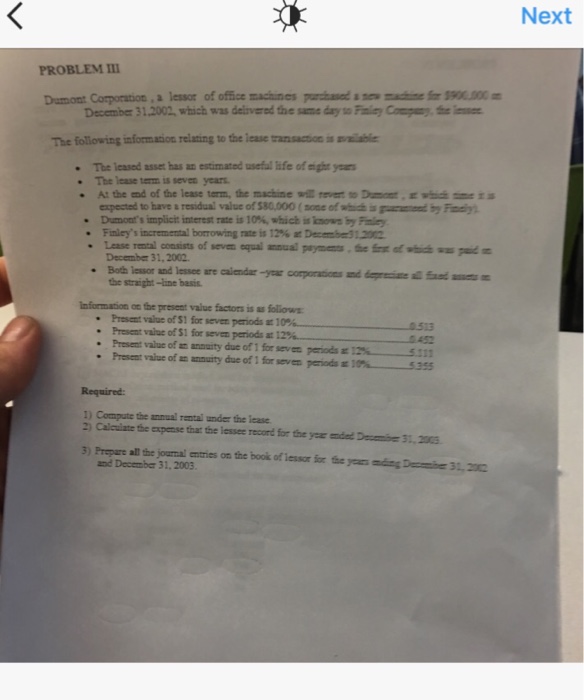

Dumont Corporation, a lesson of office machines purchased a new machine for $900.000 on December 31, 2002, which was delivered the same dry to Finely Company the lessee The following information relating to the lease transaction is available The leased asset has an estimated useful life of eight years The lease term is seven years. At the end of the lease term, the machine will revert to Dumont as which came it is expected to have a residual values $80, (some of which is purchased by Finely). Dumont's implicit interest rate i 10%, which is known by Finely. Finley's incremental borrowing rate is 12% as December 31, 2002. Lease rental consists of seven equal annual payments, the first of which are paid as December 31, 2002. Both lessor and lessee are calendar-year corporations and depreciate all fixed assets and the straight-line basis. Information on the present value factors is as follows: Present value of $1 for seven periods at 10% ________________ Present value of $1 for seven periods at 12% ________________ Present value of annuity due of 1 for seven periods at 12% ________________ Present value of annuity due of 1 for seven periods at 10% ________________ Required Compute the annual rental under the lease. Calculate the expense that the lessee record for the year ended December 31, 2003. Prepare all the journal entries on the book of lessor for the years ending December 31, 2002, and December 31, 2003. Dumont Corporation, a lesson of office machines purchased a new machine for $900.000 on December 31, 2002, which was delivered the same dry to Finely Company the lessee The following information relating to the lease transaction is available The leased asset has an estimated useful life of eight years The lease term is seven years. At the end of the lease term, the machine will revert to Dumont as which came it is expected to have a residual values $80, (some of which is purchased by Finely). Dumont's implicit interest rate i 10%, which is known by Finely. Finley's incremental borrowing rate is 12% as December 31, 2002. Lease rental consists of seven equal annual payments, the first of which are paid as December 31, 2002. Both lessor and lessee are calendar-year corporations and depreciate all fixed assets and the straight-line basis. Information on the present value factors is as follows: Present value of $1 for seven periods at 10% ________________ Present value of $1 for seven periods at 12% ________________ Present value of annuity due of 1 for seven periods at 12% ________________ Present value of annuity due of 1 for seven periods at 10% ________________ Required Compute the annual rental under the lease. Calculate the expense that the lessee record for the year ended December 31, 2003. Prepare all the journal entries on the book of lessor for the years ending December 31, 2002, and December 31, 2003