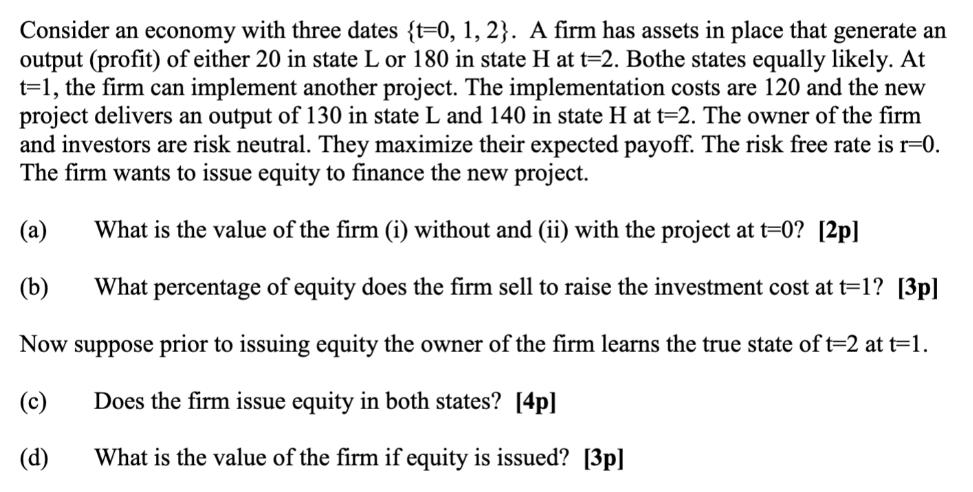

Consider an economy with three dates {t=0, 1, 2}. A firm has assets in place that generate an output (profit) of either 20 in state L or 180 in state H at t-2. Bothe states equally likely. At t=1, the firm can implement another project. The implementation costs are 120 and the new project delivers an output of 130 in state L and 140 in state H at t=2. The owner of the firm and investors are risk neutral. They maximize their expected payoff. The risk free rate is r=0. The firm wants to issue equity to finance the new project. (a) What is the value of the firm (i) without and (ii) with the project at t=0? [2p] (b) What percentage of equity does the firm sell to raise the investment cost at t=1? [3p] Now suppose prior to issuing equity the owner of the firm learns the true state of t=2 at t=1. (c) Does the firm issue equity in both states? [4p] (d) What is the value of the firm if equity is issued? [3p]

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ai Without the project the firms value at t 0 is simply the present value of the cash flows generated by the existing assets Since we are given that t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started